After years of predicting the “death of email”, boosted by the growth in eCommerce, email marketing companies are being snapped up by a new generation of software companies.

In our inaugural report, we look at past M&A in the segment and why the deals are back in 2021.

The first wave of M&A

Email marketing dealmaking took off in the early 2000s, when the cloud SaaS offerings were still nascent, but already the future of software. Marketing cloud was to be one of the pillars of the enterprise offering and email marketing – the core of the cloud.

The leading software vendors, partly driven by FOMO, bankrolled an unprecedented acquisition spree in marketing technology, acquiring platforms that once were synonymous with email marketing tech.

Oracle, Salesforce, Adobe, and IBM paid billions of dollars for the leading email marketing software companies (by 2021 standards those do not seem like high multiples, but ). Companies like ExactTarget or Vocus acquired Pardot and iContact in multi-million deals.

Of the usual suspects, it seemed only Microsoft and SAP did not make a mega-deal.

However, SAP has always been more manufacturing-focused, so it had limited value proposition in these competitive deals. At the same time, Microsoft ventured into social media, acquiring LinkedIn in 2016, relying on integrations and AppSource partners, such as ClickDimensions, backed by Accel-KKR.

The following years were spent integrating the newly acquired software into large Marketing Cloud platforms. The acquired companies became the core of the Marketing Cloud of Adobe, Salesforce, and Oracle.

Mailchimp acquisition

The Big Tech focus on delivering products to enterprise customers left a niche for an easier SMB-focused solution. With the growth of ecommerce and customers increasingly preferring easy-to-use cloud solutions many new smaller players flourished. Soon enough, a new disruptor, Mailchimp became the #1 platform for email marketing.

Bootstrapped since its founding, Mailchimp was eventually acquired by Intuit in November 2021 for a whopping $12B, more than all top past email marketing mergers combined. The goal: “to become the center of small business growth”, widening the scope of Intuit’s platform from covering back-office accounting to marketing.

The deal was notable in several ways:

- First, the 12 billion price tag implied a rich 15.0x Revenue multiple, putting strong pressure on Intuit to deliver the synergies to justify the valuation

- Second, Mailchimp, a notably bootstrapped company, proved it is possible to scale and exit even without venture capital financing

- Third, the deal will show if it is possible to build a larger platform for small businesses based on the core accounting software. Will the Mailchimp acquisition inspire a wave of deal-making by accounting software vendors? In most countries, the bookkeeping software is still local with focused functionality. Local tools for email marketing, SMS marketing, and eCommerce may well be great acquisition targets.

Private equity comeback

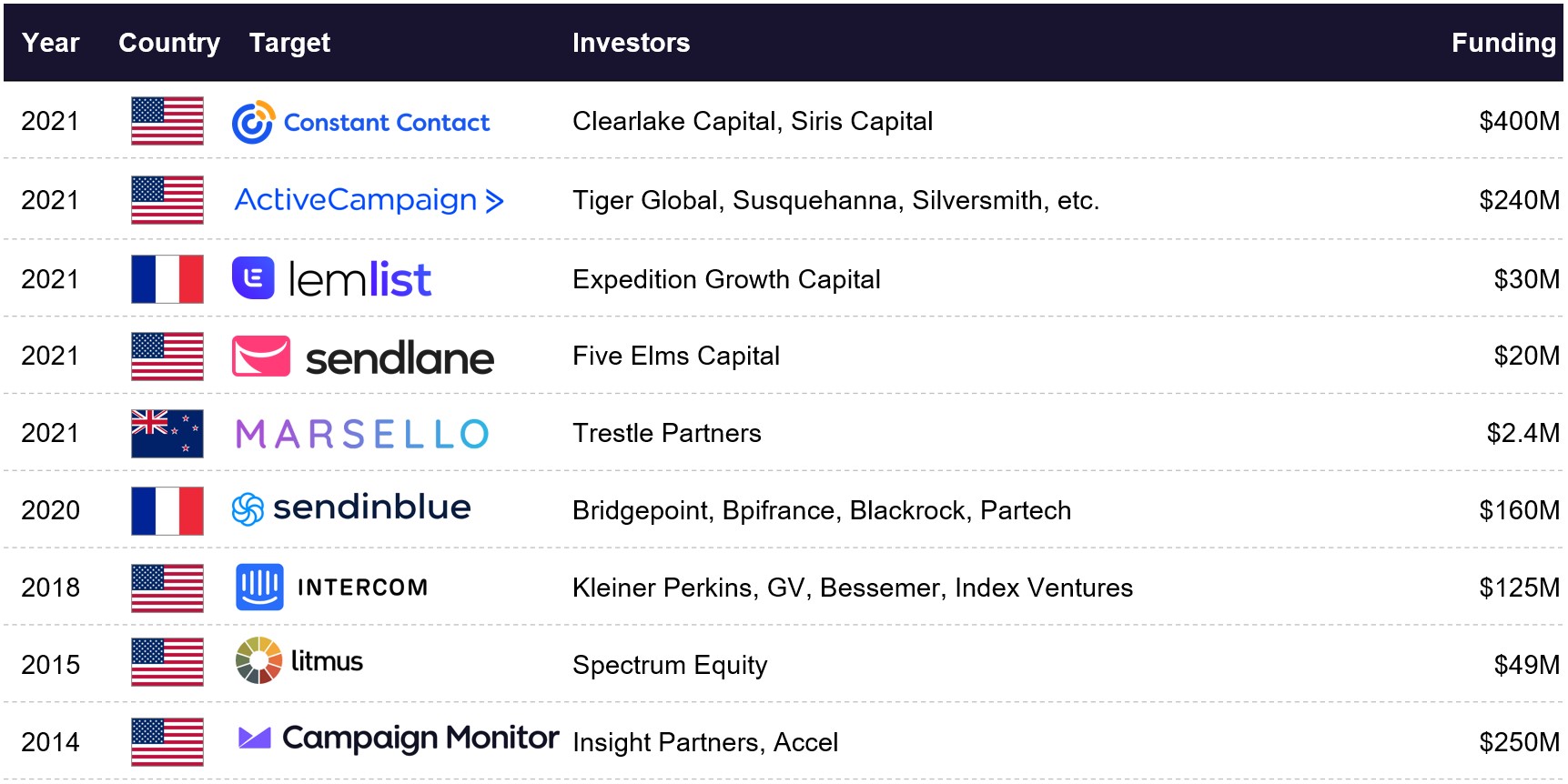

Yet while the Mailchimp deal was the most headline-grabbing, 2021 has seen a flurry of global activity.

Supported by record low interest rates and an abundance of dry powder, private equity funds became some of the most active investors in the market.

For example, Constant Contact was spun-off from a web hosting company Endurance International and raised $400M from growth equity investors.

Active Campaign is taking Mailchimp’s route. Founded in 2003, the company focused on SMBs and raised its first outside money in 2016. The most recent $240M round valued the company at $3B+ and an 18x Revenue multiple. The investment came from the leading growth equity firms: Tiger Global, Silversmith Capital Partners and Susquehanna Growth Equity.

New unicorns

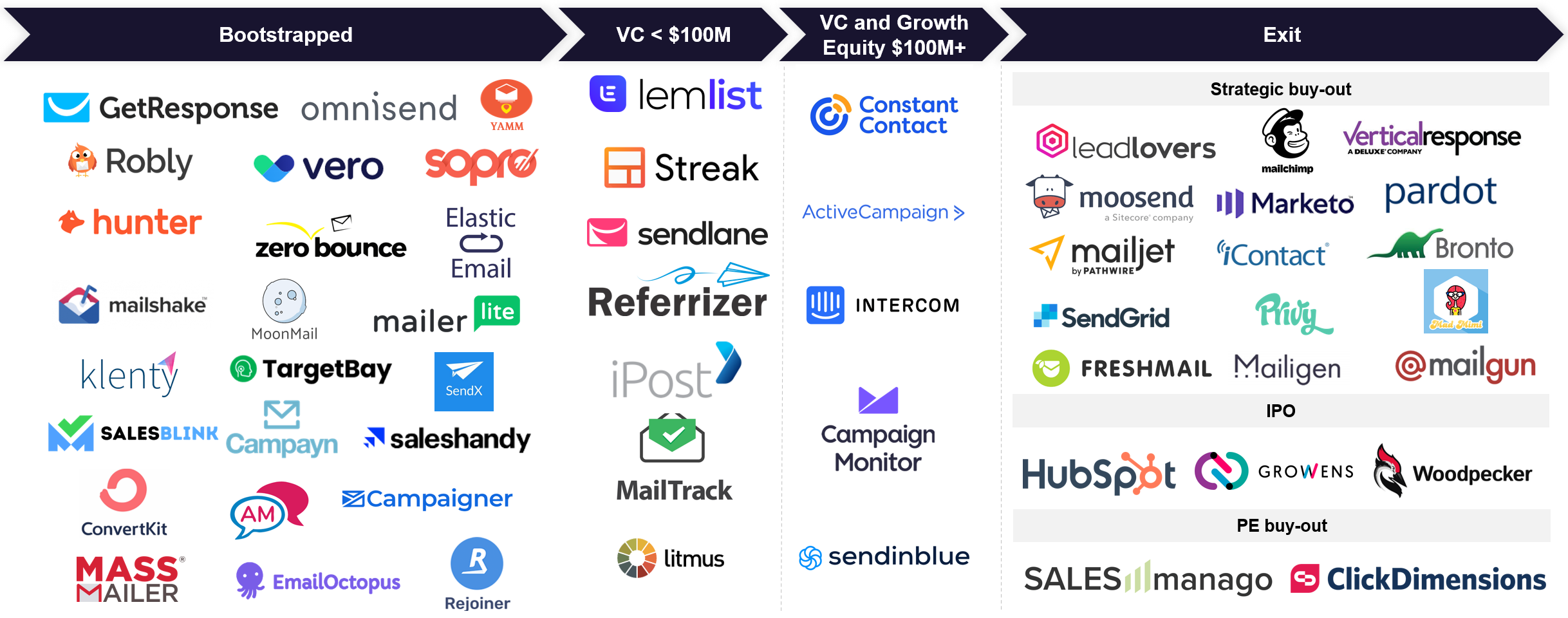

Emerging software leaders are increasingly using M&A to boost their technology stack. Many modern communication platforms now require a wide range of channels to reach their customers: email, SMS, messengers, etc.

If history is any guide, the largest SaaS and CPaaS companies are the natural buyers for independent vendors. For example, Twilio, one of the largest CPaaS companies, initially focused on SMS, but later widened its stack with the acquisition of SendGrid in 2019.

Still, many of the emerging challengers have not yet concluded an email marketing acquisition.

Shopify, a natural buyer, does not have an active M&A strategy, preferring to invest in the ecosystem. They slashed commissions to 0% in June 2021 slashed commissions to 0% for app sales below $1M.

At the same time, this doesn’t mean that the M&A in the space is thus subdued – this year, a $2.2B-valued SMS marketing specialist Attentive Mobile acquired Privy, a self-declared “Mailchimp for Shopify.” Klaviyo, a diversified eCommerce software provider, raised $320M in May of 2021.

The activity also accelerated among smaller players, with unicorns like Pipedrive or Sitecore acquiring email marketing companies. The consolidation also continues in the smaller markets: domestic deals in Poland, Brazil, and Germany are good examples.

Even after the waves of acquisitions in the email marketing segment, the industry is still fragmented with many bootstrapped companies, both with local and global presence. With the continuing emergence of new marketing, accounting, eCommerce, CRM software, the deal making in the space will continue, even if on a smaller scale.

Why you should work with an M&A advisor

Consulting with an M&A advisor is crucial for founders in the email marketing and SaaS sectors, where market dynamics are fast-paced and valuations fluctuate wildly. An advisor offers expert insight on when to sell, how to position your business, and identifies the right buyers to maximize your company’s value. With the industry constantly evolving and consolidating, an M&A advisor helps you navigate these complexities, ensuring a smoother transaction and securing the best outcome for your business.

About Aventis Advisors

Aventis Advisors is an M&A advisor focusing on technology and growth companies. We believe the world would be better off with fewer (but better quality) M&A deals done at the right moment for the company and its owners. Our goal is to provide honest, insight-driven advice, clearly laying out all the options for our clients – including the one to keep the status quo.

Get in touch with us to discuss how much your business could be worth and how to maximize the valuation.