Summary

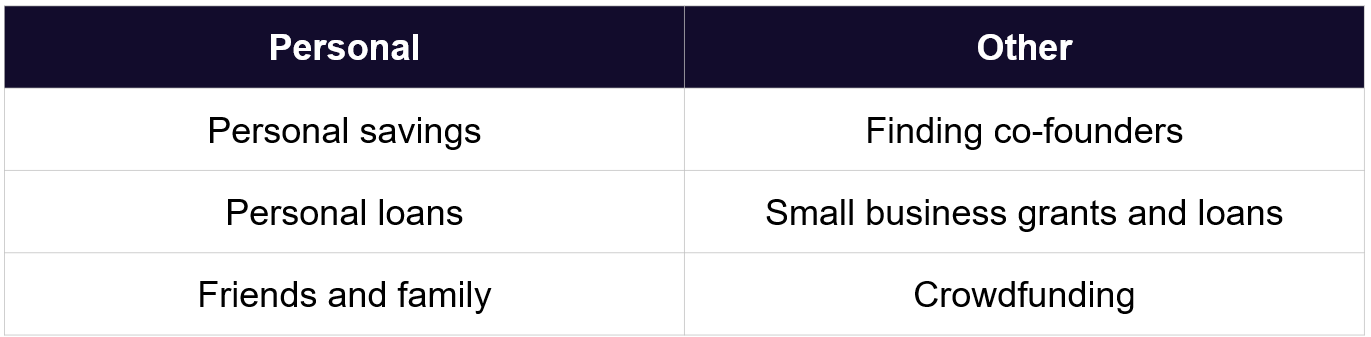

- Bootstrapping a business means raising funds from your savings, friends, and family or using your credit to get debt financing.

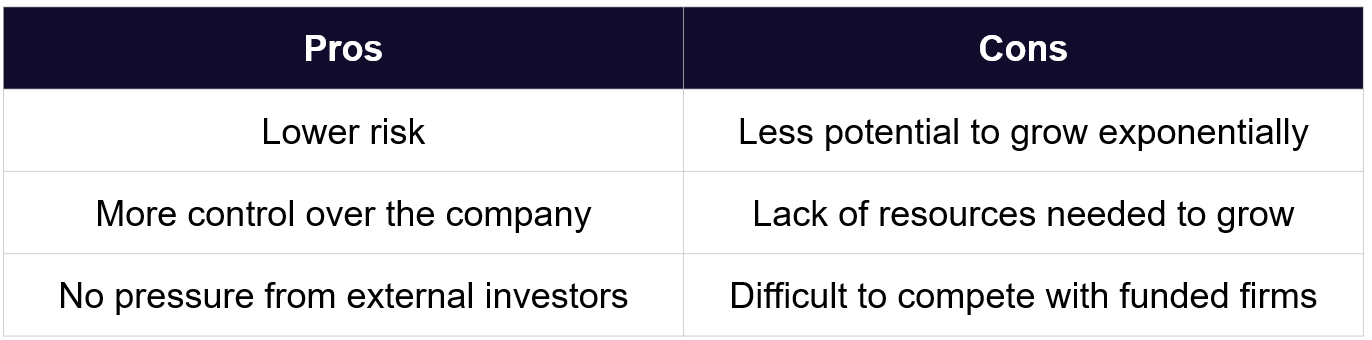

- Pros of bootstrapping a business include: lower risk, maintaining control, no pressure from external investors, while doing things at your own pace

- Cons of bootstrapping, on the other hand, might be: lower availability of capital for investments, less potential to scale rapidly, difficulties in competing with richly valued companies

- Bootstrapping makes more sense, when you prefer not to take large risks with a VC, have access to other sources of capital and are tackling a smaller market with no significant upfront investments

- Bootstrapping makes less sense, when you are operating in a highly competitive industry with well-funded peers and the business model requires significant upfront investments

What it means to bootstrap a startup

Bootstrapping a startup refers to using personal savings, loans from friends and family, and other forms of private financial investment to finance a new business venture. The advantage of bootstrapping is that it allows entrepreneurs to retain full ownership and control of their company. The cons of bootstrapping include difficulties in raising enough money to get the business off the ground; also, founders may have to work long hours with little pay to make ends meet.

Nonetheless, bootstrapping is often seen as a vital part of the startup journey, and many successful companies have been founded using this method. If you’re thinking of starting your own business, be sure to do your research and create a solid plan before taking this path. Self-funding your business can be a great way to get it off the ground, but it’s rather challenging.

Pros and cons of bootstrapping

Pros of bootstrapping

One of the biggest advantages of bootstrapping your business is that you won’t have to worry about diluting your ownership stake. When you take on outside investors, you’ll typically have to give up some equity in return for their capital. This can erode your control over the company (often down to 20-30%) and make it harder to achieve your long-term goals. By contrast, when you finance your business through bootstrapping, you can keep 100% ownership and have complete control over your destiny. This can be a major advantage in the highly competitive world of start-ups. It can also give you more flexibility to take risks and experiment with new ideas, knowing that there’s no one to answer to but yourself. Additionally, you can have a much higher rate of return when you decide to sell your business. In the end, whether or not bootstrapping is the right choice for you will depend on your personal circumstances and goals. But if you’re looking to maximize your control over the business, it’s definitely worth considering.

By choosing to bootstrap and hold onto your shares, you get a chance for greater potential returns and maintain complete control of the company strategy and growth. As VC funds usually have large portfolios, they only need a few of their companies to achieve success. Because of that, they can often push the company into unsustainable growth, outside investors push to increase the risk that you are taking. By remaining the company’s sole shareholder, you can easily avoid conflict of interest and take the risks you deem necessary for your startup to grow.

Cons of bootstrapping

Raising money using personal savings and networks, you can encounter problems with cash flow. In contrast to a VC fund, individuals usually don’t have ‘unlimited’ resources and a vast network of investors to receive consistent financial assistance. As mentioned above, VC funds often pressure founders to grow at all costs, but they also provide the company with the necessary leverage and funds which allow the startup to burn money for the sake of growth. An entirely bootstrapped venture can experience issues with insufficient resources to expand and pressure to stay profitable, even in the early stages. Even though it is possible to fund a large upfront investment (for example in R&D) without external investors it is highly unlikely and difficult.

In the current startup environment, it is uncommon for a company to be fully bootstrapped. Most successful founders accept at least some funding from external investors, such as VCs. You have to consider that you will have to compete with other early-stage businesses which receive funding. It will definitely take a lot of hard work if you want to get an edge over competing startups with your bootstrapped company.

When to bootstrap

Based on what we have mentioned so far, you can see that the most significant cons of bootstrapping a business are related to upfront investments that are required in many industries. If, however, you operate in an area in which it is possible to be profitable from the point when the founder is starting a business you might be better off bootstrapping. Some of such areas might include IT services, niche vertical software and others.

If you want to go after a small market, you may not need extra leverage from venture capital firms. You can achieve the full potential of your business without giving up any of your equity. When you succeed, you end up getting a bigger slice of a smaller pie.

When not to bootstrap

If the business is already struggling with cash flow, there might be better ideas than bootstrapping. That’s because, in a bootstrapping model, you don’t have access to external sources of capital, which can be used to cover short-term expenses or bridge cash flow gaps. Instead, you’re relying solely on your resources, which can quickly deplete if you’re not careful. So if the business model does not imply quick profitability, it’s probably wiser to seek other financing options instead of trying to bootstrap your way to success. Otherwise, you might find yourself in an even deeper hole – and that’s something no business can afford.

If you are operating in a market with many players that offer a competing product and differentiate only sales and marketing, then it will be difficult to compete. The competitors may sell their product at below cost, carrying losses for a number of years, thanks to the money raised from the investors.

Success stories

Mailchimp

Mailchimp is one of the most popular email marketing platforms available today. And it’s no wonder – Mailchimp is easy to use, has a wide range of features, and is very affordable. But many people don’t know that Mailchimp was entirely bootstrapped, meaning it was founded without any outside investment. This is relatively rare in the tech world, where VC funding is the norm. But bootstrapping meant that the Mailchimp team had total control over their product and business from the very beginning. And it paid off – Mailchimp now has over 15 million customers and generates billions of dollars in revenue each year. In 2021 Mailchimp was acquired by Intuit with a valuation of circa $12B. As Mailchimp was bootstrapped, the founders received the vast majority of this amount, in cash and equity. It wasn’t a great deal only for the founders but also for the employees, who got paid approximately $300M in bonuses.

Atlassian

Atlassian is a global software company that provides products and services to help teams work together more effectively. The company was founded in 2002 by two university friends, Scott Farquhar and Mike Cannon-Brookes, who bootstrapped the business with just $10,000 from their credit cards. Up until 2010, Atlassian remained a bootstrapped company, reaching revenue of close to $100M. Then they first received VC financing during their first round. Being a successful startup already they were able to negotiate a much better deal than they would have if they approached external investors back in 2002. As of November 2022, Atlassian employs over 8,800 people across 50 countries and is valued at over $35 billion.

GoFundMe

A unique form of bootstrapping was adopted by GoFundMe, founded in 2010 with the mission of helping people in need receive financial support from family, friends, and acquaintances. The company started as a way to help people with medical expenses but has since expanded to include a wide range of needs, including education, business expenses, and natural disaster relief. GoFundMe has raised over $9 billion dollars from over 50 million donors. Remarkably, the company was bootstrapped and did not accept venture capital funding until 2015. This makes GoFundMe one of the most successful crowdfunding platforms in the world.

GoPro

GoPro was founded in 2002. Nick Woodman, the company’s founder, bootstrapped the company with $200,000 cash from personal savings. Since then, GoPro has become one of the world’s most well-known action camera brands. Outdoor enthusiasts and athletes use the company’s products to capture footage of their adventures. In 2014 GoPro went public with a valuation of $3.5B and Nick Woodman’s 45% ownership turned into a net worth of over 1.5B dollars (750,000% return).

Summary

Ultimately it is up to you to choose whether you want to bootstrap your business or look for external investors. While both options have their pros and cons, it ultimately comes down to what makes the most sense for your business. Bootstrapping may be the right choice if you’re comfortable with a slower growth rate and can self-fund your business. However, seeking investors may be a better option if you’re looking for rapid growth and need outside funding. Ultimately, the decision is up to you and what makes the most sense for your business. Whichever path you choose, there are resources available to help you succeed.