Welcome to the Aventis IT Services Valuations Index, a valuable one-stop resource designed to help you track the performance of the global IT services industry.

From an initial database of 800 IT services companies, we have carefully selected 187 publicly listed IT services companies to constitute the Aventis IT Services Valuations index. Our index will bring you the most interesting and up-to-date insights about IT services valuation multiples, global performance trends, and sentiment of the IT services industry.

So, let’s dive in!

Table of Contents

- Who is the Index for?

- Methodology

- Aventis IT Services Valuation Index

- Aventis IT Services Index vs. S&P 500 IT Services Index

- Index Composition

- Why you need an IT Services M&A Advisor

Who is the Aventis IT Services Valuation Index for?

The Aventis IT Services Valuation Index offers a comprehensive benchmark for small, medium, and large enterprises, making it one of the most extensive indices in the industry. Carefully curated to meet the needs of key stakeholders, the index is designed to serve:

- Founders and entrepreneurs leading IT services companies – whether planning an exit, exploring growth opportunities, or benchmarking their performance against industry standards.

- VC and PE investors seeking to assess market trends and investment opportunities with the IT services sector.

- M&A professionals and corporate development teams interested in IT and tech acquisitions.

- Students, academics, and industry enthusiasts looking to gain insights into the evolving IT services landscape.

About the Aventis IT Services Valuation Index

The Aventis IT Services Valuation Index tracks the financial performance of companies specializing in IT consulting and software development services.

Our index covers a broad spectrum of businesses, categorized into the following key segments:

- Software Development – Companies engaged in designing, coding, and maintaining software applications.

- IT Consulting – Firms specializing in digital transformation, cloud migration, and strategic IT advisory

- Software Integrators – Authorized partners of platforms such as SAP, Microsoft, and Salesforce, delivering tailored integration solutions.

- Managed Services Providers (MSPs) – Businesses offering outsourced IT support and infrastructure management.

- Value-Added Resellers (VARs) – Companies enhancing and reselling IT products with additional features and support services.

Methodology

Countries included: Australia, Austria, Belgium, Bulgaria, Canada, Denmark, Finland, France, Germany, Greece, Hungary, India, Indonesia, Ireland, Israel, Italy, Luxembourg, Morocco, Netherlands, Norway, Pakistan, Poland, Portugal, Romania, Singapore, South Africa, Spain, Sweden, Switzerland, United Kingdom, United States.

Revenue size of constituents: at least $10 million as of 3 June 2024 when the Index was originally created.

The index started with 95 public IT services companies on January 1, 2015, and had 187 companies as constituents on Aug 30, 2024.

Aventis IT Services Valuation Index

Due to the fact that the IT services industry is cyclical, the Aventis IT Services index showed a steady rise between 2015 and 2018, with the index growing from 100 pts to 245 pts. This was followed by a plateau phase and decline in 2019.

Over the analyzed period, our IT Services index grew by 6x, i.e., a compounded growth rate of around 21%. During the same period, the index (excluding Indian IT services companies) grew by only 4x, i.e., a compounded growth rate of ~15%.

The strong performance of the India-inclusive index suggests that investments in Indian IT services companies could yield higher returns, albeit with potentially higher volatility.

The high valuation of Indian IT services companies, as compared to their global peers, can be attributed to several strategic and structural advantages beyond the emerging market label.

- Cost efficiency & scalability: Indian IT firms maintain cost structures significantly lower than their global competitors, mainly due to labor arbitrage. This allows them to offer competitive pricing while maintaining healthy profit margins. Coupled with India’s massive talent pool, these companies can scale rapidly and offer large-scale project capabilities, which is highly attractive to global clients.

- Global delivery model: Indian IT firms pioneered the global delivery model, enabling 24/7 work cycles and faster project delivery by leveraging teams across different time zones. This model is particularly effective for complex IT services such as consulting, application development, and infrastructure management.

- One of the largest hubs for IT outsourcing: Specialization in outsourcing helps Indian firms generate high, recurring revenue streams from long-term contracts.

- Resilience & adaptability: Indian IT services companies have shown resilience in facing global economic slowdowns, geopolitical shifts, and the recent COVID-19 pandemic.

- Digital transformation & cloud services: Many of these firms have aggressively pivoted toward high-growth areas like digital transformation, AI, cloud computing, and data analytics.

To better understand the performance of the IT services industry, we can compartmentalize it into three phases, each with its distinct characteristics and key drivers:

Pre-2020: Stable and rationale growth phase of IT services

The period between 2015 and 2019 was characterized by the rise of digital transformation efforts by corporations. The demand to shift to cloud computing and improve existing infrastructure made IT services companies worthy beneficiaries of more business from existing and new clients.

This translated into higher revenues and stable profitability margins, pushing the Aventis IT services index slowly but stably higher from 100 points to 245 points, a roughly 25% compounded annual growth in four years.

2020-22: Disruption and consequent hype phase

The global pandemic in 2020 coerced corporations to adjust to remote working, and this was no easy change. As lockdowns and uncertainty kicked in, global asset prices took a hit, and IT services were no exception. Aventis IT services valuations index was uprooted from its stable and growing phase and experienced a crash of roughly 35% between February and March 2020.

However, the IT services industry quickly recovered from these lows. Over the next two years, Aventis IT services peaked at an all-time high of 661 points before taking a breather. We attribute the reason for this rapid recovery to the following:

- The demand for IT services increased massively during the pandemic as corporations raced to ensure they had the necessary tech infrastructure to support the work-from-home revolution.

- This phase was also characterized by high YoY revenue growth for IT services companies, as shown in our research on IT services valuation multiples.

- Central banks globally focused on stimulating the economy to avoid a recessionary spell, and this prompted quantitative easing through lower interest rates.

- Interest rates and cost of capital are inversely related to the valuation of a company, so as the interest rates went down, valuations of IT services companies boomed.

Post-2022: New macroeconomic reality for IT services

Even though inflation was eating into companies’ net profits, IT services have done a fairly good job of passing on this cost increase to the clients on the back of huge demand. The AI hype also allowed IT services companies to jump and get a piece of the action by providing services related to AI cloud transformation, AI consulting, and more. Thus justifying why the IT services index is still holding up at elevated levels, but there is no guarantee that this can be sustained.

IT services is a cyclical industry, and a plateau or decline follows every growth phase. Aventis IT services index experienced volatility during 2023 but as of Dec 2024, the index is treading close to its all-time high.

There are several reasons for the volatility experienced:

- With rampant inflation across the world, central banks pivoted to quantitative tightening, thereby increasing interest rates that affected the valuations of IT services companies negatively

- The increasing interest rates also limit the ability of IT services companies to borrow cheaply and invest in growth projects to maximize revenue and, eventually, stock prices.

- However, the ongoing hype and advancements in artificial intelligence present significant opportunities for innovation and efficiency, which could lead to substantial cost reductions and improved profit margins.

- Additionally, the prospects for revenue growth remain promising, driven by the continuous demand for technological advancements and digital transformation.

As a result, investors may anticipate another growth cycle on the horizon, balancing the current slowdown with the potential benefits of AI and cost efficiencies.

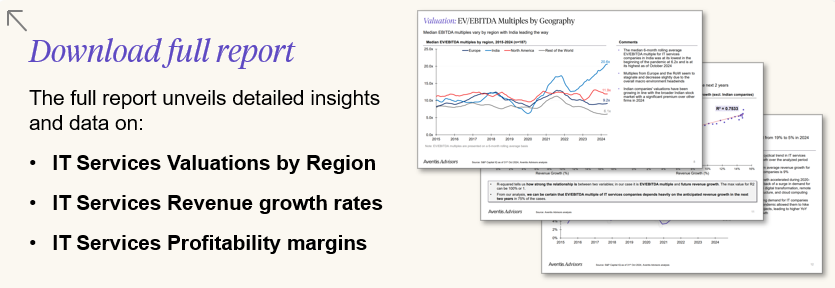

The chart above effectively highlights how anticipated revenue growth in the next twelve months (NTM) influences valuation multiples in the IT services sector. From 2020, the EV/EBITDA multiple significantly increased, peaking around mid-2021, which aligns with a substantial rise in NTM revenue growth forecasts.

Aventis SaaS Index

Aventis IT Services Index vs. S&P 500 IT Services Index

The Aventis IT services index mimics the general trend of the S&P IT services index, but overall, the Aventis IT services index outperforms the S&P IT services index in most years.

Indian IT services companies significantly drive the outperformance of the Aventis index. As of Dec 2024, the Aventis IT Services Index, including Indian companies, outperformed the index, excluding Indian companies by 37%.

So, why would you use the Aventis IT services index over the S&P 500 IT services industry index? There are several reasons!

The S&P 500 IT services industry index comprises stocks in the S&P 500 that are classified as part of the GICS IT services industry (only seven big companies!). Meanwhile, the Aventis IT Services index has a broader appeal and includes small, medium, and large IT services companies from across the world.

| Comparison | S&P 500 IT Services Industry Index | Aventis IT Sevices Index | Aventis IT Services Index (excl. India) |

| No. of constituent companies | Only 7 | 187 companies | 151 companies |

| Geography focus | USA only | Global | Global excl. India |

| Rebalancing frequency | Quarterly | Monthly | Monthly |

| 2015-2023 performance (CAGR) | 12% | 21% | 15% |

Index Composition

By revenue size

The Aventis IT services index’s constituents are almost evenly distributed in terms of their revenue size. There are 43 companies with more than $1 billion in revenue, such as TCS, IBM, Accenture, Wipro, and others, but medium—and small-sized companies also represent the index quite well, with at least 15 companies in each revenue group category.

By market capitalization

Our index consists of companies with market capitalizations as low as $10 million and up to $1 billion+. The Aventis IT services index has 100 companies with market caps between $10 million and $200 million.

By country

India is one of the biggest IT outsourcing hubs globally, and naturally, IT services companies from India are the biggest constituents of our index. They are closely followed by IT services companies in the USA, Germany, France, and Poland.

Why you need an IT Services M&A advisor

Understanding current IT services valuations provides valuable insights into market trends and helps you time your exit strategy. However, each IT services company is unique, just like every founder’s journey. That’s why it’s important to seek advice from experts in the M&A landscape, particularly advisors with experience in the IT services sector who can understand your situation.

IT services M&A advisors are adept at navigating market dynamics, valuations, and coordinating all essential workstreams. While you focus on running your business, IT services M&A advisors work diligently to ensure that no detail is missed and advocate for the best possible deal. Their success is directly tied to yours, and their impact on the final sale price can be significant.

About Aventis Advisors

Aventis Advisors is an M&A advisor focusing on technology and growth companies. We believe the world would be better off with fewer (but better quality) M&A deals done at the right moment for the company and its owners. Our goal is to provide honest, insight-driven advice, clearly laying out all the options for our clients – including the one to keep the status quo.

Get in touch with us to discuss how much your business could be worth and how the process looks.

Companies included in the Aventis IT services index

Accenture, IBM, Tata Consultancy Services, Capgemini, Cognizant Technology Solutions, Infosys, Kyndryl Holdings, DXC Technology, HCL Technologies, Atos, Wipro, CGI, Computacenter, Sopra Steria Group, Tech Mahindra, Indra Sistemas, EPAM Systems, Alten, ASGN, LTIMindtree, Atea, TietoEVRY, Econocom Group, Formula Systems, Reply, Globant, Unisys, Converge Technology Solutions, Cancom, Data#3, Exclusive Networks, 4iG, Mphasis, Matrix IT, Kontron, adesso, Softcat, Persistent Systems, Solutions 30, Coforge, Thoughtworks Holding, Sonata Software, Computer Direct Group, Nagarro, Digital Value, Endava, One Software Technologies, Malam – Team, GFT Technologies, Perficient, Netcompany Group, Neurones, Knowit, PT Anabatic Technologies, Tata Technologies, Aubay Société Anonyme, Zensar Technologies, Allgeier, Hinduja Global Solutions, All for One Group, DATAGROUP, Kainos Group, Comarch, Proact IT Group, Altron, Prodware, Keyrus, Asseco South Eastern Europe, E & M Computing, Alithya Group, Infotel, Bouvet, ECIT, Sword Group, Grid Dynamics Holdings, The Hackett Group, PT Mastersystem Infotama, SQLI, A.P.N. Promise, Comp, Columbus, SNP Schneider-Neureither & Partner, Trifork Group, PT Multipolar Technology, Exprivia, Cigniti Technologies, Digia, Systems, Gofore, Happiest Minds Technologies, KPS, AgileThought, Space Hellas, Micropole, Novabase, ORBIS, Atturra, Ctac, Siili Solutions, Glintt – Global Intelligent Technologies, izertis, Kellton Tech Solutions, Expleo Solutions, Dynacons Systems & Solutions, WidePoint, Singular People, DecisionPoint Systems, TPXimpact Holdings, Spyrosoft, Telelink Business Services Group, B3 Consulting Group, Spindox, Saksoft, AROBS Transilvania Software, Webstep, audius, CAG Group, Allied Digital Services, Itera, Atende, Bittnet Systems, Seven Principles, Softronic, Microdata, CombinedX, Exsitec Holding, Witted Megacorp, Magellanic Cloud, Sescom, Performance Technologies, TSS, Metrofile Holdings, CSP, Blue Cloud Softech Solutions, PBT Group, Sygnity, Inspirisys Solutions, Onward Technologies, Qlosr Group, CES, Arribatec Group, DevPort, Made Tech Group, Novotek, Sirma Group Holding, Mindteck, Castellum, Betacom, Netum Group, Sevenet, Reti, HITECHPROS, plenum, CloudCoCo Group, Ceinsys Tech, Neurosoft Software Production, Softlab, Fos, Digital Workforce Services, XTGlobal Infotech, Silver Touch Technologies, CyberTech Systems and Software, Cambridge Technology Enterprises, Trigyn Technologies, Union Technologies Informatique Group, Xchanging Solutions, KBJ, Speedvalue, PT Data Sinergitama Jaya, TechNVision Ventures, Talex, GRC International Group, MakoLab, Triad Group, ROX Hi-Tech, CPT Global, mVISE, Quicktouch Technologies, Kermann IT Solutions, SOCO Corporation, Ksolves India, Quality & Reliability, AION-TECH Solutions, Lukardi, Solidx, NINtec Systems, Wirtek.