BI Convert

-

acquired by

-

TSG Group

Transaction Details:

Business Services

Buy-side advisory

2024

Marcin Majewski, Filip Drazdou

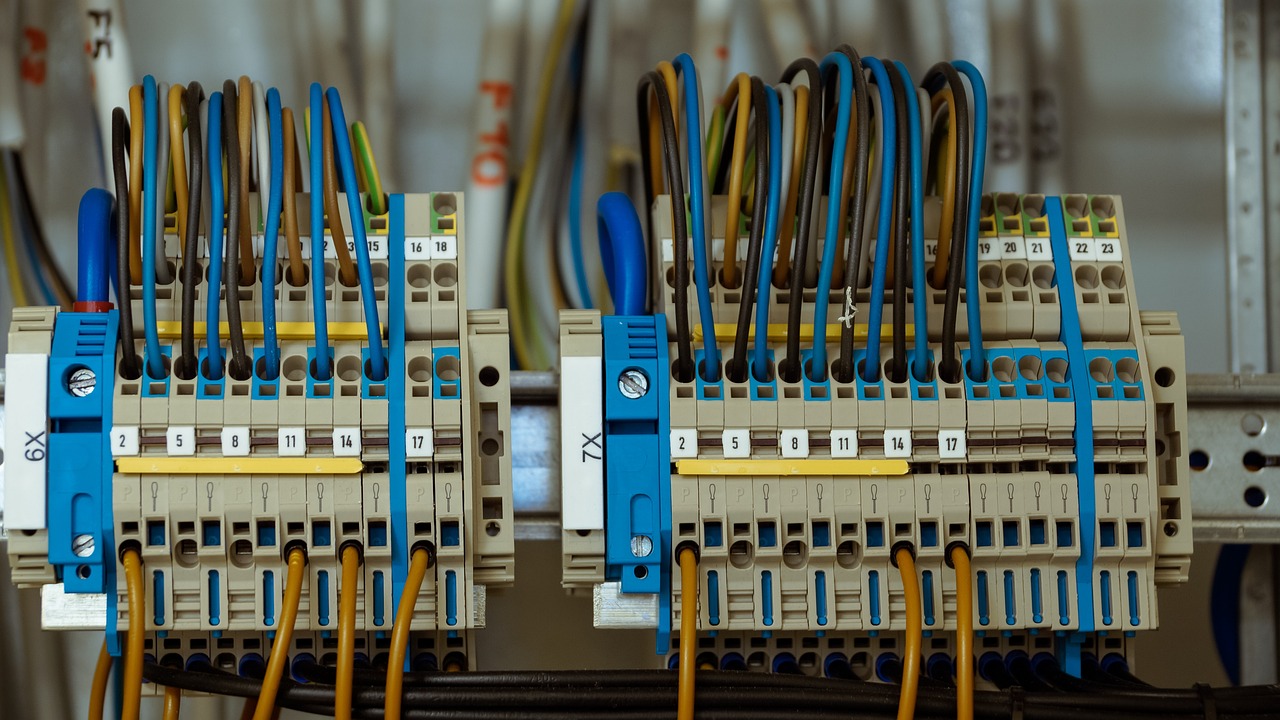

Aventis advised TSG on its acquisition of BI Convert, a Polish company specializing in electrical installations and maintenance. TSG, a European leader in technical services for responsible mobility solutions, acquired BI Convert to strengthen its presence in Eastern Europe and enhance its capabilities in electric mobility and sustainable energy solutions.

Background

TSG Group is a leading player in the energy transition for mobility, operating in 30 countries. The company designs, builds, and maintains energy distribution infrastructures, including electric vehicle charging networks, LPG/LNG, hydrogen, and fuel/biofuel service stations. To strengthen its presence in Eastern Europe, TSG sought a strategic acquisition to enhance its regional capabilities.

BI Convert, a well-regarded Polish company specializing in electrical installation and maintenance services, was identified as a key acquisition target. This acquisition supports TSG’s vision of becoming a leader in new energy solutions for mobility, particularly in the growing market for electric mobility and sustainable energy solutions.

The Challenge

TSG aimed to acquire a Polish firm that would:

- Strengthen its presence and operational capabilities in Eastern Europe

- Enhance its electrical services offering, particularly in the growing market for electric mobility and sustainable energy

- Provide immediate synergies and growth opportunities in the region

Transaction

Our team at Aventis Advisors, in collaboration with Atout Capital, provided comprehensive advisory support to TSG throughout the acquisition process, leveraging our regional expertise and industry knowledge to:

- Identify BI Convert as a strategic target and evaluate its alignment with TSG’s goals.

- Facilitate negotiations and secure favorable terms that supported both companies’ objectives.

- Support due diligence and integration planning to ensure a smooth transition and continued success.

- Ensure that the founder and leadership team of BI Convert remained integral to the company post-acquisition, enabling operational continuity.

The acquisition enhances TSG’s electrical services capabilities and strengthens its ability to deliver high-quality electrical installations in Poland, supporting its leadership in the energy transition for mobility.

Outcome

The acquisition of BI Convert positions TSG to:

- Strengthen its leadership in the Eastern European energy market.

- Enhance its capabilities in electric mobility and sustainable energy solutions.

- Leverage synergies within TSG’s broader network to drive growth and operational efficiency.

Looking Ahead

The acquisition sets the stage for TSG to:

- Continue expanding its presence in the electric mobility and sustainable energy markets.

- Explore further acquisitions in the region to support its long-term vision.

- Drive future growth as a leader in the energy transition for mobility, with a focus on delivering innovative solutions across Europe.

Aventis Advisors Will Help You Navigate the Polish M&A Landscape

Acquiring a company involves much more than evaluating financials—it’s about finding the right cultural fit, understanding market trends, and ensuring a seamless integration post-acquisition. Polish M&A advisors bring local expertise, alongside helping you identify the most strategic acquisition targets, navigate the complexities of the deal, and improve the probability of a transaction.

Aventis Advisors is a Polish M&A advisor focusing on IT services, software, and business services companies. Our team has accumulated significant know-how in helping international buyers navigate the unique complexities of investing in Poland. With our experience in bringing together foreign investors and Polish targets, you can trust us to take care of all your investment needs – from understanding complex financials to bridging cultural gaps!

Contact us if you want to learn more about M&A in Poland. We would be happy to answer any of your questions and find the best deals for you.

Take it easy while we make things happen

Stay focused on your business and let us take care of the M&A process.

Get in Touch