Growing your business to the point where it is sellable is a tremendous achievement for a business owner. You have worked hard to start and scale your company, and now it’s time to receive a fair price for the assets you’ve worked so hard to create.

For many business owners, the idea of preparing a business for sale seems overwhelming and challenging. However, just like any other aspect of business, preparing your company for sale is just another process. When you have a well-defined series of actions to follow then everything will go smoothly and you will receive the high valuation you deserve. On the other hand, failing to prepare early may lower the value of your business or lead to you missing out on a great deal.

We’ve worked with countless businesses to sell their companies successfully and we’ve learned that businesses that get the highest valuation start planning and preparing for their sale early on. You should ideally lay the groundwork for the sale process months or even years before taking it to the market.

These are the steps we recommend you to follow when preparing to sell your business.

Determine your goals and objectives of the sale

Before you begin the process of selling your company, take the time to consider your goals and objectives. Speak with a financial or an M&A advisor to define your vision for the future. List out your goals and prioritize what is most important for you. It’s common when selling a business to have to make trade-offs, so prioritize your wants early on so you have a guide to follow when evaluating potential offers in the future.

You can consider some of these questions when forming your goals and objectives:

- How quickly do you want to sell?

- Do you want to remain involved in the business financially or operationally? If so, under what role and for how long?

- Do you wish to keep any of the business’s assets?

- Are there any restrictions on the sale of your business?

Put your accounts in order

Keeping organized accounting records makes it easier for a potential buyer to assess the value of your business. You will need to provide a clear picture of your business’s financial condition, including past financial statements, and these must be accurate and consistent with industry standards.

Here are some ways you can prepare your accounts for the business sale process:

Introduce management reporting

If you haven’t already, introduce management reporting to consolidate financial information and demonstrate the value of your business over specific time periods. Management reports provide easy-to-read visualizations and insights on how your business is performing. These can be used for decision making and to help potential buyers assess the value of your company.

Change revenue recognition principles

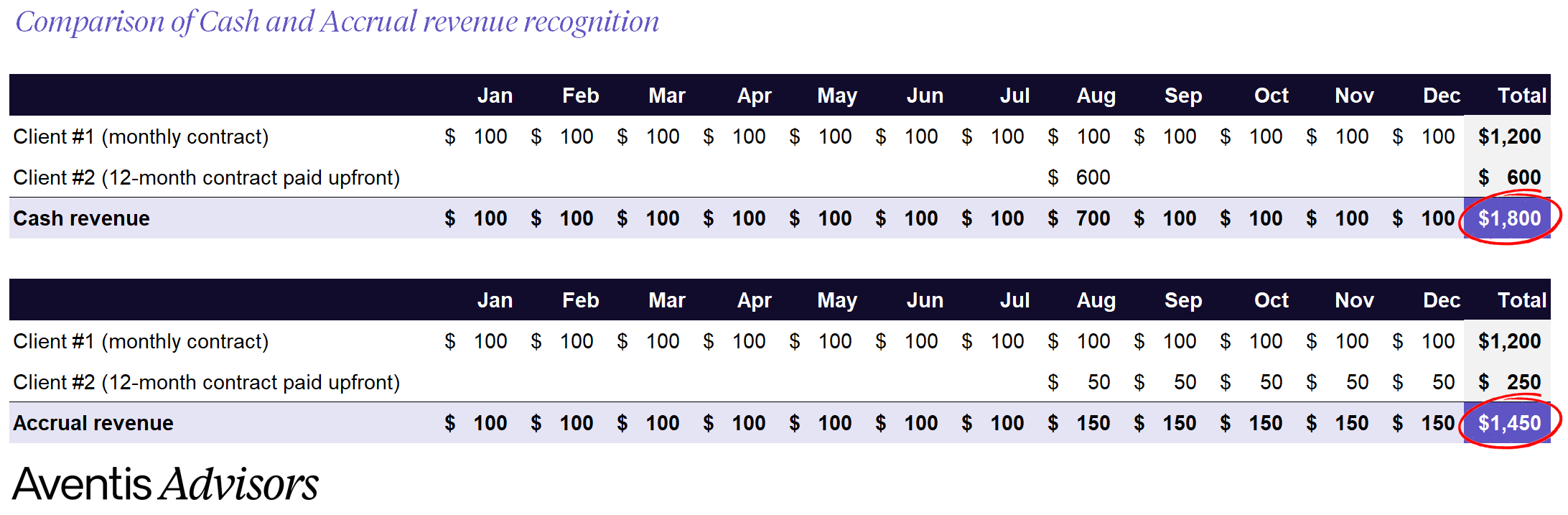

Revenue recognition affects the integrity of your business’s financial statements and it must be accurate and consistent. Generally Accepted Accounting Principles (GAAP) or IFRS (International Financial Reporting Standards) require your business to use accrual-basis accounting, which recognizes revenue once it has been earned rather than at time cash is received. This is different to cash-basis accounting which recognizes revenue at the time cash is received. Similarly also expenses may be recognized over time.

A potential buyer will expect your financial statements to use the accrual method in revenue recognition so they can compare your business financials with other companies in the same industry. If required, adjust your revenue recognition principles so that your business’s revenue is recognized when a service or product is delivered to the customer and not when cash is received.

Use accounting software

If you haven’t already, start using accounting software. This helps prepare a business for sale by enhancing productivity and operational efficiency while also making accounting up-to-date and easy to view. Move away from Excel and Word and use accounting software tools to avoid mistakes in your financial statements, automate processes, and save time.

Accelerate monthly reporting processes

Prepare your business for sale by accelerating your monthly reporting to keep data accurate, reliable, and timely. Consider weekly reporting to make up-to-date data available instantly so you have a consistent idea of how your business is performing and can instantly share it with potential buyers. Weekly reporting will be made much easier with an accounting software, so be sure to have this set up.

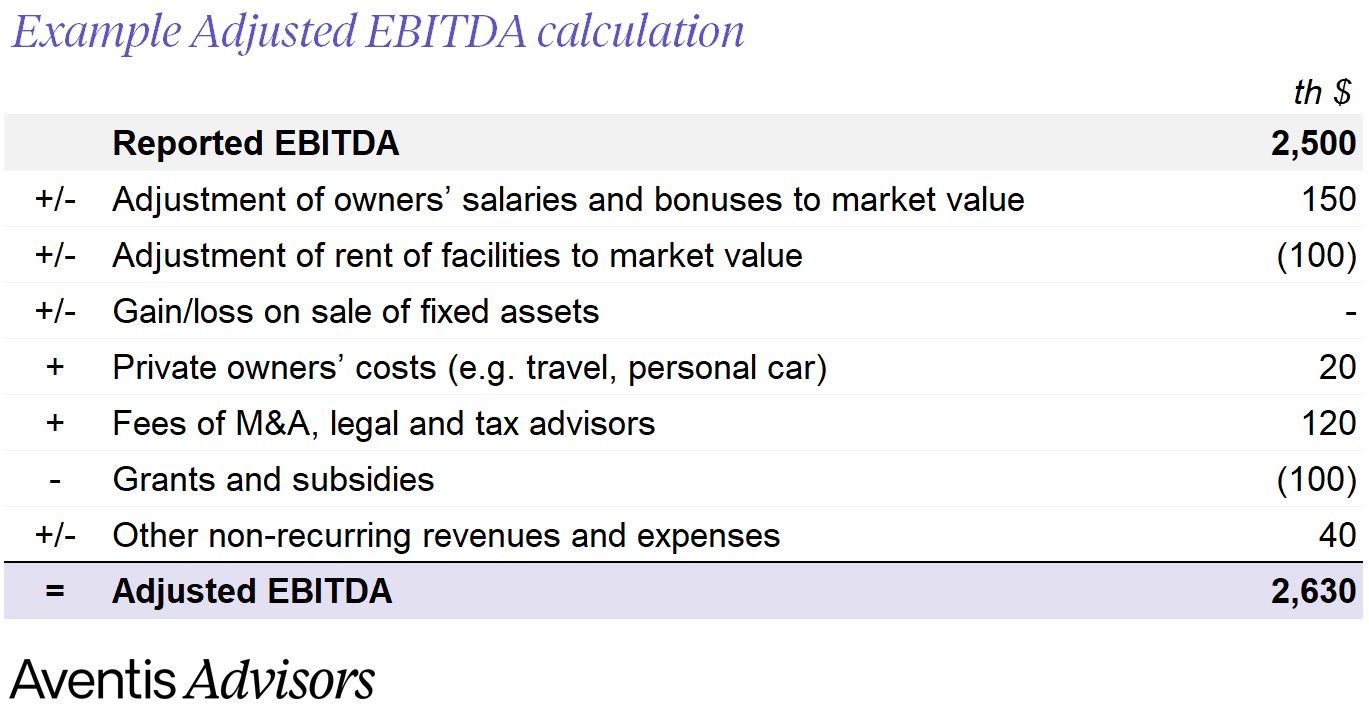

Adjust your reported profits

The sale process will require you to review your earnings and adjust where necessary. You may want to examine and adjust things like:

- Your salary and perks

- The salary and perks of any family members

- Market rent price if you are owner of the facilities and don’t pay for it

- Personal expenses e.g. mobile phone, childcare, travel expenses

- Expenses or income that isn’t expected to continue after the sale

- One-off events

- Discontinued operations

These could all be lowering your business value by not showing its full earnings potential. It is better to rely on a measure such as Adjusted EBITDA to determine the true earning capacity of your business.

Get an objective assessment of where your business is today

Most business owners have a vague idea of their business’s value but don’t have a complete picture. Work with an M&A advisory to get an objective assessment of what your business is worth before you put it to market. Doing this early on in the process can help business owners identify risks that could prevent a deal or lead to a lower valuation.

Getting an unbiased assessment before you sell your business includes reviewing all financial data, KPIs, your product or service, goals and objectives for the company, and more. An M&A advisor will help assess whether your business is ready for sale or what you might need to do before selling your business. They can help you decide whether the timing is right, maximize your company’s value, address any issues before you go to market, and identify steps you can take to ensure an eventual sale that meets your goals and expectations.

Review systems and processes

You must review your systems and processes to prepare a business for sale. First, refine your systems and processes to be more efficient. Wherever possible, automate business processes to reduce human capital and decrease the amount of time it takes to do things.

Once you have refined your systems and processes, document everything into a format that can be transferred in the eventual sale, like an operations manual. Include all business processes, from working guidelines to policies and procedures, HR, accounting, and project management. You can then hand this over to potential buyers to allow them insight into how your business operates on a daily basis.

Having well-documented systems and processes can increase your company’s value as it creates replicable success and presents your business as a turnkey operation with all things ready to go. This can help increase your company’s sale price.

Clean up your legal issues

Business owners should resolve any potential legal issues before selling their business to reduce risk. Any remaining issues need to be disclosed to the potential buyer before sale. Here are some legal aspects to consider when preparing your business for the sales process:

Ensure the cap table is in order

Business owners may want to purchase and consolidate small minority investors in the business before putting it up for sale. They may demand a larger amount for their shares if they think a potential buyer is committed and complicate the sales process.

Intellectual property

Check who owns the IP rights for your business name, domain, and any trademarks. Look over employee contracts and ensure that IP generated throughout their employment is secured by your business.

GDPR processes

If you operate in the EU, your business must comply with General Data Protection Regulations (GDPR) and have the appropriate processes in place or risk a fine for noncompliance. If you haven’t already, assemble a team to plan and implement GDPR processes. Review your IT security policy and data procedures. Update your privacy policy if necessary and develop a data breach notification plan.

Ensure employee contracts are up-to-date and conform with current regulations

Make sure your employee contracts are in order with clearly defined pay rates, benefits, and termination clauses. Without a formal employment contract, your employees may be able to leave anytime and work for a competitor, which is an unattractive possibility for buyers and can lower your business’s sale price

Hire M&A advisors

Preparing your business for sale is made easier with the help of M&A advisors. An M&A advisory like Aventis Advisors can guide you throughout the entire process of selling your business, from preparation to closing the deal. We have an extensive global network of investors and can help you maximize your valuation and find the right buyer for your business.

Don’t wait until the last minute before you hire M&A advisors. Lay the groundwork early with a team that knows the process so you can guide your business to a successful exit without any unpleasant surprises along the way. A strong advisory team can help you identify risks early on, clean up financials and legal issues, and advise you on which steps you need to take to get the high valuation you deserve.

Put your story together

A potential buyer may be looking at several businesses and an investor could see thousands of deals a year. You must make your business stand out amongst competitors with a compelling story that clearly demonstrates why your business is valuable. Take the time to put your business story together so that you can share it clearly and confidently. Consider why your business has been successful and why it will continue to grow and be more successful in the future. Give your potential buyer the evidence they need to offer a higher valuation with confidence.

Succession planning

It is essential to consider how your business will continue to operate profitably without you there. Proper succession planning shows potential investors that your business’s value will continue to rise in the future, even when you are gone.

Take the time in the years and months before selling to reduce dependency on you, put key people in place, document processes and systems properly, and develop a succession plan that ensures other people know how to manage the business and keep it profitable without you. All of this gives extra confidence to a potential buyer and can increase your company’s valuation.

Increasing Company Value Before A Sale

Part of preparing your business for sale is maximizing its value before putting it on the market. Take steps early on to really drive revenue and profits to increase your company’s value so you can sell it at a higher price.

Consider performing a SWOT analysis and focusing on areas that drive growth and reducing company activities that don’t bring in enough profits. Get input from your staff and employees on how you can increase revenue. Focus on improving your product and service and retaining customers.

You may also want to trim unessential costs wherever possible, including entertainment, memberships, subscriptions, conference attendance fees, and so on. Especially in the year leading up to your business sale, try to hold back on these expenses to increase your company’s value.

Consider how you will frame your business

As a business owner, you deeply understand the nuances of your business and its customers but potential buyers do not have the same intel. They will be looking at specific metrics and data and may miss important insights that aren’t immediately obvious, resulting in a lower valuation. This is where framing comes in.

You must optimally frame your business to highlight specific data and trends and avoid the chance of misinterpretation. For example, a large percentage of your customers may be low-value and have a high churn rate. A potential buyer may look at your customer retention rate, find it low, and offer a lower valuation. However they aren’t seeing the bigger picture. In that case, you may want to separate your low-value and high-value customers and show that your high-value customers have a high retention rate. This changes the way an investor perceives your business, provides the full story, and prevents misinterpretation of data.

Consider what metrics a potential buyer will be looking at and see if you can spot situations that may require framing.

Put yourself in a potential buyer’s shoes

Finally, when preparing your business for sale you want to think like a buyer and not a seller. Consider what a potential buyer might be looking for in a business. Be honest with yourself when examining your business from their perspective and identify any weaknesses or challenges that may need to be addressed or framed in a particular way. Perform due diligence on your business and look at your financial statements with a fresh, unbiased eye.

This process helps prepare you for any questions and concerns, and gives you the opportunity to fix issues before they are brought up by a potential investor.

Preparing your business for sale – Summary

You have worked hard to grow your business and you should be awarded with the valuation you deserve. Make the process easier for yourself by planning early and working with M&A advisors who can guide you through the process with unbiased expertise that ensures a successful exit.

Why You Need an M&A Advisor

When the right acquisition offer comes in, being unprepared with essential documents can lead to missed opportunities or a failed deal. An M&A advisor ensures you’re fully prepared, guiding you through every stage of the process. From securing a higher valuation to streamlining due diligence and strengthening your negotiating position, an M&A advisor maximizes your chances of a successful exit. They also help reduce stress by managing the complexities of the sale and ensuring you avoid costly pitfalls. Whether you’re planning to sell soon or optimizing for the future, an M&A advisor is key to a smooth and profitable transition.

About Aventis Advisors

Aventis Advisors is an M&A advisor for technology and growth companies. We believe the world would be better off with fewer (but better quality) M&A deals done at the right moment for the company and its owners. Our goal is to provide honest, insight-driven advice, clearly laying out all the options for our clients – including the one to keep the status quo.

Get in touch with us to discuss how much your business could be worth and how the process looks.