Timing is everything when it comes to selling a technology company. Even a great business can fetch a disappointing price if sold during a market lull, while a mediocre one might command a premium in a frothy market.

For mature tech company owners contemplating a sell-side M&A process, choosing when to sell is as critical as deciding whether to sell. Unlike buy-side acquisitions (where the focus is on finding and integrating targets), sell-side timing is about maximizing your company’s value and likelihood of a successful exit by aligning with optimal market and business conditions.

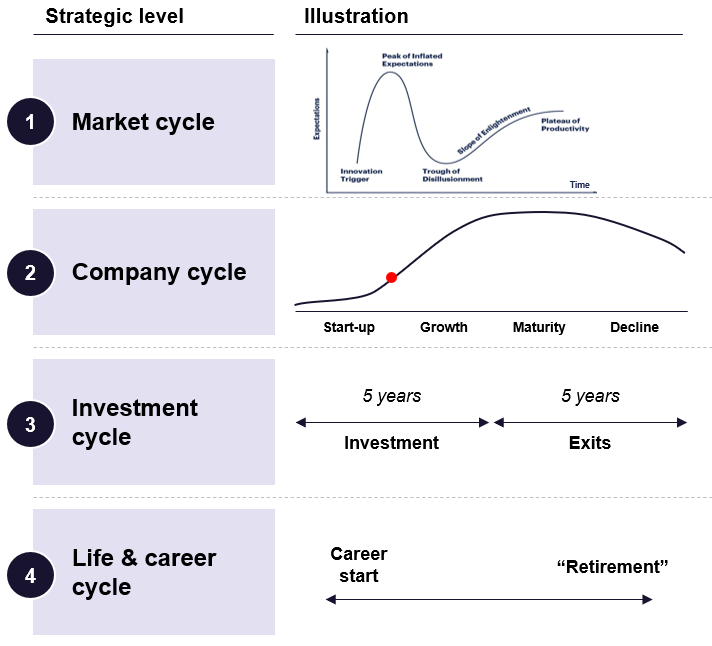

This article presents a comprehensive framework, grounded in market data and investor behavior, to help you determine the right timing for your exit. We will examine four key dimensions of timing:

- Market Cycle: The macro environment and industry trends.

- Company Lifecycle: Your company’s growth stage and business trajectory.

- Investment Cycle: Capital availability and investor/shareholder timelines.

- Founder’s Life & Career Goals: Personal objectives and readiness of the owner/founder.

Each of these factors plays a role in when you should initiate a sale process. The goal is to identify a window where external market conditions are favorable, your business is at a valuation peak (or heading toward one), investor pressures align, and you (the owner) are personally ready to make the transition. In practice, these factors won’t all line up perfectly – there will always be some uncertainty – but understanding each dimension will help you make a well-reasoned, data-driven decision on timing. Let’s dive into each of the four dimensions in detail.

Market Cycle: Riding the Waves of Tech M&A Markets

The broader market environment sets the backdrop for any M&A deal. Market cycle refers to the overall state of the economy and the tech sector – are we in a boom, a downturn, or somewhere in between?

Sellers generally get the best outcomes when the market cycle is in their favor, i.e. when investors are bullish, capital is cheap, and buyers are actively looking for acquisitions. Key market factors to consider include interest rates, the health of capital markets, tech stock valuations, M&A activity levels, and even regulatory climate.

- Interest rates and cost of capital: Interest rates have a powerful influence on tech company valuations. In recent years we’ve seen a stark demonstration of this effect. During the late-2010s and into 2020-2021, interest rates were very low, which meant abundant cheap capital and sky-high valuations for tech companies. Many software and tech firms commanded extremely rich revenue multiples at the peak of the market. However, as inflation surged and central banks tightened policy, interest rates climbed to their highest levels in over a decade by 2023, resulting in significant market correction

- Tech market sentiment and M&A activity: Beyond interest rates, gauge the overall sentiment in the tech sector. Is the tech market in an upswing (bull market) or downturn (bearish sentiment)? During periods of optimism, acquirers (both corporate and private equity) are more aggressive in pursuing deals, fearing to miss out on growth opportunities.

- Industry trends and hype cycles: The broader tech landscape often moves in waves of hot trends. Whether it’s cloud computing, fintech, artificial intelligence, or biotech, being in a “hot” sector can dramatically affect your timing. When a particular technology or sector is in vogue, buyers pay a premium for growth and strategic position.

Actionable insight: Evaluate the market cycle before you sell. Ask yourself: Is the economy expanding or contracting? What are interest rates doing? Are similar tech companies getting good valuations in M&A or IPOs right now? If the overall market is near a peak (high valuations, lots of deal activity), it could be an excellent time to sell – buyers have optimism and access to capital, and you might achieve a premium price. If the market is in a trough (low valuations, scarce deals), consider whether you can afford to wait for a rebound. Of course, trying to time the market perfectly is risky – no one can predict exactly when peaks or bottoms occur. But understanding the market cycle will help set realistic expectations. In short, lean towards selling when the market winds are at your back, unless there’s a compelling reason to do otherwise.

Company Lifecycle: Leveraging Your Growth Stage for Maximum Valuation

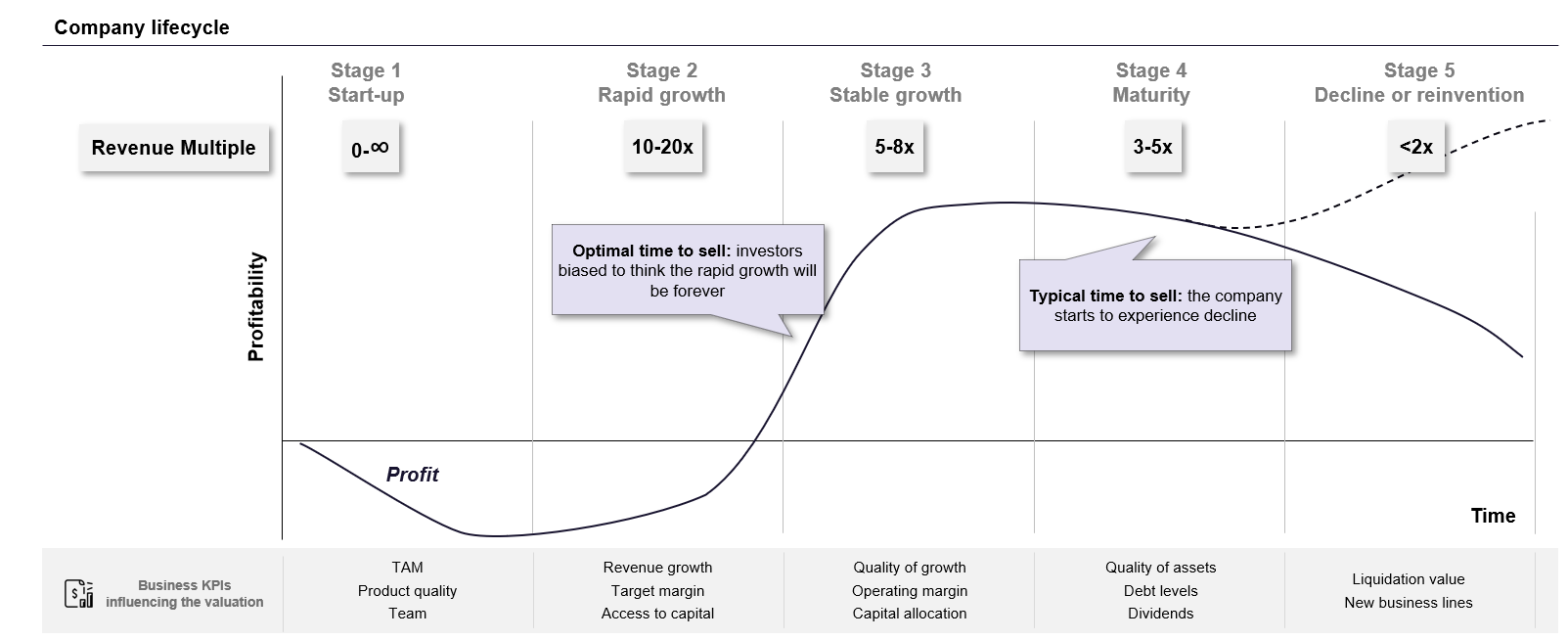

Just as markets have cycles, so do companies. Every tech business goes through stages, from startup and rapid expansion to maturity and potentially decline. Your company’s lifecycle stage has a huge impact on its valuation and thus on the optimal timing for a sale. In general, valuation multiples (like price-to-revenue or price-to-EBITDA) are highest during the period of rapid growth, and they tend to shrink as growth slows and the company becomes more “established.” Savvy sellers aim to hit the market while their company’s future still appears full of growth, rather than after it has plateaued.

Extremely high-growth tech companies can command revenue multiples in the double digits (10× or more) during their rapid growth phase, when investors believe the growth trajectory will continue for a long time. As the company transitions to stable growth or maturity, typical valuation multiples drop to single digits (e.g. ~3x-8x in a stable growth stage, compressing to ~2x-5x in mature stage).

Eventually, in a declining or very mature business, investors look at EBITDA multiple as future growth prospects dim and the business needs to generate cash flow.

Where is your company in its lifecycle? This is a crucial question for timing. If you’re still in a high-growth stage with a long runway ahead, you are in a sweet spot to potentially sell the dream of future expansion to acquirers. In fact, many investors say the best time to sell is when you can convince buyers that your rapid growth will last “forever” (or at least far into the future). Practically speaking, this often means selling before your growth rate visibly starts to decelerate.

In summary, from a company lifecycle perspective, the best time to sell is when your company is on a high-growth trajectory that is still convincing, but after you’ve removed some early-stage risk. As one analysis succinctly put it, the optimal time is during the rapid growth phase when investors are “biased to think the rapid growth will be forever,” whereas waiting until the growth stalls is a common pitfall.

Actionable insight: Assess your growth curve candidly. If you are growing fast now, project how your growth rate will trend over the next 2-3 years. If you see signs of deceleration ahead (e.g., market saturation, emerging competition, capacity limits), consider starting conversations with potential acquirers sooner rather than later. Ensure your house is in order to showcase the best metrics (a strong last twelve months and next twelve months projection).

Remember that perception matters: selling while your company’s story is one of expansion and potential yields far better negotiations than selling when the narrative has shifted to “challenges and turnaround”. Timing, in this respect, is about capturing the peak sentiment about your company’s future.

Investment Cycle: Investor Timelines and Capital Considerations

VC & PE-backed businesses

The third timing dimension is what we might call the investment cycle, essentially, the context of your company’s financing and ownership structure. This includes the expectations and timing needs of your investors (venture capital, private equity, or even internal shareholders), as well as the availability of capital for further growth if you don’t sell. Broadly, ask: Are the company’s investors (including you) pushing for liquidity soon, or are they willing and able to continue supporting growth? And, what does the funding environment look like if you were to raise more capital instead of selling?

If your company is venture-backed or PE-backed, your investors likely have a target timeline for exit. Most VC funds, for example, operate on roughly a 7-10 year fund cycle. If they invested in your company, say, 5-7 years ago, they will be increasingly eager to realize a return (via a sale or IPO) in the coming years.

In practical terms, that means if you have investors from those years, they are probably nudging you to consider exit options or at least generate liquidity for them. Ignoring investor timing can become problematic: investors might start pushing for a sale even if market or company conditions aren’t ideal, which can create pressure to sell at a less-than-optimal time. As a founder or CEO, you’ll need to balance what’s best for the business with what satisfies key stakeholders.

Another option is to initiate an M&A process timed to align with their fund horizon. The key is communication – know your investors’ exit mandates. If you’re nearing the end of your investors’ patience or fund life, that itself might dictate a timeline: you might decide to ride the current market cycle as far as possible but not beyond a certain year, for instance.

Bootstrapped businesses

Even if you are the sole owner (no outside investors), consider your own investment cycle – you’ve likely invested years of your life and maybe personal funds into the company. At some point, you’ll want liquidity or diversification of wealth. The concept of opportunity cost comes in: could the capital (and time) you have tied up in this business yield better returns if deployed elsewhere or even in a passive investment? Many owners eventually reach a stage where doubling the business again might take many years and lots of effort, and they conclude it’s better to sell and perhaps invest in new ventures or other opportunities. That personal investment calculus is akin to an investor’s timeline, even if informal.

Shareholder alignment: If you have multiple shareholders (co-founders, angel investors, employee stockholders), their interests come into play too. Perhaps some stakeholders are eager to liquidate holdings (buy that house, lock in a win, etc.), while others prefer to keep building the company. It’s important to gauge the sentiment – a fragmented shareholder base with different timing desires can complicate a sale process. Ideally, you reach a consensus or at least ensure the key decision-makers are on the same page. Sometimes, bringing in a financial advisor for an objective view on valuation and exit options can help align everyone on timing.

Actionable insight: Map out your investment timeline alongside your investors’. Ask: Are we under any timing pressure from investors or cash needs? If your VCs/PE have a target to exit in the next 1-2 years, it’s prudent to begin positioning the company for sale – that might mean talking to advisors, cleaning up financials, and perhaps timing one last growth push to coincide with the sale process.

Founder’s Life & Career Goals: Personal Readiness and Objectives

Finally, the timing of a sale must align with the goals and readiness of you – the founder or owner (and often the key executive). It’s easy to focus purely on market and business metrics, but an M&A event is a profoundly personal decision too. Your life situation, ambitions, and energy level are pivotal in determining when the time is right to sell. After all, building and selling a company is not just a financial transaction; it’s a transition in your career and life.

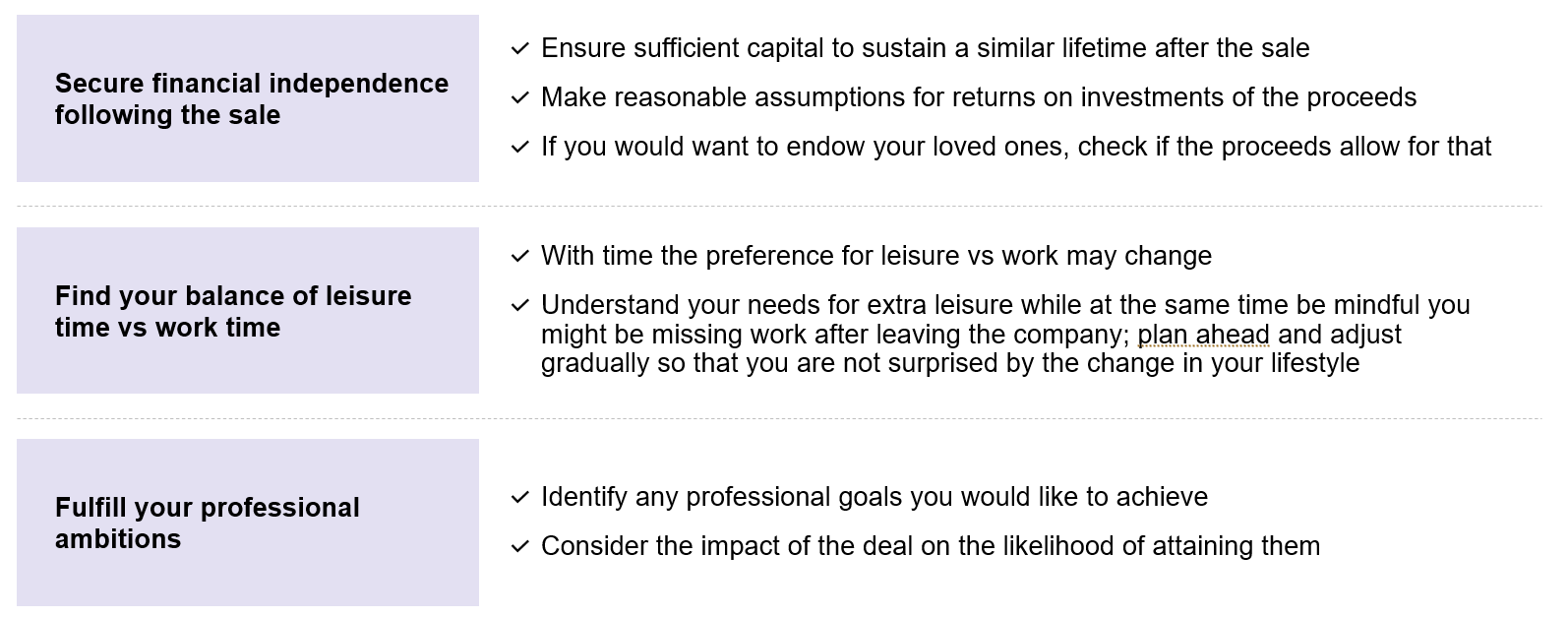

Start with a fundamental question: What do you (and your founding team) want for your lives and careers in the next chapter? Some founders set out from the beginning with a certain goal, e.g. “I want to retire by age 50” or “I’ll grow this venture for 10 years then move on to a new challenge.” Others may find their feelings evolve over time – the grind of running a business might be wearing them down, or conversely they may still be passionate and not ready to let go. There is no right or wrong answer, but it’s critical to be honest with yourself. Selling your company will likely bring a substantial change: you might gain financial security, but you’ll lose the day-to-day role and perhaps your identity as “the boss.” Your personal aspirations need to align with the decision to exit.

Consider the following personal factors in timing:

- Financial independence and security: One common reason to sell is to secure your financial future. If a sale at current valuations would achieve “enough” for you (and your family) to be financially independent, that might tilt the calculus towards selling sooner. Post-sale, you could diversify your wealth, invest, or simply enjoy a comfortable life without the risks tied up in a single business. It’s wise to actually calculate what “number” you need to sustain your desired lifestyle and goals after a sale. Ensure that an exit can reasonably meet that number (after taxes, transaction fees, etc.). If not, you may decide to hold and grow the business more until you can hit your financial target.

- Professional ambition and fulfillment: Ask yourself if you have achieved what you set out to with this company, or if there are still burning ambitions you want to fulfill by continuing to lead it. Some founders simply love the game and want to keep running the business for as long as possible. If that passion is still strong, selling too early could lead to personal regret, even if the financial outcome is positive.

- Burnout and stress vs. passion: Running a tech company, especially a scaling one, is intense. It’s common to hit periods of burnout. If you find that the joy is gone and it’s becoming purely stressful or draining, that is a strong personal signal that a transition might be appropriate. A founder who is burnt out can inadvertently harm the business (reduced energy, slower decisions, etc.), which in turn can harm valuation, so oddly enough, selling before you’re completely burnt out (but as you feel your enthusiasm waning) can preserve value. On the flip side, some entrepreneurs are very aware that they thrive on the early stages of a business but not the later operational stages. If you feel your strengths are in innovation and you’re now spending time managing HR, processes, and bureaucracy in a more mature firm – and you don’t enjoy it – you might time your exit to let a new management (perhaps from the acquiring company) take over the scaling while you move to a new startup project.

- Life circumstances: Don’t overlook personal life events. Family considerations (new children, kids approaching college, aging parents), health issues, relocation desires – these can all influence timing. For example, if you know you’ll be moving to a different country in two years for family reasons, it might make sense to plan the sale before that move. Or if you have a health concern that might make it hard to continue the all-consuming role of CEO, that could accelerate your timeline. These aren’t business metrics, but they are real factors that mature company owners should weigh. After all, one benefit of selling is often reclaiming personal time. Some founders can’t wait to have more free time for family, hobbies, or travel; others fear they’ll be bored without the company. Know which camp you fall in.

In preparing for a sale, personal readiness is as important as corporate readiness. A transaction can be emotionally taxing: you’ll go through intense negotiations, due diligence (which can feel invasive), and then the psychological process of letting go of something you built. You should be sure you’re up for that. Additionally, think about your role post-sale. In many sell-side M&A deals, especially if you sell to a larger company or PE, you might be asked to stay on for a transition period (6-24 months) or to roll some equity. If you are completely done and want out, you might negotiate differently (perhaps accept a slightly lower price for an all-cash, clean exit). If you don’t mind sticking around under new ownership, that can expand your pool of buyers. Timing here might involve aligning a sale with a point where you are ready to potentially step back. For instance, you might not want to leave until a successor is groomed or until you hit the company’s 10th anniversary, etc. Those are personal milestones that can influence timing.

Actionable insight: Gauge your personal “why” for selling. If your primary motivation is financial, calculate if the current market and company value can meet your needs: if yes, it could be time; if not, you might push the business further before selling. If your motivation is non-financial (e.g. freedom, new projects, burnout), be realistic about whether those feelings will intensify or if they can be managed by other means (like hiring a COO to ease your workload, etc.).

Sometimes, founders hesitate to sell because of emotional attachment – it’s often said “a company is like your baby.” Overcoming that emotional hurdle is part of being ready. Make sure you won’t be crippled by seller’s remorse; if you suspect you might, perhaps delay until you accomplish certain personal milestones with the company that you’d be proud of.

Conversely, don’t let pure emotion trap you in running a company that you know logically you should exit. Achieving clarity on your personal goals will either reinforce the decision to pursue a sale now or suggest that you hold off until those personal goals align better with an exit.

Balancing the Four Dimensions: Crafting Your Exit Timing Strategy

We’ve broken down market, company, investment, and personal factors as if they were separate, but in reality, they interplay in complex ways. The art of timing your sell-side M&A process is in balancing these dimensions and finding a window that optimizes as many as possible. Inevitably, there may be trade-offs.

Remember, uncertainty is a given in M&A. You will almost never have 100% certainty that “now is the absolute peak moment” that recognition usually only comes in hindsight. Instead of seeking perfection, seek sufficiency: is the timing sufficiently favorable on the key dimensions to likely result in a successful exit that meets your goals?

Practical next steps for tech business owners considering an exit:

- Regularly review these four factors: perhaps every year or bi-annually – as if creating an “Exit Timing Dashboard.” Keep tabs on market indices, recent M&A deals in your sector, your company’s latest growth metrics, investor sentiment, and your own personal state of mind. This way, you’ll notice trends (e.g. market improving, or your motivation declining) early enough to act.

- Get a valuation or marketability assessment. Engage with an M&A advisor informally to get a sense of what your company might be worth in the current market and who potential buyers could be. They can provide insight into how buyers are behaving now and what might be the biggest drivers or impediments to a deal. This can validate (or challenge) your internal read on the timing.

- Align stakeholders. If you have co-founders, a board, or major investors, start a frank conversation about timing. It’s much better to surface any differences in vision early. If your lead investor expects an exit in 2025 but you were thinking 2028, that’s a gap to address. Getting everyone on the same page will make the eventual process smoother and avoid derailments.

- Prepare the company for sale well before you intend to actually execute. Good timing can be squandered if your company isn’t ready for due diligence or can’t present itself well. Ensure your financial records are solid, legal issues resolved, key contracts secured, and growth plans articulated. That way, when you sense the timing is right, you can jump into a sale process and move fast to closing while the window is open.

- Be willing to walk away. Even with all timing factors considered, if you start a sale process and the market shifts or offers come in far below expectation, you can choose to pause and revisit later. Selling your company is ideally a once-in-a-lifetime event, it’s worth doing at the right time rather than forcing it at a bad time.

In the end, timing a sale is part science, part art. You manage what you can control (your company’s performance and readiness) and stay alert to what you can’t (market swings). By following a structured approach and grounding your decision in both data and honest introspection, you can exit on your own terms. And when you do, you’ll maximize not just the enterprise value captured, but also the likelihood that you look back and say, “We sold at the right time.”

About Aventis Advisors

Aventis Advisors is an M&A advisor for technology and growth companies. We believe the world would be better off with fewer (but better quality) M&A deals done at the right moment for the company and its owners. Our goal is to provide honest, insight-driven advice, clearly laying out all the options for our clients – including the one to keep the status quo.

Get in touch with us to discuss how much your business could be worth and how the process looks.