Tech investors have seen AI valuations surge to stratospheric heights since late 2022, as artificial intelligence became the hottest theme in both private and public markets. Yet this excitement has been coupled with volatility, exemplified by events like the “DeepSeek scare” in early 2025 that briefly sent tech shares plummeting. This article provides a comprehensive overview of AI valuations and market trends, helping readers understand the forces shaping the current landscape.

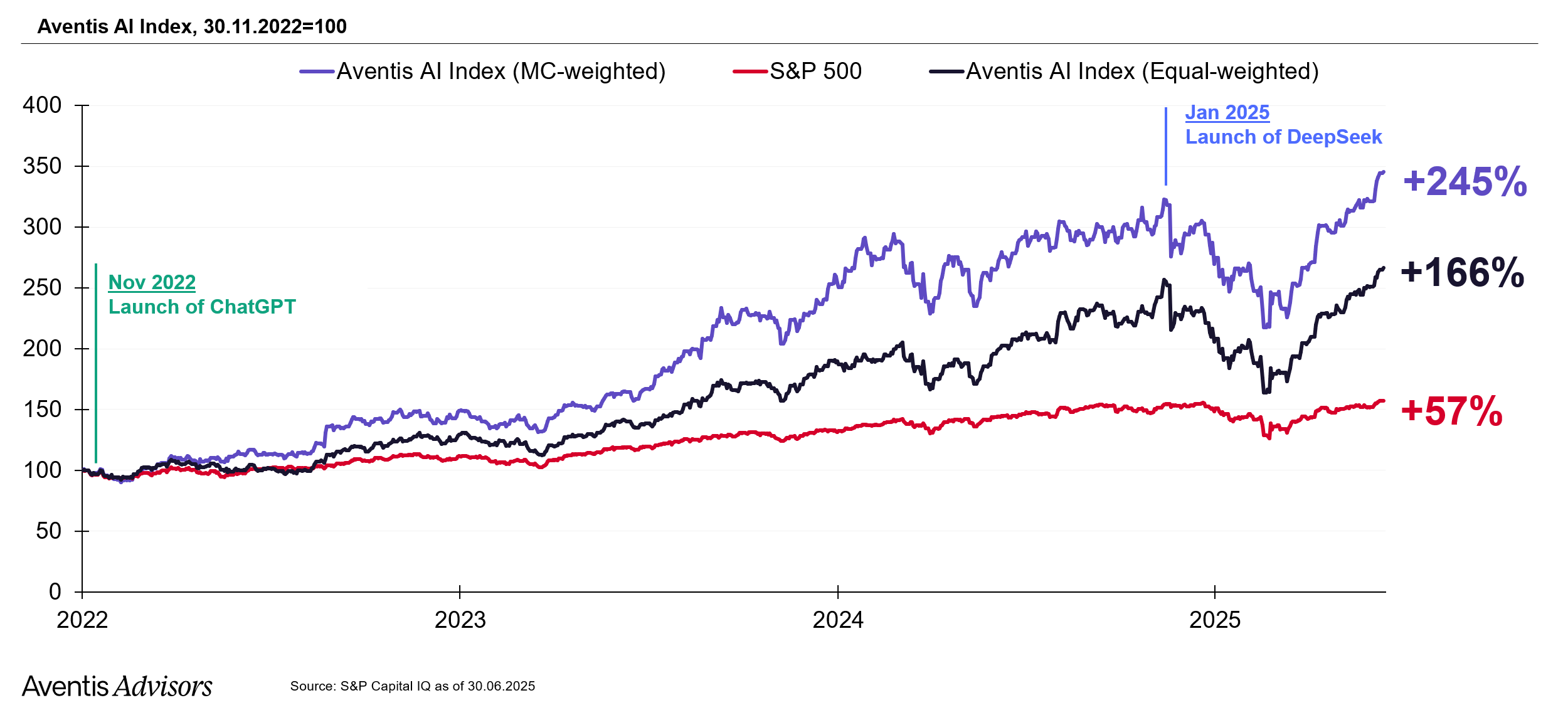

AI has been developing for decades, with a rich history of funding and innovation that has set the stage for today’s rapid growth and high valuations. In this context, Aventis Advisors developed the Aventis AI Index to bring clarity on how public markets are pricing AI exposure across the entire value chain. This comprehensive, equal-weighted index tracks companies spanning from energy and infrastructure to chipmakers and EDA software, offering a data-driven view into where value is accruing in the AI ecosystem.

Why Aventis Created an AI Valuations Index

Aventis built the AI Valuations Index as a benchmark for AI exposure in public equities – essentially to answer which companies and sectors the stock market sees as winners in the AI boom, and how those companies are being valued.

In the past two years, AI has evolved from a niche topic to a broad-based economic force, lifting the valuations of everything from semiconductor manufacturers to data center landlords. This frenzy left many observers guessing how much of the “AI narrative” was baked into stock prices. By assembling a dedicated index, Aventis aimed to provide much-needed clarity on how public markets price AI across the value chain: from the most obvious plays (like AI chip providers) to more second-order beneficiaries (such as power utilities and construction firms that enable AI infrastructure).

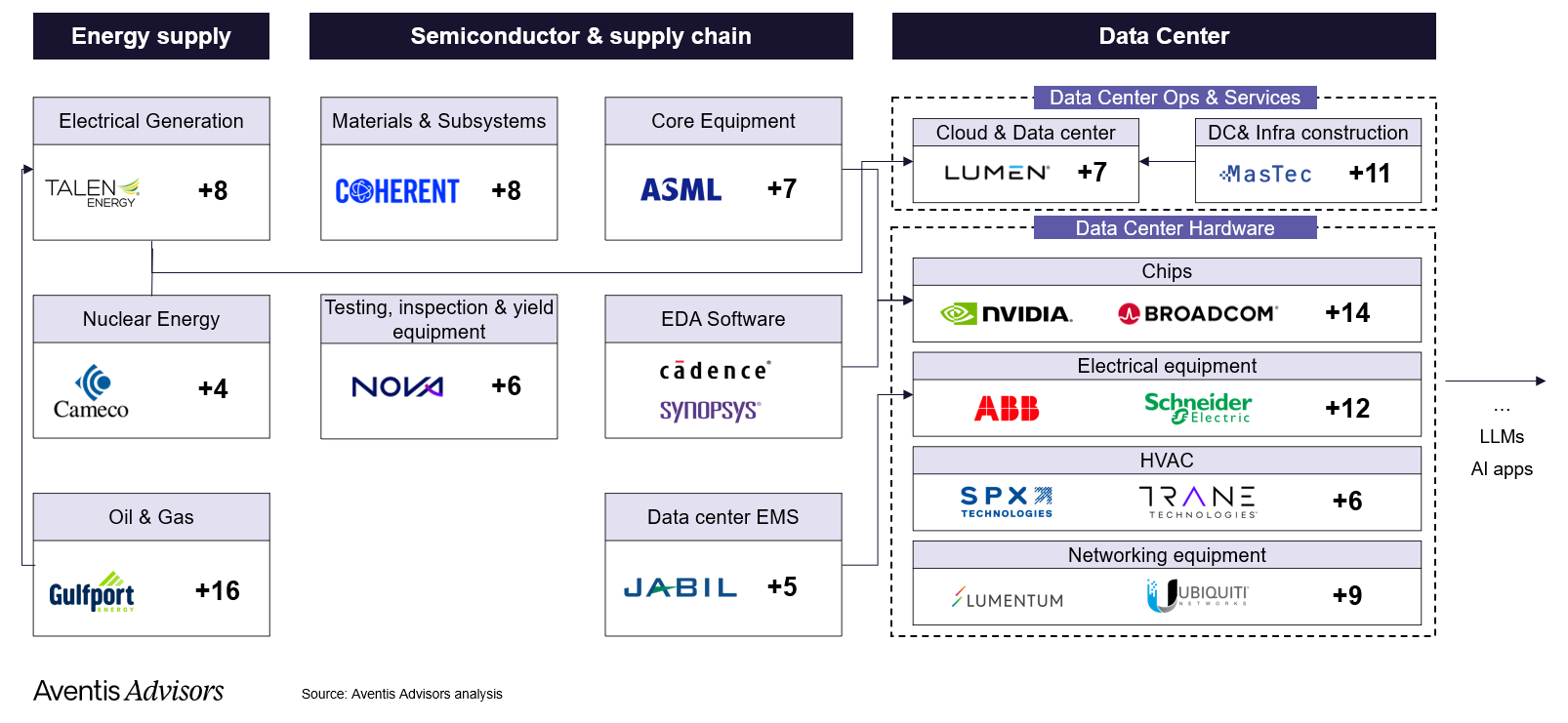

We defined “AI exposure” very broadly to capture the full value chain of AI. Rather than focusing only on pure-play AI software companies (of which very few are public), the index spans “any company across the AI value chain, from energy supply to data centers and cooling systems to EDA software, chip production, and AI applications”.

By late June 2025, we selected 137 companies as AI-related public companies. This broad inclusion is deliberate, as AI reshapes industries, even companies in power generation, HVAC, or electronic manufacturing services (EMS) can become critical “AI plays.” The Aventis index shines a spotlight on all these players so founders and investors can see where public markets believe the value in AI truly lies. The index also provides valuable insights for founders and investors seeking to understand market trends and optimize their companies strategy.

How the Aventis AI Valuations Index Was Built: Valuation Metrics and a DeepSeek Stress Test

To assemble the index, we took a novel approach: rather than pre-judging which companies are “AI companies,” we first let the market itself identify AI exposure via a real-world stress test.

We looked at publicly traded companies worth over $1 billion on US/UK exchanges whose stock price dropped more than 5% in the wake of DeepSeek’s January 27, 2025 research release.

This event – the launch of DeepSeek-R1, a cutting-edge AI model – served as a litmus test for investor perceptions. DeepSeek-R1 was a “cheaper AI model” seen as a threat to closed or infrastructure-heavy models, and its debut rattled markets. Advancements like DeepSeek-R1 can directly influence an AI-exposed company’s market value and investor confidence, as rapid AI progress often shifts competitive dynamics and future growth expectations.

In other words, if a company’s stock sold off sharply on the “DeepSeek scare”, it signaled that investors believed that company had significant AI exposure or dependence.

We manually reviewed the companies that dropped more than 5% and selected 137 companies as AI-related public companies for the index.

The index focuses on public companies, as valuing a startup in the AI sector presents unique challenges due to limited financial history, high uncertainty, and different investment frameworks compared to established firms.

The Aventis AI Valuations Index is structured as an equal-weighted index, deliberately designed to provide a more balanced and representative view of the AI ecosystem. Unlike market-cap weighted indices, which are often dominated by a handful of mega-cap firms like NVIDIA, this index gives equal importance to each constituent

AI Index Performance Overview: AI Stocks Soar

From its base date of November 30, 2022 (index value = 100), the Aventis AI Index has skyrocketed by +166% as of June 30, 2025. In less than three years, the basket of AI-exposed public companies gained significantly in value – vastly outpacing the broader equity market. For context, the S&P 500 was up on the order of tens of percent over a similar period, making the AI cohort’s performance truly extraordinary.

This run-up underscores how dramatically investor sentiment shifted in favor of anything related to AI, especially following the late-2022 breakthroughs in generative AI that set off an arms race in tech. The amount of money invested in AI stocks has reached record highs, reflecting strong investor confidence in the sector. Interestingly, that DeepSeek-driven drawdown (when many AI stocks sold off on fears of a cheaper model undercutting incumbents) proved to be a temporary shakeout. The index has since fully recovered those losses.

Strong demand for AI technologies has also fueled the index’s performance, driving further growth and competition within the sector.

Beyond the Mega-Caps: Broader Rally and Rebound

While NVIDIA and chipmakers grab headlines, it’s important to note that many other AI-exposed sectors have also delivered spectacular gains, in some cases even outpacing NVIDIA in percentage terms.

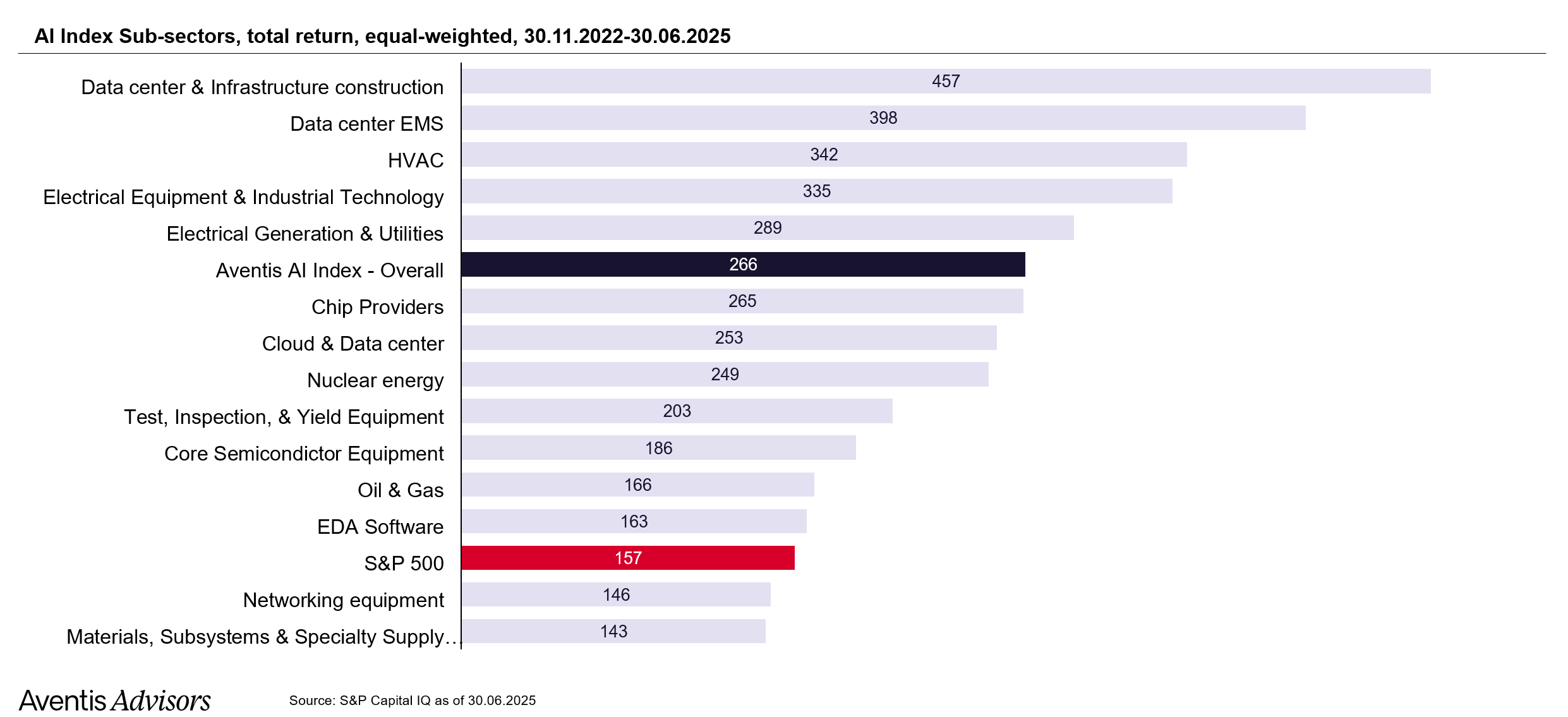

The breakdown reveals that infrastructure-heavy verticals are driving the index’s gains. Data center construction, electronics manufacturing services, and HVAC suppliers have delivered the highest equal-weighted returns in the index.

Notably, these enabling sectors have even outpaced core technology segments such as chip providers and cloud services, underscoring a significant market re-rating of the industries that underpin AI’s expansion. This trend highlights that second-order infrastructure enablers – firms building and servicing the physical backbone of AI – have captured substantial upside, not just the well-known chipmakers. While NVIDIA has grown an impressive 833%, most other chipmakers did not benefit equally from the GPU goldrush

Indeed, some of the top-performing stocks in the index hail from these “picks-and-shovels” niches: for example, contract manufacturer Celestica has surged +1,267%, building-systems specialist Limbach Holdings +1,069%, and infrastructure firm ASC +857%, all far exceeding the gains of mega-cap NVIDIA.

Download the full report on the left for a deep dive into the broader rally beyond mega-cap tech, including detailed breakdowns of groups, top constituents, and the infrastructure enablers driving outsized AI-related gains. Succeeding in these sectors is increasingly seen as a winning strategy in the global AI race.

Valuing AI Companies: Metrics, Models, and Market Realities

As artificial intelligence reshapes the global economy, valuations across the AI ecosystem have surged driven by investor excitement, disruptive potential, and structural shifts in both infrastructure and software. Whether assessing AI startups or mature public companies, the question of AI valuation remains central to investment, M&A, and strategic decision-making. Yet valuing businesses in the AI space poses unique challenges due to rapidly evolving market dynamics, divergent business models, and the lack of reliable precedents.

This section explores how investors approach the valuation of AI companies, with a focus on key valuation metrics, benchmarking practices, and the methodological gap between private and public markets.

Private vs. Public Company Valuations in the AI Industry

One of the most striking observations in the AI industry today is the divergence between private and public companies in how they are valued. In public markets, AI-exposed companies are typically evaluated using established financial metrics, such as EV/Revenue, EV/EBITDA, and in some cases discounted cash flow models. This reflects the greater availability of data and the market’s emphasis on short- to mid-term earnings visibility.

In contrast, private companies, particularly early-stage AI startups, often operate without meaningful revenue or profit. Their company’s valuation is driven by future potential, talent, intellectual property, and positioning within the broader AI ecosystem. This disconnect is especially evident during funding rounds, where startups may secure $100M+ valuations on limited revenue based on perceived relevance to the generative AI boom.

For investors, this means applying fundamentally different toolkits to each side of the market. Public companies can be analyzed via comparables and historical performance. Private AI companies require a qualitative assessment of defensibility, market fit, and technical advantage, often with significant valuation risk if hype outpaces delivery.

Common Valuation Metrics Across the AI Value Chain

The Aventis AI Index provides a helpful reference point for how AI companies across the value chain are currently valued in public markets (download the full report for details). Below are some of the most commonly used valuation metrics:

- EV/Revenue: This remains the dominant metric for software valuation, but those companies on the public stock markets are scarce. The revenue multiples primarily used in the valuations of companies raising VC rounds.

- EV/EBITDA: For firms in mature or capital-intensive parts of the AI value chain (e.g., HVAC, electronics manufacturing, utilities), EBITDA multiples offer a more grounded way to assess value. These typically range from 8x to 18x, depending on scale, margin profile, and growth rate.

- Discounted Cash Flow: While less common in fast-evolving sectors, DCF models are commonly applied to cash-flow generating businesses benefiting from AI tailwinds, such as power infrastructure or cooling systems. Here, long-term visibility and capital deployment cycles make DCF much more applicable.

The key takeaway is that valuation is not one-size-fits-all. Investors must tailor their approach to each segment, comparing firms to the most relevant companies within their domain, whether that’s EDA software, data centers, or application-layer platforms.

Conclusion

The Aventis AI Valuations Index offers a unique, data-rich perspective on where value is accruing in the AI economy. AI’s value chain is broader (and deeper) than many realize.

Public markets have rapidly priced in the transformative potential of AI, but in doing so they have favored the foundational layers of the stack. The infrastructure, such as chips, cloud, power, cooling, is enjoying the narrative and the increased spending, whereas the application layer must still prove it can lock in durable value.

For tech founders and investors, this may suggest calibrating strategies and expectations: aligning with the “picks and shovels” of AI can yield outsized returns, while building purely on the application front may require exceptional execution or differentiation to attract comparable valuation multiples.

About Aventis Advisors

Aventis Advisors is an M&A advisor focusing on AI, technology and growth companies. We believe the world would be better off with fewer (but better quality) M&A deals done at the right moment for the company and its owners. Our goal is to provide honest, insight-driven advice, clearly laying out all the options for our clients – including the one to keep the status quo.

Get in touch with us to discuss how much your business could be worth and how to maximize the valuation.