Introduction

The SaaS industry is dynamic, fast-growing, and full of opportunities. As a founder, you’ve built a recurring revenue machine by solving real-world problems with scalable software while generating predictable income. But at some point, you may start thinking about the next step: whether to scale further, pivot, or exit.

Selling a SaaS company is a major decision, and navigating the process can feel complex. However, with the right strategy, selling can be a smooth, profitable transition rather than an overwhelming challenge.

This guide breaks down everything you need to know about selling a SaaS business—from reasons to sell your business, understanding valuation metrics like Annual Recurring Revenue (ARR) and Customer Acquisition Cost (CAC) to identifying serious buyers, structuring the deal, and optimizing your exit strategy. We’ll also explore post-sale considerations, ensuring you maximize value and position yourself for your next venture.

Selling your SaaS company isn’t just about cashing out—it’s about leveraging the value you’ve built and creating new opportunities for the future. This guide provides a clear roadmap to help you evaluate whether selling is the right move and how to navigate the process effectively.

Table of Contents

- Key Reasons SaaS Founders Choose to Sell

- Preparing Your SaaS Business for Sale

- Where to Sell Your SaaS Business?

- Finding the Right Buyer

- How the Sales Process Works

- Post-Sale Considerations

- Measuring the Value of Your SaaS Business

- Common Pitfalls to Avoid

- About Aventis Advisors

Key Reasons SaaS Founders Choose to Sell

Selling your SaaS business is a huge decision. You’ve poured your heart into building it, and thinking about an exit means reflecting on the value you’ve created and the opportunities ahead.

Here are some common reasons SaaS founders choose to sell their businesses:

You want to take your business to the next level, but you lack the means

Scaling a SaaS business requires significant resources—capital, infrastructure, and access to new markets. If you’re limited in these areas, selling to a strategic buyer with deeper pockets or broader reach can unlock faster growth. It’s not about stepping back; it’s about recognizing that another entity can help you scale your SaaS product faster and more effectively.

Your main focus is on building great products

As your SaaS company grows, you may find yourself buried in operational issues, customer acquisition costs, and administrative tasks. If your passion lies in product development, selling can free you from day-to-day management, allowing you to focus on innovation. Many SaaS founders decide to sell when they realize they’d rather create the next big software product than manage the operational heavy lifting.

Your product could be a part of a larger suite

In some cases, your SaaS business may have more potential as part of a larger service offering. Buyers often look for software products that complement their existing services, allowing for cross-selling opportunities and expanded customer reach.

A larger company can offer your SaaS product new markets and customers that might be difficult to reach on your own. This makes selling a strategic decision, ensuring your product realizes its full potential.

You want to reap the rewards

After years of dedication, selling your SaaS business can be the culmination of your hard work. Whether you’re looking for financial freedom, exploring new ventures, or simply enjoying the fruits of your labor, selling allows you to cash in on your success.

For many founders, this is about more than just the monetary value – it’s about having the flexibility to pursue other passions or step back after building a valuable and profitable business.

Curious About Your SaaS Company’s Value?

Let’s Talk! Get Your Free 60-Minute Valuation Call Now.

Preparing Your SaaS Business For Sale

To prepare your SaaS business for sale, you must focus on strategic steps that increase valuation, ensure strong financial performance, and attract qualified buyers. Careful preparation will not only boost your business’s value but also speed up the sales process and improve the likelihood of finding the right buyer.

Below are the key steps to maximize your business’s appeal and ensure a smooth sale.

Step 1: Enhance Your SaaS Business Valuation

Before entering the selling process, it’s crucial to improve your company’s value through strategic decisions. This involves timing the sale, optimizing pricing, refining sales strategies, and reducing owner dependency.

Time the sale for peak performance

Maximizing your SaaS company’s valuation means selling when your business is at its best. Strong growth trends and a positive market outlook boost buyer confidence. Most buyers, including private equity firms and strategic buyers, seek businesses with sustainable revenue and growth potential.

Over the past nine years, SaaS growth rates have gradually slowed as companies reached scale, with the median growth rate declining to 23% YoY by Q2 2020. While the pandemic temporarily reversed this trend, pulling demand forward and accelerating growth, the market has since returned to its long-term trajectory. After peaking in Q2 2021, growth rates have been normalizing and could even dip further if macroeconomic conditions deteriorate.

While estimates indicate slower growth through late 2024 and early 2025, a potential acceleration is expected in the second half of 2025. This shift could be driven by lower interest rates, emerging SaaS verticals, and AI advancements enhancing software capabilities. For SaaS founders considering an exit, understanding these trends is key—timing a sale to coincide with renewed investor optimism could lead to a stronger valuation and increased buyer interest.

Optimize your pricing strategy

Underpricing is a common mistake among SaaS founders, as they often fear customer churn from price hikes. However, undervaluing your SaaS product can hurt perceived value and overall profitability.

Regularly reevaluating your pricing strategy can significantly increase revenue and business valuation. Even small price increases, when properly implemented, can have a major impact on your Monthly Recurring Revenue (MRR) and Annual Recurring Revenue (ARR), both of which are key valuation metrics in the SaaS industry. These metrics are closely analyzed by potential buyers when assessing business valuation.

Refine your sales strategy

To increase the perceived value of your SaaS business, diversify your customer base and target high-value enterprise clients. While many SaaS businesses rely on self-service sales models, pursuing sales-assisted models can help land larger contracts. These enterprise-level deals increase your Average Contract Value (ACV), enhance cash flow stability, and make your business more attractive to strategic buyers.

Expanding into new markets and reducing reliance on a single customer segment also increases business valuation and reduces risk for a new buyer.

Reduce owner-dependency

A business heavily reliant on its founder will raise red flags for potential buyers. Implement processes that allow your SaaS company to run independently. Train employees, automate routine operations, and put leadership structures in place to ensure the business can continue to thrive without you. Most buyers, including those in the largest marketplace for online businesses, prefer companies that require minimal heavy lifting from a new owner.

Step 2: Organize Financials and SaaS Metrics

Solid financials and clearly presented SaaS metrics are critical in the sale process. Buyers will scrutinize your financial health and look for consistent, predictable revenue streams. Here’s how to prepare your finances and metrics:

Know your SaaS metrics

Potential buyers will evaluate key SaaS metrics such as:

Providing a clear narrative around these metrics that explains trends and key decisions made will significantly improve buyer confidence and streamline the due diligence process. A well-structured explanation of these numbers can be the difference between attracting serious interested buyers or dealing with tire kickers. To find out what is your current level of preparedness, see how to use our SaaS Exit Readiness Dashboard.

Keep financial projections accurate

Beyond organizing your financials and metrics, crafting accurate and compelling financial projections is of paramount importance during the sales process. These projections—covering revenue forecasts, expense predictions, and estimated growth rates—act as a window into your business’s future, enabling potential buyers to gauge its profitability and scalability.

A professional valuation that includes financial performance indicators such as net profit, seller’s discretionary earnings, and net income will support your asking price. Strong financial projections can shape the negotiation process, helping you justify the highest multiples and secure a favorable deal. However, these forecasts must be data-driven, realistic, and continually updated as your business evolves and market conditions change.

Maintain up-to-date company information up-to-date at all times

The sale process for a SaaS company is dynamic and can last several months. Throughout this time, the business will continue to operate, acquire new customers, and generate revenue. This means that key metrics will not stay the same but will continue to evolve. It’s crucial to keep these metrics updated during the sale process.

Regular updates provide potential buyers with an accurate, real-time understanding of the business’s performance. This not only enhances transparency but also shows your commitment to maintaining the business’s health, even during the transition period, thereby increasing buyer confidence. Buyers looking to acquire a market leader will appreciate up-to-date financials, which can make a big difference in securing a deal.

Step 3: Address legal requirements

Thorough legal preparation is essential to ensuring a smooth and successful sale process. This begins with a comprehensive review of all contracts, including customer agreements, vendor contracts, and employee agreements, to identify and address any unfavorable terms that could complicate the transaction. Ensuring that all agreements are well-documented and legally sound can help prevent unexpected issues during due diligence.

In addition to contract review, it is crucial to secure and document intellectual property (IP) rights, such as trademarks, patents, and copyrights. Clear ownership of IP not only protects the business from legal risks but also reassures potential buyers of its long-term value. Engaging an experienced M&A advisor can help streamline these legal preparations and strengthen your position in the sale process.

Step 4: Prepare a compelling data room

A data room is a secure online repository that stores all critical business documents. This includes financial statements, contracts, user data, operational metrics, and anything else a potential buyer might need to evaluate your business.

Preparing a compelling data room not only expedites the due diligence process but also shows potential buyers that your business is well-organized and transparent. A well-prepared data room can be the difference between a smooth transaction and a deal falling through.

Where to Sell Your SaaS Business

There are several routes to consider, including selling directly to interested buyers, listing on an online marketplace, or working with an M&A advisor. Each option comes with its own advantages and challenges.

Selling Directly to Strategic Buyers

One way to sell a SaaS business is by directly reaching out to potential buyers—such as competitors, industry leaders, or private equity firms—who may see your SaaS company as a valuable acquisition. If you already have connections or know businesses that might be interested, this approach can be effective.

How to Find Buyers:

- Leverage Your Network: Reach out to industry contacts, partners, or even customers who may be interested in acquiring your software company.

- Cold Outreach: Just like acquiring new customers, you can email or call strategic buyers and pitch your business. Highlight your recurring revenue, net profit, and market position to generate interest.

- Industry Events & Online Communities: Attend SaaS and tech industry events or participate in online forums where potential buyers are active.

Pros:

- Full control over negotiations and deal terms

- No broker fees—maximize your seller’s discretionary earnings

Cons:

- Requires extensive effort in researching, reaching out, and negotiating.

- Risk of dealing with tire kickers (buyers who aren’t serious).

- Even with no advisor fee, you’ll still need to hire a lawyer and accountant.

Listing Your SaaS Business on a Marketplace

For SaaS founders looking for a new buyer quickly, online business marketplaces can be a great option. These platforms act as a largest marketplace for buying and selling online businesses, allowing you to list your SaaS product where qualified buyers are actively searching.

Popular Marketplaces for Selling a SaaS Business:

- Acquire.com: A leading platform for buying and selling SaaS businesses, with a focus on bootstrapped and profitable companies

- Flippa: A general marketplace for buying and selling online businesses, including smaller SaaS startups

- Empire Flippers: A curated marketplace for established and profitable online businesses, including SaaS companies

- MicroAcquire: A platform specifically for acquiring and selling bootstrapped SaaS businesses

Pros:

- Access to a wide pool of interested buyers.

- Can lead to a quicker sales process than selling directly.

Cons:

- You must vet buyers yourself, which can be time-intensive.

- Marketplaces may charge listing or commission fees.

- Lower chance of securing the highest multiples compared to an M&A sale.

Working with an M&A Advisor for Maximum Value

For SaaS founders seeking the highest valuation and a seamless sale, partnering with an M&A advisor is often the best strategy. Experienced advisors specialize in exit planning and connect sellers with strategic buyers or private equity firms willing to pay a premium for the right business.

Why Choose an M&A Advisor?

- Professional Valuation: Experts assess your ARR, MRR, net income, CAC, churn rate, and future profitability to secure the highest multiples.

- Buyer Vetting & Negotiation: They filter out tire kickers and handle negotiations to maximize your deal value.

- Smooth Sales Process: M&A advisors manage due diligence, contracts, and closing, reducing operational issues for you.

Pros:

- Access to high-net-worth strategic buyers and private equity firms.

- Less heavy lifting—advisors handle negotiations and paperwork.

- Higher likelihood of a premium sale, especially for market leaders.

Cons:

- Advisors charge success fees, typically a percentage of the sale price.

- The earnout period may be required in some deals, depending on your business model.

Choosing the Right Path to Sell Your SaaS Business

The best exit strategy depends on your company’s size, profitability, and growth potential. A direct sale through outreach or a marketplace may work if speed is the priority and you’re prepared to manage the process yourself. However, these options require significant effort and offer no guarantee of securing the best valuation.

For those aiming to maximize value and attract serious buyers, an M&A advisor provides the best chance of a smooth and profitable exit. By handling negotiations, buyer sourcing, and due diligence, advisors allow founders to stay focused on business growth while ensuring an optimal deal structure.

Strategic vs. Financial Buyer – Which one is right for you?

How to Prepare Your Company for Sale

Finding the Right Buyer

Finding the right buyer for your SaaS business is crucial to maximizing its value and ensuring a smooth transition. The ideal buyer should align with your company’s vision, have the financial resources to support growth, and recognize the strategic value of your SaaS product. Working with an M&A advisor significantly increases the likelihood of securing the right buyer while streamlining the entire selling process.

Types of Potential Buyers

In M&A transactions, it is common to divide buyers into two groups: strategic and financial investors. However, in the SaaS sector, a third category – vertical software conglomerates – also plays a notable role.

- Vertical Software Conglomerate: An important buyer type specific to SaaS businesses is vertical software conglomerates (e.g., Constellation Software). These entities merge characteristics of both strategic and financial buyers. They focus on business valuation metrics like recurring revenue and profit but operate their acquisitions indefinitely, unlocking value over time without a planned exit strategy.

- Strategic Buyers: Strategic buyers are typically other software companies, competitors, or industry players looking to expand their market share, acquire new customers, or integrate complementary technology. These buyers are often willing to pay a premium because of the synergies they can achieve post-acquisition.

- Private Equity and Financial Buyers: Private equity firms and other financial investors are primarily focused on financial performance, recurring revenue, and growth potential. They seek businesses with strong cash flow, stable net income, and high scalability. Unlike strategic buyers, they usually have an exit plan, aiming to sell the company at a higher valuation after improving operations.

How to evaluate the right fit?

Selecting the right buyer involves assessing their financial capability to ensure they can afford the purchase and subsequent operation costs. Strategic alignment is equally critical, as the buyer should share your business’s vision and growth plans. Lastly, cultural compatibility should not be overlooked. The buyer should resonate with your company’s culture and values to make the post-sale transition smooth for both your team and customers.

How the Sale Process Works

Navigating the complex waters of a SaaS business sale involves many stages, each with its own significance and challenges. It’s in these phases where an M&A advisor’s expertise becomes invaluable.

Phase 1: Negotiating the deal

The process often begins with a ‘teaser’ – a brief, anonymous document designed to pique the interest of potential buyers without revealing the identity of your SaaS business. This document will typically highlight key selling points, attractive metrics, and the strength of your recurring revenue model while maintaining confidentiality.

Next is the Information Memorandum (Info Memo), a detailed document that provides comprehensive information about your SaaS company. It covers everything from company history, product descriptions, market analysis, financial performance, key SaaS metrics like Monthly Recurring Revenue (MRR) and Customer Acquisition Cost (CAC), to future projections. The Info Memo is the primary document potential buyers will use to evaluate your business valuation.

Following the Info Memo, there’s usually a Q&A phase, where interested parties can seek clarifications and more information. Your M&A advisor will help manage this process, fielding questions and ensuring that all communication supports the overall negotiation strategy, crucial for attracting qualified buyers.

A significant milestone in the deal-making process is the Letter of Intent (LOI). This is a document that outlines the buyer’s intention to purchase your business, including the proposed price and terms. While not legally binding, an LOI signifies serious intent from the buyer and allows both parties to move forward with more detailed negotiations, ultimately helping to maximize the value of your SaaS business.

Upon acceptance of the LOI, the buyer will initiate the due diligence process. This involves a thorough review of your business, including financial, legal, and technical aspects. Financial due diligence assesses the financial health of your company, focusing on cash flow and net profit. Legal due diligence examines contractual obligations, legal disputes, and compliance with laws and regulations. Technical due diligence involves a deep dive into your software, including its architecture, codebase, scalability, and potential for future profitability.

Phase 2: Closing the deal

The closing stage involves finalizing the Sale and Purchase Agreement (SPA), and arranging the payment through a secure method like an escrow service. Your M&A advisor, working in tandem with your legal team, ensures all these steps are completed smoothly and in your best interest.

Throughout these stages, your M&A advisor plays a pivotal role. They help prepare the teaser and Info Memo to ensure both are compelling and accurate. They manage the Q&A process to help you respond to queries in a way that maximizes perceived value. Finally, they guide all negotiations, leveraging their market knowledge and experience to secure the best possible terms.

Post-Sale Considerations

After the sale of your SaaS business, there are several key considerations that should be accounted for to ensure a smooth transition and secure your financial future.

Transition period

Firstly, many deals involve a transition period where the previous owner provides support to the new owner. This typically involves training the new owner or management team, introducing them to key clients or partners, and helping to troubleshoot any challenges that arise in the early days post-acquisition. The length and nature of this transition support period should be clearly defined in the Share Purchase Agreement.

Non-compete agreements

Secondly, non-compete agreements are common in SaaS companies’ sales. These legally-binding agreements restrict the seller from starting a similar business or working with a direct competitor for a specified period of time and in a defined geographic area. While these agreements protect the buyer’s investment, as a seller, it’s essential to ensure that the terms of the non-compete agreement are fair and reasonable, and won’t unduly limit your future career opportunities.

Tax implications

Finally, the sale of a business can have significant tax implications and you’ll need to engage in careful financial planning to manage your newfound wealth effectively. Depending on your jurisdiction and the structure of your deal, you may face capital gains tax or other tax liabilities. It’s advisable to work with a tax advisor or financial planner who can help you understand the tax implications of your sale, identify strategies to minimize your tax liability, and guide you in investing and managing your post-sale finances.

Measuring the Value of Your SaaS Business

Before entering the selling process, it’s essential to determine your SaaS business valuation. Understanding your company’s worth helps you set realistic expectations, attract qualified buyers, and maximize the sale price. SaaS companies are typically valued based on three primary methods, with revenue multiples being the most widely used.

SaaS revenue multiples

The most common valuation method for SaaS company is through the EV/Revenue multiple (Enterprise Value to Revenue), rather than EV/EBITDA. This is because many SaaS businesses prioritize growth over profitability, reinvesting revenue into customer acquisition, product development, and market expansion. The SaaS business model allows for temporary unprofitability as long as recurring revenue and future profitability trends remain strong.

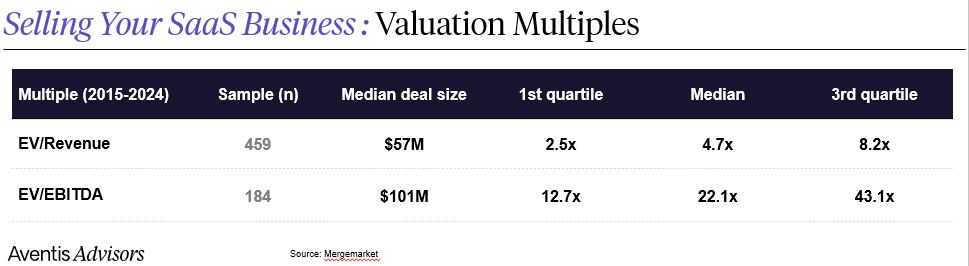

In our analysis of more than 450 transactions shows a median revenue multiple of 4.7x, with valuations varying significantly:

- Top 25% of deals achieved multiples above 8.2x

- Bottom 25% saw multiples below 2.5x

Deal size played an important role in determining SaaS valuation, with larger transactions generally commanding substantially higher multiples. For example, our analysis of SaaS acquisitions found that deals in the $50M–$100M range had median revenue multiples of 6.3x, while those in the $100M–$500M range had median multiples of 5.4x. In contrast, smaller deals ($5M–$20M and $20M–$50M) had significantly lower median multiples of 3.2x and 3.1x, respectively.

This disparity can be attributed to several factors. Larger, more established SaaS businesses are often perceived as less risky investments, offering greater predictability and stability. Additionally, acquirers can achieve economies of scale and operational efficiencies by integrating a larger business. Finally, acquiring a major player in the market can help consolidate market share and strengthen competitive advantage.

What are the valuation multiples for SaaS companies?

Revenue growth and profitability of your business

There are many factors in play for valuation, but the two most crucial ones are revenue growth and profitability. These metrics offer a snapshot of a company’s current cash generation capabilities and forecast the potential for future profit growth.

The sum of these two metrics is also used in the calculation of a so-called Rule of 40. Rule of 40 states that an efficient SaaS company has a sum of profit margin and revenue growth above 40. For public SaaS companies in our analysis, Rule of 40 is an important predictor of revenue multiple with a 10% in Rule of 40 score corresponding to 1.0x increase in multiple.

Predictability of revenue is another key driver. SaaS companies with a high share of recurring revenue are valued more favorably, as subscription-based models provide stability and long-term visibility. Low churn rates and strong net revenue retention (NRR) signal customer loyalty and expansion, further driving higher valuations. In contrast, companies with volatile revenue or heavy reliance on one-time sales often see lower multiples due to higher risk.

Customer acquisition efficiency plays a crucial role as well. A strong LTV/CAC ratio indicates that the business can acquire and retain customers profitably, making it attractive to investors. However, even a great acquisition model must be backed by strong retention—high churn can erode value, regardless of initial customer acquisition efficiency.

Enterprise SaaS businesses often command higher multiples due to long-term contracts, higher customer lifetime value (LTV), and lower churn. Buyers perceive these revenue streams as more stable compared to SMB-focused companies, where customer turnover tends to be higher.

Ultimately, SaaS valuation is a dynamic equation, where growth, profitability, retention, and efficiency all interact. Companies that perform well across these metrics attract strategic buyers willing to pay a premium, while weaknesses in any area can significantly impact the final valuation.

Valuing a SaaS business isn’t a straightforward task—it’s part art, part science. But by understanding these key factors, you’ll be well-equipped to determine a fair price that reflects the true worth of your SaaS business.

Common Pitfalls to Avoid

While the prospect of selling your SaaS business can be exciting, it’s essential to approach the process with a clear understanding of the potential challenges. Failing to anticipate and address these pitfalls can significantly impact your final outcome, potentially leaving you with less than you deserve or even derailing the sale altogether.

By understanding the importance of accurate valuation, thorough legal preparation, a smooth transition, selecting the right buyer, and avoiding hasty decisions, SaaS founders can navigate the sale process with confidence and maximize their returns. With careful planning and execution, selling your SaaS business can be a rewarding experience that unlocks new opportunities for the future.

About Aventis Advisors

Every SaaS business is unique, just like each founder’s journey. That’s why it’s crucial to consult with experts in the SaaS M&A space, particularly advisors who specialize in the sector and can fully understand your specific circumstances.

Aventis Advisors is an M&A advisor focusing on SaaS companies. We believe the world would be better off with fewer (but better quality) M&A deals done at the right moment for the company and its owners. Our goal is to provide honest, insight-driven advice, clearly laying out all the options for our clients – including the one to keep the status quo.

Get in touch with us to discuss how much your business could be worth and how to maximize the valuation.