The launch of generative AI models like ChatGPT marked a turning point for the tech world. Focus shifted from older trends as investors and founders realized AI’s potential to reshape entire industries.

Major players such as OpenAI, Anthropic, and Perplexity raised record-breaking funding rounds, dominating headlines. At the same time, thousands of smaller startups began building niche solutions, showing how AI can boost human capabilities.

The AI revolution did not happen overnight. It has been years in the making, with steady progress and growing investor interest.

In this article, we examine deal activity before and after ChatGPT’s release. We highlight the leading financial and strategic investors driving growth in the AI space. We also analyze key data on AI valuations and multiples to help guide your next fundraising or exit strategy.

Table of Contents

- Methodology

- Deal volumes

- Deal volumes by funding stage

- Total capital raised by AI startups

- Top investors in AI

- Median deal sizes

- Median pre-money valuation

- AI Outlook – 2024 and beyond

Methodology

We reviewed all the funding rounds by AI companies across the globe in the period between 2010 and 2024. The source of the data is Crunchbase and the total results were ~53,000.

Our analysis defines an AI company based on the Crunchbase industry tag – Artificial Intelligence. This contains 6 different industry sub-segments: GenerativeAI, ML, Predictive Analytics, NLP, RPA, and Intelligent Systems.

Our analysis focused on understanding the fundraising volumes over the years, total capital invested in AI companies, median investment size, and pre-money and post-money valuation of AI startups.

AI Valuations in Public Markets

Deal volumes in AI: Almost 4x in the last decade

Our analysis period started in 2010 when there were only 240 AI-related fundraising rounds, and the technology was in its nascent phase. We saw a steep rise in AI fundraising rounds from the year 2015. This year was an important milestone for the artificial intelligence industry as OpenAI, considered one of the pioneers of AI technology, raised its first-ever funding round as a non-profit in June 2015.

In 2015, there were over 2,000 funding rounds in the Artificial Intelligence sector. That is a significant number as Artificial Intelligence as a theme has been around for decades but still remained dwarfed by other investing themes of the past years, such as SaaS. The interest and funding has been growing at a rapid pace since 2015.

By 2019, buoyed by the overall rosy fundraising environment and capital availability, the number of funding rounds for AI companies topped 5,700 a year. While in 2021, at the peak of the recent technology cycle, the number of deals in the AI space almost reached 6,800. The market cycle and valuations were also at their peak for SaaS companies during this 2021-22 period, as confirmed in our separate report on SaaS Valuation Multiples.

SaaS valuation multiples: 2015-2024

The release of ChatGPT in 2022 was a turning point for generative AI startups. Venture capitalists, corporations, and founders rushed in as real-world applications became clear.

ChatGPT sparked massive AI investment, but funding rounds stayed near 6,000 per year. This shows the overall fundraising climate matters more than single events.

By February 2024, 692 AI funding rounds had been recorded, indicating the year was unlikely to set new records unless activity picked up later. For the full year, funding rounds declined 10% year-over-year to 5,084, though this drop did not lead to lower overall capital invested in the sector.

Deal volumes by funding stage: AI’s formative era

Right now, investors are still getting accustomed to the rising interest in new startups focused on applications of Artificial Intelligence.

Our analysis found that Seed deals constituted 32% of the total AI fundraising deals between 2015 and 2024 (September). This proves that the AI ecosystem is in its formative era with many newer startups trying to hop on to the scene, raise seed stage from venture capital investors, and work towards a use-case solution of artificial intelligence.

When we look holistically at Pre-Seed, Seed, and Series A rounds, they make up roughly 60% of fundraising for AI companies in the same period.

As an industry matures, however, the pattern of funding rounds changes. In the early stages, pre-seed and seed rounds dominate as founders raise initial capital to test ideas and build prototypes.

Once the sector shows traction, focus shifts to Series A and B rounds aimed at scaling operations and expanding market reach. These rounds usually attract larger institutional investors and private equity firms.

Other funding types include crowdfunding, grants, non-equity assistance, angel rounds, and debt financing, as defined by Crunchbase.

Total capital raised in AI: Multi-billion rounds dominate

After ChatGPT’s breakthrough, tech giants quickly saw AI’s potential and raced to dominate the LLM space. While thousands of smaller startups raised seed funding, companies like Microsoft and Amazon poured in billions to secure leading positions.

As a result, late-stage and corporate rounds reached record levels. Investments in OpenAI, Anthropic, and Inflection rank among the largest funding rounds in history:

- $10 billion investment in ChatGPT’s parent company OpenAI by Microsoft

- $4 billion investment in Anthropic by Amazon

- $2 billion investment in Anthropic by Google

- $1.3 billion investment in InflectionAI by NVIDIA, Microsoft, and others

Total money invested in AI hit a new record in 2024 at $95 billion, from the previous impressive figure of $93 billion in 2021. There were 5,084 deals in 2024, out of which 13 deals were of $1 billion+ size. Some of the most notable deals were:

- $6 billion investment in xAI by a consortium of financial investors

- $5 billion investment in Waymo by Alphabet

Top investors in AI: Jumping on the bandwagon

With the sudden shift of investors’ interest in AI, especially given the decline of many other investing themes, such as crypto or fintech, venture capital investors of all sizes jumped on the AI bandwagon. Naturally, the USA emerged as the largest funding source for upcoming AI startups. The likes of Andreessen Horowitz, Sequoia, and Tiger Global were leading the biggest rounds.

At the same time, the investor universe is not limited to the bigwigs of the VC industry. Across the ~53,000 funding rounds, more than 200 funds were invested in 10 or more AI companies, suggesting a vast investor landscape. The investor locations were also not limited to the USA, but many were from emerging tech hubs, such as London, Berlin, or Paris.

We see three main types of investors that are currently active in the AI space – Financial, Strategic, and Sovereign.

In the wake of AI’s breakthroughs, corporate giants swiftly recognized the transformative potential of AI and started to partner with AI companies with proven potential (such as Microsoft’s $10 billion investment into OpenAI) or embarked on internal AI initiatives.

A not-so-common approach was seen when, in March 2024, Microsoft decided to form a long-term partnership with the French AI company MistralAI instead of wholly acquiring the technology or the company. This hints at a new playbook that larger companies may deploy to take the lead in the AI race.

Companies across sectors, from tech titans to traditional enterprises, sought to harness AI to streamline operations, enhance decision-making processes, and unlock new revenue streams. Some of the largest investors and acquirers include Microsoft, Amazon, Google, Volkswagen, and Intel.

Median deal sizes in AI: 3x over the 7 years

The median round sizes dipped in the recent years as venture capitalists readjusted their investment appetite following 2021 rush. We expect the median deal sizes to stay largely unchanged, as the multi-billion investment rounds will not translate into bread-and-butter AI companies.

As of H1 2025 we see that:

- AI startup raising pre-seed would have a median deal size of $500k

- AI startup raising seed capital would have a median deal size of $3M

- AI startup raising Series A capital would have a median deal size $12M

- AI startup raising Series B capital would have a median deal size of $28M

- AI startup raising Series C capital would have a median deal size of $56M

AI startup valuations – by funding rounds

Reflecting the growing interest in AI and the increasing capital requirements to train or use AI, both the median funding round sizes as well as median valuations have been growing over the years.

So, what are the current AI company valuations in 2025?

The median AI pre-money valuations as of 2024 were:

- AI startup raising pre-seed capital would have a median $3.6M valuation

- AI startup raising seed capital would have a median $10.0M valuation

- AI startup raising Series A capital would have a median $45.7M valuation

- AI startup raising Series B capital would have a median $366.5M valuation

- AI startup raising Series C capital would have a median $795.2M valuation

Pre-money valuation is the total equity value of a company before receiving cash from a funding round. With a larger valuation and a similar amount of money raised founders are giving away less equity in the company.

Now that we have seen the trend of AI startup valuations above, a natural question may arise: How to value an AI company?

Well, valuing a startup is notoriously difficult, so many investors rely on rule of thumb to put in a number in a term sheet. Earlier-stage investors, such as Techstars or YCombinator have their own guidelines.

Valuation is also commonly a result of negotiations and investor interest. Many interested investors allow the founders to push up the valuation.

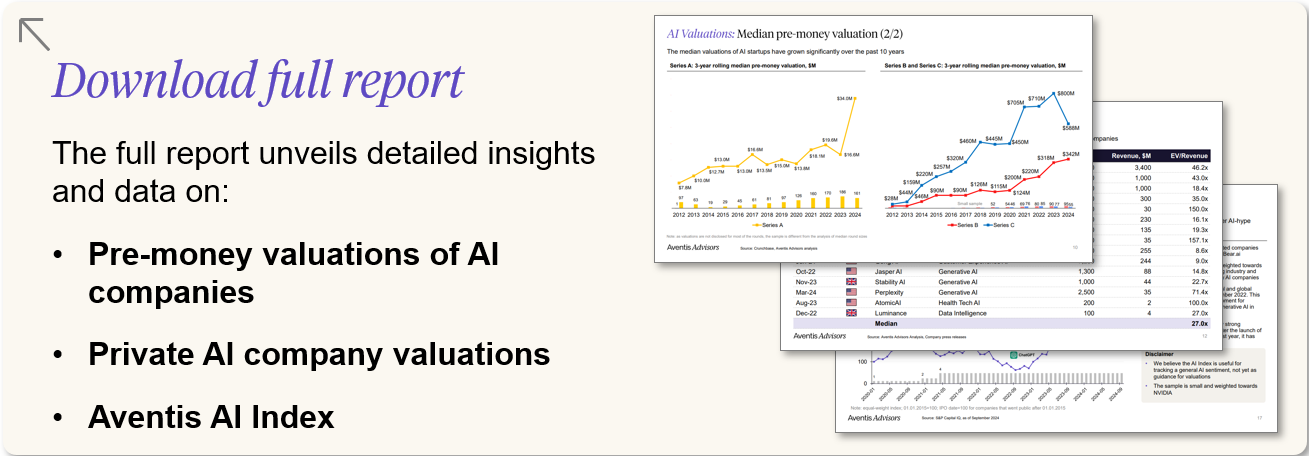

AI valuation multiples: 24x revenue and above

As AI is a relatively new, as well as capital-intensive segment of technology, there majority of the Artificial Intelligence deals are concentrated in capital raisings rather than traditional M&A in AI. Naturally, the available AI valuation multiples are primarily coming from larger capital raises.

Below we collected a set of revenue multiples from large capital raising transactions and M&A deals. The median revenue multiple for AI companies stood at 29.7x.

It’s important to note the valuation multiples are much higher in capital raising transactions than in 100% sales. The sample also includes the largest and most successful companies, so founders looking to sell their AI startups should take this data with a grain of salt. The valuation multiple will likely be significantly lower in the sale offer you receive.

World of AI – 2025 and beyond

The outlook as a whole remains incredibly promising for AI advancements. There is an increasing conviction among financial and strategic investors that the upcoming AI sector will unleash a wave of innovation, productivity, and wealth-creation opportunities. It remains to be seen how AI Startup valuations fare in 12-18 months from now. The road ahead for AI will be characterized by:

- Intersection of AI with IoT, robotics, and machine learning: This is a key trend that we envision in the future that will drive efficiency, productivity, cost savings, and new revenue streams for businesses

- Ethical considerations: Like with any new technology, ethical challenges are always present and need to be resolved through open dialogue, accountability, and transparency.

This is our first report of its kind on Artificial Intelligence capital raises and valuations, and we hope to update it regularly with new data and insights as they become available.

Software Valuation Multiples: 2015-2024

Conclusion

The rise of generative AI models like ChatGPT has driven a major shift in the technology landscape. Venture capitalists and founders quickly adapted, reshaping their strategies to capture emerging opportunities.

Tech giants dominated headlines with billion-dollar investments in AI. At the same time, thousands of smaller startups pushed AI valuations higher than in mature sectors like SaaS. This surge reflects growing investor appetite and confidence in AI’s long-term potential.

However, reliable data on AI valuation remains limited compared to established industries such as SaaS and IT services. Founders should approach exits and fundraising with caution, focusing on building sustainable, customer-driven businesses rather than chasing short-term hype. Over time, strong fundamentals will matter far more than inflated valuations.

Frequently asked questions

1) What are AI valuations in 2025?

Fundraising rounds price around 25–30x EV/Revenue on median, with top outcomes well above that.

2) How are AI companies valued?

Investors use EV/Revenue (or EV/ARR) for growth, then adjust for margins, retention, data moats, and capital needs.

3) What is a typical AI startup valuation by stage in 2025?

Pre-seed ≈ $3.6m, Seed ≈ $10m, Series A ≈ $45.7m, Series B ≈ $366.5m, Series C ≈ $795.2m (pre-money).

4) What are typical AI funding round sizes in 2025?

Pre-seed ≈ $0.5m, Seed ≈ $3m, Series A ≈ $12m, Series B ≈ $28m, Series C ≈ $56m.

5) Why are fundraising multiples higher than M&A multiples in AI?

Rounds price future option value and market share; M&A prices control, integration risk, and full diligence.

6) What drives higher AI valuations today?

Fast growth, durable retention, high gross margins, proprietary data, efficient distribution, and lower inference costs.

7) How do AI valuations compare to SaaS in 2025?

AI fundraising medians are ~25–30x EV/Revenue; public SaaS trades closer to ~6x EV/Revenue.

8) What sectors or models get the highest multiples?

Infrastructure, cybersecurity, and data-moat applications tend to command premium revenue multiples.

9) How do I value a pre-revenue AI startup?

Use stage pre-money benchmarks and milestones, adjusted for model performance, data access, and go-to-market proof.

10) Who are the most active investors in AI?

Tier-one VCs and large strategics, including Andreessen Horowitz, Sequoia, Tiger Global, Microsoft, Amazon, and Google.

Why you need a Technology M&A Advisor for your AI company

Keeping track of AI valuations provides valuable insights into market trends and helps you time your exit strategy effectively. However, every company is unique, just as every founder’s journey is unique. Therefore, it’s crucial to seek guidance from experts in the AI M&A space, particularly M&A advisors who specialize in the technology sector and can understand your specific situation.

Technology M&A advisors possess deep knowledge of market dynamics, valuation methodologies, and the intricacies of the M&A process. While you focus on managing your business, advisors diligently ensure that every detail is addressed and advocate for the best possible deal on your behalf. Technology M&A advisors success is intertwined with yours, and their expertise can often significantly influence the final sale price.

About Aventis Advisors

Aventis Advisors is an M&A advisor focusing on technology and growth companies. We believe the world would be better off with fewer (but better quality) M&A deals done at the right moment for the company and its owners. Our goal is to provide honest, insight-driven advice, clearly laying out all the options for our clients – including the one to keep the status quo.

Get in touch with us to discuss how much your business could be worth and how to maximize the valuation.

Contact Us

Tell us about what you want to achieve; we can support you from start to close on your M&A journey.

Read also: