Deciding to sell your business can be difficult when the economy is in a downturn. After all, most companies suffer during recessions and owners are better off waiting until the situation improves. Most founders prefer to take a look-and-see attitude in an economic downturn. And indeed for most companies it would be wise to wait it out.

However, there are valid reasons to sell a business in a recession. In this article we will look at four of those reasons.

1. It takes time for the private M&A activity and valuations to slow down

Stock market crashes can be brutal, wiping out years of gains in months. But while the valuations of publicly traded companies and the number of IPOs come crashing down quickly, the same cannot be said for private M&A transactions.

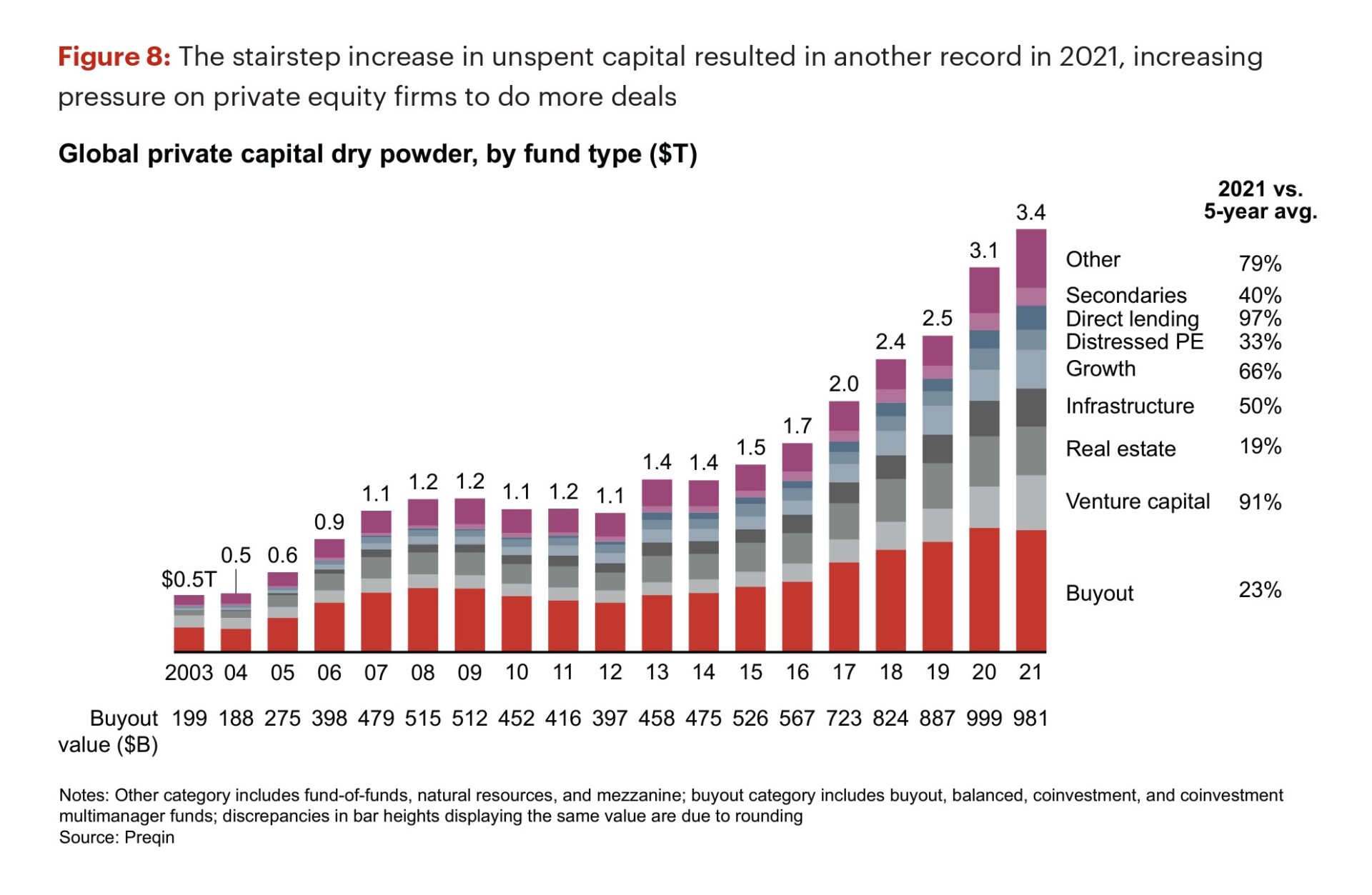

Strategic investors and private equity firms tend to be more patient when investing in companies, and they’re often willing to pay premium prices for businesses they believe have long-term potential.

It takes time for strategic investors to put projects on hold and they may even become more interested in acquisitions to turn around their businesses. At the same time, financial investors still need to deploy the funds raised during the preceding boom period.

In many instances, the owners are better off selling a business in the early stages of a recession than waiting until the economy rebounds.

2. Downturn is a great time to start a new venture

Many people view declines in economic activity as a time of uncertainty, and for a good reason. However, recessions can also offer business opportunities for those willing to take risks. Starting a business at the peak of the cycle is tricky as you compete with richly funded companies, fighting for the employees and customers.

When the trouble starts, large companies are less agile and have less space for maneuvering, so they have to fall back to lower prices, cost cutting, and mass layoffs. Hiring qualified employees, finding cheaper suppliers, and surviving in a rapidly changing environment is more accessible for new businesses. Recessions can offer a unique window of opportunity for those with the courage to seize them.

While it may seem counterintuitive, difficult economic times can be an excellent time to start a business. It was the case with Airbnb, Uber, and Square, which were all founded during the last recession in 2007-2009.

During periods of recession, people are typically more cautious with their spending. This can lead to a decrease in demand for luxury hotels but an increase in demand for cheaper short-term rentals (Airbnb).

In addition, recessions can also create opportunities for new businesses to fill gaps in the market left by struggling incumbents. For example, when the dot-com bubble burst in 2001, many new businesses could thrive by leveraging the Internet infrastructure created during the tech boom.

Similarly, Microsoft was founded during the 1970s stagflation, a period of high inflation and unemployment. While other companies were forced to lay off employees and cut costs, Microsoft was able to invest in research and development, laying the foundation for its eventual dominance of the tech industry.

Funding a new venture

When funding your new business or making investments, you might want to consider divesting from your current business. Divestment is the process of selling off some of your assets to redeploy the capital into a different project. While it may seem risky, divestment can be an intelligent way to generate the funds you need to get your new business off the ground. Here are a few things to keep in mind if you’re thinking about divesting:

- Make sure you have a clear plan for what you will do with the money from the sale.

- Consider the tax implications of divesting.

- Be sure that divesting is the right move for your overall financial strategy.

If you take the time to consider all of these factors carefully, divestment can be an excellent way to generate the capital you need to start your new venture.

3. Not every business will survive the recession

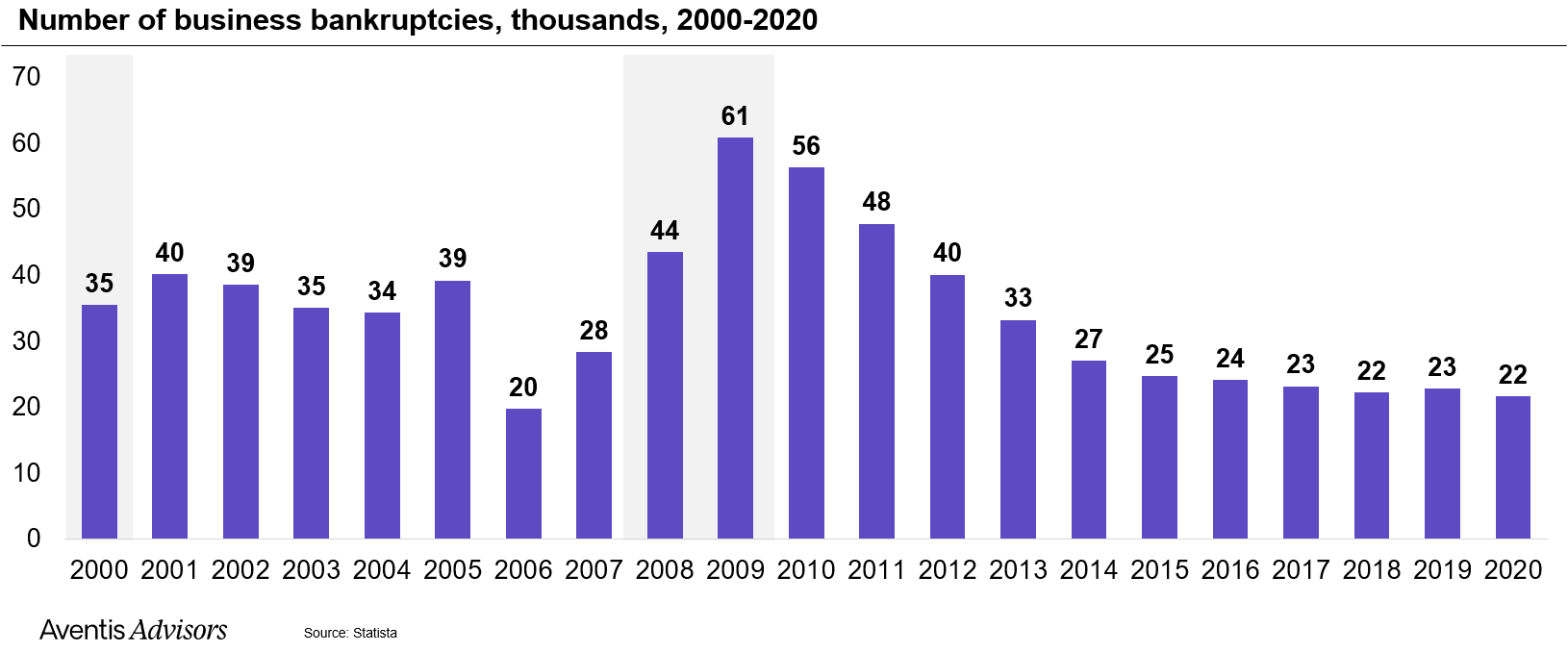

While no one wants to experience a recession, the fact is that many businesses will not survive the harsh economic times. Defaults and bankruptcies increase during a recession. This can put a strain on many small businesses.

M&A can be a solution if you are concerned about your company’s future in a deep recession. If you are part of a larger group or have access to financing, you have a much better chance of withstanding a recession. Defaults and bankruptcies are less common among larger businesses, and they often have the resources to weather an economic downturn until the economy recovers.

4. Perils of leverage

In particular, highly leveraged businesses are at greater risk during a recession. If your company has a debt of more than 4-5x EBITDA, it may be difficult to make payments and stay afloat during tough times, especially given the rapid pace of interest rate hikes worldwide.

Even amid a recession, the M&A market is open, and ample exit opportunities exist. Sometimes selling at a lower valuation in a recession may turn out more favorable than facing the recessionary headwinds on your own.

Certain industries can thrive during a recession. The best businesses are the ones generating solid profits and that provide essential products or services. For such companies, you may be able to negotiate a higher price than you would during an economic boom.

The reason is that these industries can provide stability during economic uncertainty. With limited investment opportunities in other sectors, investors turn to non-cyclical companies that can generate strong cash flow even in an economic downturn.

The risk profile of many investors shifts from growth to profits so they can pay top dollar for the best business. So the loyal client base, committed employees, and brands become the most significant value drivers in valuation.

Recession proof businesses

Health care and education are two sectors typically immune to recession, as people will always need access to medical care and education. Additionally, essential services such as utilities, transportation, and food manufacturing are also typically unaffected by recessions.

There are several industries that benefit from economic downturns. As consumers become more price-conscious, they are increasingly drawn to retailers that offer low prices on a wide range of goods. Many other industries, such as debt collection or short-term loans may also benefit from a deterioration in the economic environment.

Recessions and the tech industry

While an economic recession negatively impacts most industries, the technology sector has historically been more resilient. This is partly because spending on technological innovation is often seen as a necessity rather than a luxury. In addition, many tech companies can weather a downturn by focusing on cost-cutting measures and increasing efficiency. As a result, tech companies often emerge from a recession relatively unscathed.

However, it should be noted that the technology sector is not immune to economic downturns. While tech stocks may not experience the same sharp valuation declines as other sectors, they are still susceptible to market volatility. As such, technology founders should carefully consider the timing of M&A deals.

So while a recession can be brutal for many businesses, there are opportunities for those companies that know how to adapt and take advantage of changing conditions.

Learn how Aventis helps to successfully sell your business

Selling your business can be a difficult decision. There are many factors to consider, and it’s important to have all the information you need to make an informed choice. That’s where we can help. We would be happy to give you our opinion about how resilient your business is in the current environment and what level of valuation you may expect depending on different economic scenarios.

About Aventis Advisors

Aventis Advisors is an M&A advisor focusing on technology and growth companies. We believe the world would be better off with fewer (but better quality) M&A deals done at the right moment for the company and its owners. Our goal is to provide honest, insight-driven advice, clearly laying out all the options for our clients – including the one to keep the status quo.

Get in touch with us to discuss how much your business could be worth and how to maximize the valuation.