India has solidified itself as a key hub for mergers and acquisitions (M&A) over the last decade.

With a fast-growing economy, a large consumer base, and a flourishing technology ecosystem,

it offers unrivaled opportunities for investors. The country’s M&A landscape continues to attract

both financial and strategic players.

Favorable demographic trends, ongoing regulatory reforms, and a surge in entrepreneurial activity across critical sectors like technology, healthcare, and infrastructure have all fueled India’s M&A momentum. As India positions itself as a global economic powerhouse, M&A will remain an essential driver of market consolidation and growth.

This report delivers a comprehensive analysis of M&A activity in India over the past decade, focusing on disclosed valuation multiples to uncover key market trends. Our approach examines the balance between financial and strategic buyers, with particular attention to majority acquisitions (stakes exceeding 50%). By analyzing buyer behavior and industry dynamics, we provide valuable insights into the forces shaping India’s evolving M&A landscape.

Table of Contents

- Summary

- Number of Acquisitions

- Financial and Strategic Investors

- Key Sectors Driving M&A Growth in India

- Median Deal Values

- Valuation Multiples Dynamics

- Legal Considerations

- About Aventis Advisors

Indian Economy: A Powerhouse Driving M&A Growth

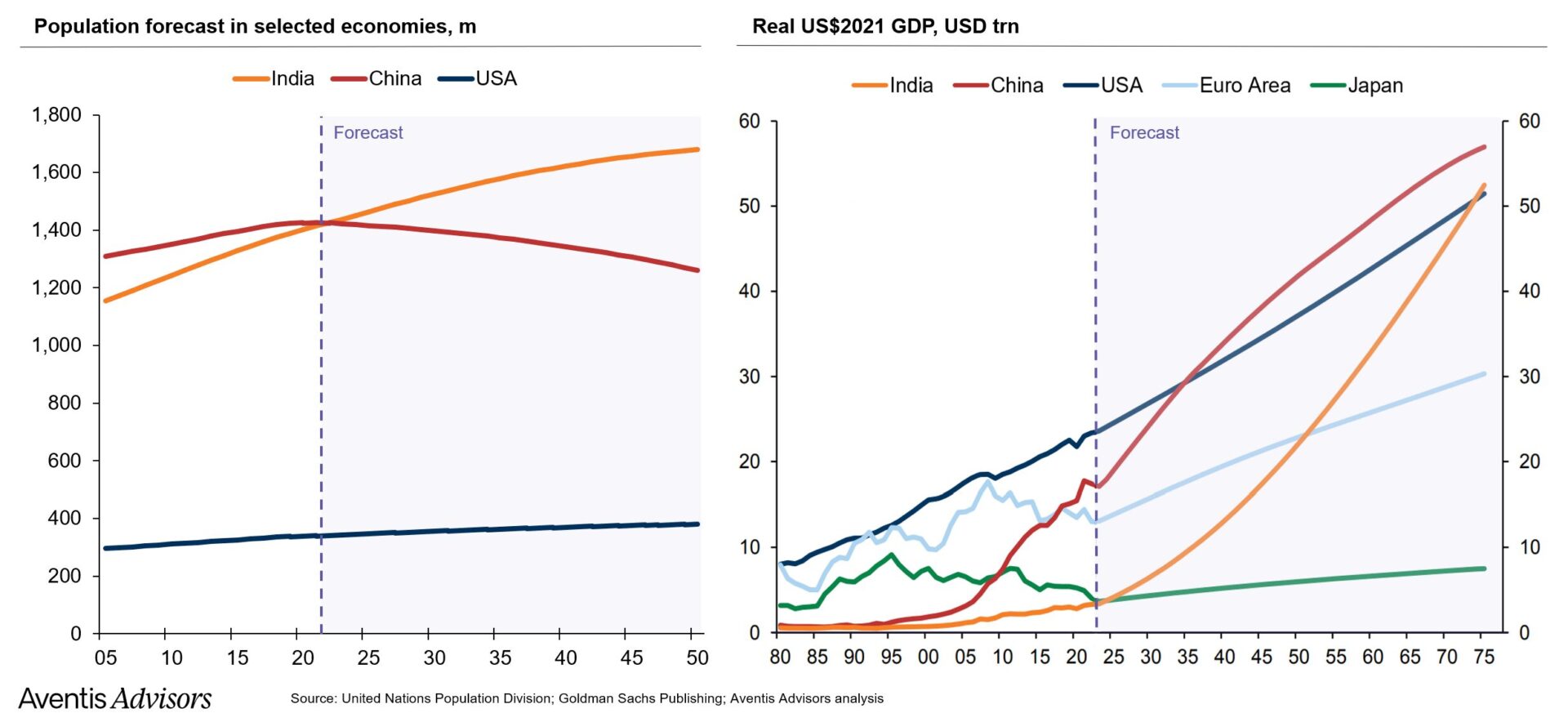

India’s projected population growth and GDP surge offer significant opportunities for mergers

and acquisitions. By 2050, India’s population is set to exceed 1.6 billion, providing a vast talent pool and a growing consumer base. This demographic dividend will attract global corporations seeking market expansion and skilled labor.

Simultaneously, India’s GDP growth trajectory—expected to narrow the gap with economic giants like the USA and China—signals a rise in domestic companies’ global competitiveness. M&A activity in India will likely increase as foreign firms seek entry into this high-growth market and local firms expand globally, capitalizing on India’s economic and demographic strengths.

India’s economy remains one of the world’s fastest-growing, reinforcing its role as a leading market for M&A activity. Real GDP growth is projected to hit 6.7% by 2027, underscoring the strength of its domestic market, government policy support, and robust activity across key sectors.

Stable inflation, with the Consumer Price Index (CPI) expected to reach the Reserve Bank of India’s 4.0% target by 2027, further enhances economic stability. Paired with steady currency conditions, India is increasingly seen as a strategic hub for global acquisitions, particularly attracting interest from overseas investors and private equity funds.

Summary of Key Insights and Trends in India’s M&A Market

India’s M&A landscape is evolving rapidly, reflecting the country’s broader economic growth and strategic importance. Here are some key trends driving this activity:

- Growing Deal Volumes: India continues to see consistent growth in M&A activity, with strong interest from foreign investors and private equity funds, highlighting its attractiveness.

- Sectoral Momentum: The technology, financial services, healthcare, and energy sectors are leading the charge, benefiting from digital transformation, regulatory support, and the drive toward sustainability.

- Rising Influence of Financial Investors: Financial investors, including private equity and venture capital firms, are playing a bigger role in M&A, reflecting growing confidence in India’s high-growth potential and technology-driven sectors.

- Shifting Market Dynamics: While strategic acquisitions have historically dominated, the increasing participation of financial investors points to a more balanced and competitive M&A environment.

- Foreign Investor Appeal: India’s favorable economic policies and demographic trends continue to draw significant interest from overseas buyers, particularly in high-growth industries like technology and e-commerce.

These trends suggest that India’s M&A market will remain vibrant, driven by the nation’s strong economic fundamentals and growing influence as a global investment hub.

Number of Acquisitions

M&A activity in India has expanded at an impressive compound annual growth rate (CAGR) of 7.1% from 2014 to 2024. Peaks in activity in 2019 and 2022 highlight the high level of interest across sectors, particularly from foreign investors.

The sectors leading this momentum include computer software, financial services, and e-commerce, driven by the rapid growth of India’s digital economy. This trend underscores the increasing importance of technology-led businesses as the country embraces a digital-first approach.

In 2023, deal volumes dipped slightly, with 1,093 transactions, followed by a further decline to 1,005 in 2024. This slowdown reflects a natural cooling-off after the 2022 peak, coupled with global headwinds such as inflation, geopolitical tensions, and tighter financial conditions. However, the outlook for 2025 is optimistic, with expectations of a rebound driven by improving economic conditions, stabilizing financial markets, and renewed investor interest across key sectors.

Despite short-term challenges, India’s M&A market is poised for sustained growth. Its rapidly expanding economy and sectoral opportunities continue to attract both domestic and international investors. The strategic positioning of Indian companies, combined with a supportive regulatory environment, further enhances the market’s appeal, setting the stage for a strong 2025.

Financial and Strategic Investors

The number of financial acquisitions in India has grown substantially, rising from 186 in 2014 to 605 in 2022. This upward trend reflects a growing interest from financial investors, particularly private equity (PE) and venture capital (VC) firms. These players are increasingly targeting India’s dynamic technology-driven businesses, especially in sectors like e-commerce and software.

Historically, strategic acquisitions have dominated India’s M&A landscape. However, the gap between financial and strategic buyers has narrowed over time. Financial deals now make up half of all M&A activity, reflecting a shift in market dynamics as investors increasingly pursue long-term growth opportunities alongside strategic positioning.

This evolution mirrors broader global trends, with financial investors becoming more significant players in India’s growth story. Their interest, particularly in high-potential sectors like technology and digital platforms, suggests they see India as a market offering substantial long-term returns.

Key Sectors Driving M&A Growth in India

India’s technology sector leads the M&A landscape, accounting for 21.0% of all acquisitions. This surge is fueled by the country’s rapid digital transformation and the growing demand for tech solutions. With a strong focus on cloud computing, artificial intelligence, and cybersecurity, India is emerging as a major hub for software development and digital infrastructure.

The financial services sector represents 9.3% of M&A activity, with internet/e-commerce at 8.7%. Both are key areas of growth, driven by India’s burgeoning fintech ecosystem and the rise of online retail. Increased digital payments, mobile commerce, and tech-enabled financial services have fundamentally transformed these sectors, creating new opportunities for investors.

In these sectors, financial acquisitions dominate, reflecting the growing role of private equity and venture capital. PE firms, in particular, are focusing on high-growth tech companies with strong expansion potential, highlighting their critical role in shaping India’s digital economy.

Beyond technology and financial services, energy and natural resources (8.6%) and healthcare (7.8%) also saw substantial M&A activity. Investors in these areas are often driven by sustainability goals, with a particular focus on renewable energy and healthcare innovation. These sectors are poised for long-term growth, aligning with global trends toward clean energy solutions and advancements in biopharma.

Deal Values

India’s M&A market has seen a notable surge in deal values, peaking in 2021. The COVID-19 pandemic was a significant driver, with sectors like technology and e-commerce seeing high growth as digital transformation accelerated. Investors flocked to these areas, recognizing their resilience and potential for rapid expansion.

However, after the 2021 peak, median deal values declined in 2023, reflecting a cooling-off period. Global uncertainties, including geopolitical risks, inflationary pressures, and tightening financial conditions, weighed on investor sentiment. Despite this, the outlook for 2025 is positive, with median deal values expected to continue improving gradually, reflecting growing confidence in sectors such as technology, healthcare, and digital services.

As the market stabilizes, there is increasing scope for consolidation, particularly in key sectors. With India’s strong economic fundamentals and robust regulatory environment, the M&A market is likely to continue offering attractive opportunities for investors.

Valuation Multiples Dynamics

Valuation multiples, such as EV/EBITDA, have shown upward momentum over the past decade, particularly in high-growth sectors like technology, financial services, and e-commerce. From 2014 to 2024, the general trend has been one of increasing multiples, driven by investor optimism and rising demand for digital businesses.

The 2021 peak, which saw valuation multiples reach unprecedented levels, reflected the surge in interest in technology-driven sectors during the pandemic. However, by 2023, the 3x rolling average dropped to 14.6x, signaling a broader market correction. In 2024, multiples slightly decreased to 14.1x, reflecting a cautious outlook amidst global uncertainties.

Despite this dip, the overall upward movement in valuation multiples indicates sustained interest from investors, particularly in sectors like technology, healthcare, and other high-growth industries. This trend is expected to continue as India’s economy rebounds and investors seek opportunities in the country’s most dynamic sectors.

Legal Considerations

India’s M&A market benefits from a robust regulatory framework, including the Companies Act, Foreign Exchange Management Act (FEMA), and Securities and Exchange Board of India (SEBI) regulations. These laws streamline acquisition processes and enhance transparency, encouraging both domestic and foreign investments.

The framework also supports cross-border mergers, making India an attractive destination for foreign investors. Clear regulatory guidelines ensure smooth transactions, fostering market growth and facilitating inbound mergers and cross-border deals.

Government policies further bolster foreign investment, strengthening the market positions of Indian companies. This legal environment boosts confidence and drives capital flow into key sectors such as the manufacturing sector, healthcare sector, and renewable energy, fueling M&A activity and drawing strong interest from overseas investors.

Why you need an M&A advisor when buying a company in India

The Indian M&A market offers significant opportunities through its growing economy, expanding consumer base, and tech sector strength. However, success demands careful navigation of regulations, cultural dynamics, and local business practices. Key challenges include diverse negotiation approaches, due diligence complexities, and country-specific risks, making M&A expert guidance essential.

M&A advisors in India bring valuable local expertise to navigate the country’s dynamic market and ensure a smooth transaction process. With in-depth knowledge of local regulations, valuations, and deal structuring, M&A advisors help businesses optimize value and drive successful transactions. Their expertise in rapidly evolving sectors like technology and healthcare makes M&A advisors invaluable partners for both domestic and international buyers seeking to successfully complete deals in India.

About Aventis Advisors

Aventis Advisors is an M&A advisor specializing in technology and growth companies. Our focus is on delivering high-quality, strategic deals at the optimal moment for companies and their owners, with a commitment to insight-driven advice and transparency.

In today’s dynamic business environment, we believe that fewer, more meaningful transactions will drive long-term success. With an increasing interest in India’s M&A landscape, Aventis Advisors is expanding its presence in the country. Our goal is to offer expert guidance to both Indian companies and foreign investors looking to tap into India’s most promising sectors.

Our team is ready to help you explore a full range of strategic options and ensure the best outcome for your business. Get in touch with us to learn how Aventis Advisors can help unlock value and guide you through the M&A process with local insights and global expertise.