AI M&A activity is accelerating as companies race to stay competitive in the age of artificial intelligence. From healthcare to finance and logistics to marketing, AI systems are becoming indispensable to how businesses operate, compete, and grow.

With AI M&A activity on the rise, companies are increasingly choosing acquisition over internal development to accelerate their capabilities. This trend isn’t just about gaining access to cutting-edge generative AI tools or proprietary algorithms—it’s about securing a strategic advantage in a market where speed, innovation, and differentiation are critical to success.

In this article, we explore the five most compelling strategic drivers behind why companies acquire AI firms. These drivers reflect not only the technological promise of artificial intelligence but also its value in business execution, market positioning, and long-term competitive viability. Whether it’s reducing the time required to launch AI-powered tools, acquiring top-tier talent, or harnessing data analysis to enhance decision-making, each factor highlights the growing importance of AI M&A in shaping the future of digital-first organizations.

We also delve into how firms leverage AI technologies to streamline manual processes, unlock insights from historical data, and deliver solutions that respond to evolving user behavior. As industries face growing pressure to adapt and innovate, understanding the motivations behind AI M&A transactions becomes essential—not only for buyers but also for AI companies considering a potential exit.

Table of Contents

- Speed Over Build: The Time-to-Market Advantage

- The Value of Proprietary AI Technology

- Talent as a Strategic Asset

- Product Synergies and Capability Expansion

- Competitive Pressure and Market Positioning

- Conclusion: M&A as a Strategic Lever in AI

Speed Over Build: The Time-to-Market Advantage in AI M&A

In artificial intelligence, speed often beats perfection. Building advanced AI systems in-house takes time, capital, and deep expertise. For many companies, the process delays product launches and drains resources. AI M&A offers a shortcut.

By acquiring an AI company, firms get immediate access to tested solutions. That includes proprietary AI algorithms, trained models, and valuable datasets. These assets allow the acquirer to deploy AI-powered tools quickly—often in less time than it takes to build a prototype internally.

In fast-moving industries like finance, logistics, or retail, every delay counts. Companies that act fast gain insights from data analysis sooner. They can automate manual processes and respond to market trends in real time. Acquiring AI technology means less time spent on development—and more time focused on value creation.

Case Study: Kraken’s Acquisition of NinjaTrader

In 2025, cryptocurrency exchange Kraken acquired retail trading platform NinjaTrader for $1.5 billion. To expedite the due diligence process, Kraken employed Termina, an AI startup developed from Tribe Capital. Termina analyzed vast amounts of data in mere hours, validating key business metrics like revenue growth and customer retention. This AI-driven approach enabled Kraken to make rapid, confident decisions, exemplifying how AI tools can significantly reduce the time required for complex financial transactions.

The Value of Proprietary AI Tools and Artificial Intelligence Assets

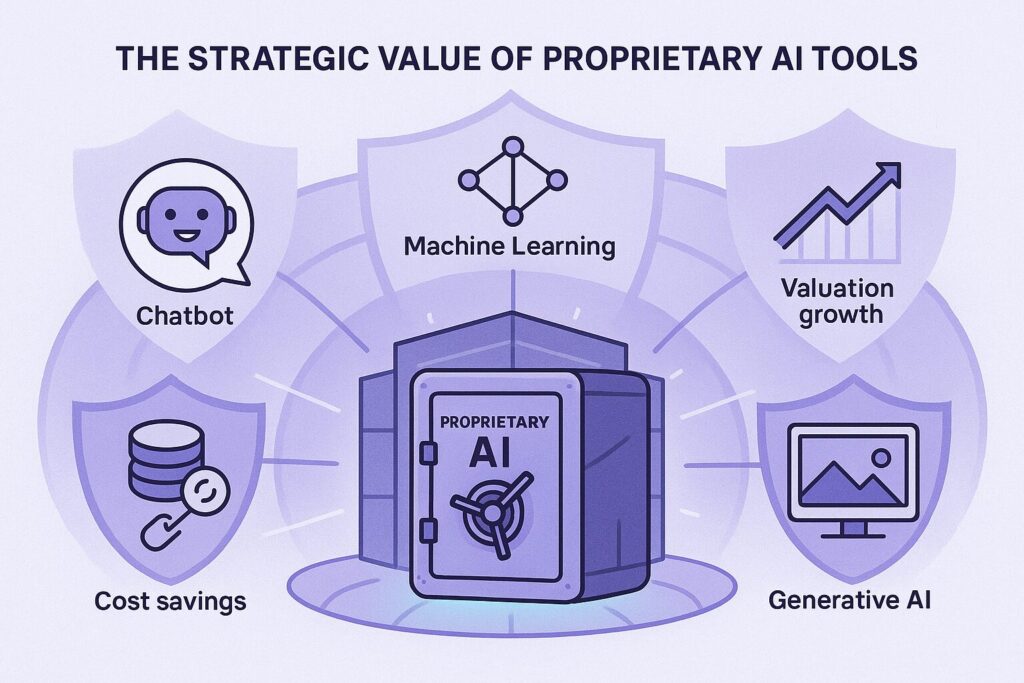

Owning proprietary AI is a powerful strategic asset. It gives companies exclusive access to tools and capabilities that competitors can’t replicate easily. In many cases, these proprietary technologies form the core of an AI company’s value.

Acquiring such assets gives the buyer a unique edge. It could be a natural language processing model, a machine learning engine optimized for a specific use case, or a generative AI platform tailored to a niche market. These tools allow organizations to offer differentiated solutions that stand out in a crowded space.

When a company owns its AI stack, it reduces dependence on third-party providers. That means more control over features, updates, and data security. It also allows faster iteration and tighter integration with internal systems.

Another advantage is cost efficiency. Instead of paying recurring licensing fees for AI tools, businesses that own the technology can scale usage freely. This is especially valuable in high-volume environments like e-commerce, digital advertising, or enterprise SaaS.

Lastly, proprietary technology increases valuation. Investors and strategic buyers place a premium on companies with defensible IP. Owning AI algorithms and platforms not only strengthens product offerings but also raises the strategic profile of the acquiring firm.

Case Study: OpenAI’s Acquisition of io

OpenAI’s $6.5 billion acquisition of io, an AI device startup founded by former Apple executive Jony Ive, marked its largest deal to date. This strategic move provided OpenAI with proprietary AI technologies and a talented team, enhancing its capabilities in the hardware space. The acquisition underscores the value companies place on owning unique AI assets to maintain a competitive edge.

Talent as a Strategic Asset in AI Systems Development

AI talent is one of the scarcest and most valuable resources in today’s market. Engineers, data scientists, and AI researchers are in high demand—and short supply. For many companies, acquiring an AI firm is the fastest way to bring this expertise in-house.

These teams come with specialized knowledge in machine learning, data analysis, and AI systems integration. They understand how to build, scale, and optimize AI-powered tools. Acquiring such a team means gaining more than just headcount—it’s acquiring hard-to-replicate know-how.

This approach, often called “acqui-hiring,” also accelerates cultural transformation. It infuses innovation into the broader organization. AI specialists can train internal teams, lead key projects, and drive long-term capability growth.

Beyond technical skills, these employees often bring strategic insight. They know how to apply AI to business problems. Whether it’s automating repetitive tasks or identifying patterns in historical data, they help companies create smarter, more efficient solutions.

Retaining this talent post-acquisition is crucial. Many deals include incentives to keep key employees engaged. Done right, these transactions create long-term value—not just from the technology, but from the people behind it.

Case Study: OpenAI’s Acquisition of Windsurf

OpenAI’s acquisition of Windsurf, an AI-assisted coding tool company, for $3 billion exemplifies the strategic value of acquiring top-tier AI talent. This move not only expanded OpenAI’s technological offerings but also brought in a team with specialized expertise in AI development, reinforcing the importance of talent acquisition in AI M&A strategies.

Product Synergies and Capability Expansion

AI M&A unlocks powerful synergies. When companies acquire AI tools that complement their existing products, the result is often greater than the sum of its parts. These integrations enhance functionality, improve user experience, and boost overall value.

For example, a SaaS company might integrate predictive analytics into its dashboard. Or a logistics firm could embed real-time route optimization based on AI algorithms. These enhancements make products smarter and more useful—without the time and risk of building features from scratch.

AI also helps companies enter adjacent markets. A healthcare firm might acquire a startup specializing in medical image recognition. This opens new revenue streams while deepening its AI capabilities.

In many deals, the acquirer isn’t just buying tools—they’re buying a platform. This means a modular system that can evolve, scale, and adapt to different business units. It also reduces duplication of effort across teams.

These expanded capabilities give companies an edge in competitive bidding, enterprise sales, and client retention. Customers increasingly expect AI features in the tools they buy. Acquisitions help organizations meet that demand quickly and convincingly.

Case Study: Salesforce’s Pursuit of Informatica

Salesforce’s renewed discussions to acquire data-management software firm Informatica aim to enhance its AI capabilities. Informatica’s technology helps enterprises organize and cleanse their data, which is crucial for effective generative AI applications. This potential acquisition illustrates how companies seek product synergies to expand their AI capabilities and offerings.

Competitive Pressure and Market Positioning

AI adoption isn’t just a strategic choice—it’s becoming a survival tactic. As industries digitize, companies face mounting pressure to integrate AI tools into core offerings. Falling behind means losing relevance, customers, and market share.

This urgency is driving a wave of AI M&A. Acquiring AI capabilities signals innovation to investors, customers, and the broader market. It positions a company as a forward-thinking leader, not a follower reacting to change.

Acquisitions can also neutralize competitive threats. If a rival is eyeing the same AI startup, moving first prevents that asset from falling into competitors’ hands. This defensive strategy protects both market position and future growth.

Moreover, AI systems boost operational efficiency. Businesses can automate manual processes, reduce costs, and allocate talent to higher value tasks. These improvements translate into better margins and stronger performance metrics—key factors in competitive positioning.

Case Study: Palo Alto Networks’ Consideration of ProtectAI

Palo Alto Networks’ reported interest in acquiring AI cybersecurity startup ProtectAI for $650–$700 million highlights the strategic imperative to stay ahead in the evolving AI security sector. This potential acquisition would position Palo Alto as a leader in addressing AI security challenges, reflecting the competitive pressures driving AI M&A activities.

Conclusion: M&A as a Strategic Lever in AI

AI M&A is no longer a niche strategy—it’s a mainstream lever for growth and innovation. As artificial intelligence transforms business models, acquiring AI firms gives companies a fast, focused way to stay competitive.

From cutting development time to gaining proprietary AI algorithms, the benefits are clear. These transactions help companies leverage AI more effectively and integrate cutting-edge capabilities into their platforms. That includes generative AI, machine learning models, and AI-powered tools for data analysis and automation.

More importantly, acquisitions bring talent. AI teams can accelerate internal R&D, improve product design, and drive better use of market data. This human capital is often as valuable as the technology itself.

Each strategic driver—speed, technology, talent, synergy, and market pressure—underscores the same message: acquiring AI means gaining a complete solution. It provides the tools, the people, and the platform to compete in a world shaped by artificial intelligence.

As adoption grows, we expect AI M&A to play a crucial role in shaping market leaders. For tech founders, it’s a signal of opportunity. For buyers, it’s a way to transform faster, smarter, and with more precision.

About Aventis Advisors

Aventis Advisors is an M&A advisor for SaaS companies. We believe the world would be better off with fewer (but better quality) M&A deals done at the right moment for the company and its owners. Our goal is to provide honest, insight-driven advice, clearly laying out all the options for our clients – including the one to keep the status quo.

Get in touch with us to discuss how much your business could be worth and how the process looks.