“The value of initial public offerings in the US and Europe has fallen 90 percent this year”, reports the Financial Times. A quick look at the FESE IPO report shows that the European market has slowed down after a significant number of initial public offerings in 2021, which undoubtedly was the record year for listings. Rebound after the pandemic was spectacular, but inflation, slowing global growth, and war in Ukraine caused even more significant declines.

Major indices like S&P 500, EURO STOXX, or MSCI World declined considerably. Investors were selling-off rather than buying equities. Market volatility forced companies to postpone their plans to go public.

source: FESE

Going public is a complex and lengthy process that you need to time well. IPO preparation can take a few to over a dozen months. To have a compelling offer for investors, the company must also be at the appropriate stage of development. In times of high uncertainty, inflation, and economic slowdown, it may be hard to lengthen the pre-marketing period for IPO and stay on the growth path for attracting investors simultaneously.

Many companies planned to go public in 2022, but IPOs are being pushed back to 2023 due to unfavorable market conditions.

If you are a business owner, who wants to find investors at the very best of your company’s time, yet you may have missed the window for the highest market valuations in decades – what’s the alternative?

You may consider some other options. Keeping in mind that IPO is not an ultimate goal but a way to achieve it, you may focus on those goals and think about an alternative solution.

What do you want to achieve by going public?

To choose the best alternative to an IPO, you should first decide which aspects of your company’s listing on the stock exchange were most important to you. There are usually a few reasons why companies go public. Let’s focus on those five:

Raising Capital

It is the first and most common purpose for almost every company that contemplates going public. Being a public company allows you to access theoretically unlimited financing sources for future projects. However, it comes at the cost of opening up your books to competition, tedious financial reporting, and investor pressure on short-term profitability.

Other options: bank loan, corporate bonds, growth PE investor.

Raise funds from investors who are just the right fit for your business goals and vision.

Growth

Additional funds enable faster growth and development of business. For example, they allow you to finance R&D projects, enter international markets or make acquisitions.

Other options: bootstrapping, reinvesting revenue, VC, growth equity.

Planning to grow – see how we can help you in acquisitions.

Liquidity

Raising capital may be the most common and important reason to go public, but liquidity is no less important. If your company is privately held, you have few options to sell shares, and transaction costs are prohibitive for small, non-majority transactions. Following an IPO, trading in your company’s shares is centralized in the stock exchange, connecting multiple buyers and sellers that establish a market price through trading. Thanks to the liquidity that an IPO creates, existing investors, founders, and employees can sell (or buy) the company’s shares.

Exit opportunity

Related to liquidity – IPO is often an exit opportunity for stakeholders. Even if they don’t decide to sell instantly, the stock exchange will provide such an option as long as the company is listed.

Other options: strategic investor, buyout private equity investor.

CKSource sold to Tiugo Technologies: Learn more

Improved credibility

Stock market listing is a proven way to boost the credibility of your business. Due to high hurdles and requirements for admission to public trading and the transparency from financial reporting, it signals to stakeholders that your business can be trusted. At the same time, the need to report makes your competitors know your detailed financial results. On the one hand, it gives the opportunity to obtain better contracts or more prestigious clients, but on the other hand, it is one of the most frequently mentioned reasons why companies do not want to go public.

Other options: industry investor, strong PR, ESG reporting, and voluntary publication of financial reports.

Why you should consider an M&A track as an IPO alternative

Regardless of the business development strategy, it is worth considering a potential M&A track as an alternative to an IPO. While the stock market can be volatile, in the private market, changes take slightly longer and are less abrupt. Although the period of increased activity in the IPO market is over, the funds raised by private equity during economic expansion are still abundant, especially for companies that generate strong cash flows.

Targeting buyers and preparing for private sale can also increase a company’s ability to secure more investment funds in the future.

By selling your business to a strategic acquirer, you will take some chips off the table and be able to exploit synergies between the two companies. It is also an excellent exit opportunity for your passive shareholders.

Among potential investors mentioned earlier, an important group are Private Equity (PE) funds. Similar to strategic investors, a takeover by PE gives passive investors a great exit option. At the same time, the founders usually have more flexibility because some shares can remain in their hands. A vast universe of private equity funds focuses on various companies at different stages of their growth cycle. Private Equity funds are typically more flexible and focus on creating a transaction structure that would motivate the managers and share an upside.

In times of capital markets volatility and the related uncertainty of the success of the IPO, companies choose a dual-track process, which includes going down the path of conducting an initial public offering while also pursuing a possible M&A exit. The company retains the flexibility to opt for one way versus the other until late in the process, but it can be much more expensive and time-consuming.

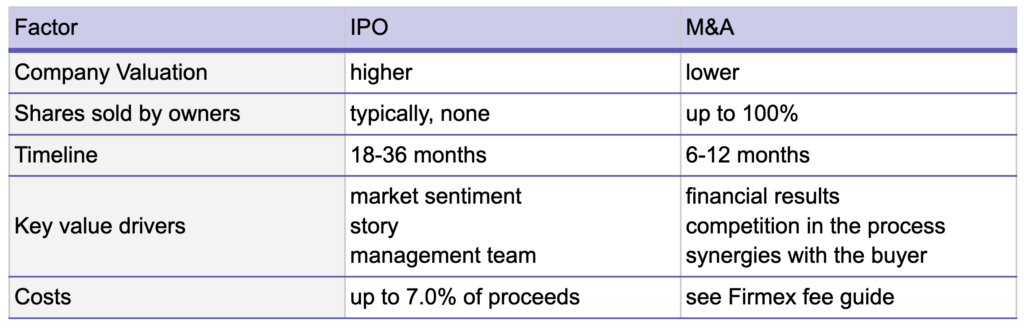

It is worth remembering that an IPO usually helps obtain a higher valuation. Also, the company’s owner transfers a much smaller stake to the shareholders. Going with an industry investor is not the same as entering the stock exchange; it is not conclusively better or worse because it depends on the owner’s goals and needs.

What are your benefits of hiring an M&A advisor?

Choosing between an IPO and selling is one of the most critical steps for a company’s owners.

At Aventis Advisors, we want to support you with our experience and market research to help them make informed decisions. How can we help here?

1. Deciding on the right course of action

We always start with carefully listening and understanding a client’s unique set of goals: both personal and business. We then clearly lay out all the options before you – including the one to keep the status quo. Sometimes waiting is the best course of action. The best deals are closed at the right moment for you personally, your company and the market.

2. Maximizing company valuation

We work to get the greatest number of offers to leverage competition to maximize your gain. It’s worth knowing your company’s value and having an exit opportunity even if the IPO window is temporarily closed.

3. Supporting your team

During the preparations for an IPO, there’s a lot of work to do to meet the market regulator’s requirements. Your involvement will also be essential during the M&A process, especially in due diligence. Therefore, you need an excellent organization to avoid disrupting your business. We can help you plan and manage the journey to make it as simple as possible.

4. Negotiating terms and closing the deal

Once you’ve decided which offer you like best, you can return to focusing on your business. We’ll take care of the heavy lifting – finalizing the terms and deal structure to ensure no surprises.

Whether you plan to go public, get an investor on board or sell your business – it is always worth having time to consider all the potential options. We typically first engage with our clients a couple of years before the actual transaction, so when the deal happens, it is the perfect moment. Get in touch with us to discuss when it is the right time for your business.

Whether you want to wait for the significant return of the IPO market or just see how the market is valuing your business, you can start building investor relationships with the future in mind. You don’t have to make a decision today, but it’s important to know what your prospects are. If you want to see how we can help you with examples, check out our case studies and testimonials.

About Aventis Advisors

Aventis Advisors is an M&A advisor focusing on technology and growth companies. We believe the world would be better off with fewer (but better quality) M&A deals done at the right moment for the company and its owners. Our goal is to provide honest, insight-driven advice, clearly laying out all the options for our clients – including the one to keep the status quo.

Get in touch with us to discuss how much your business could be worth and how to maximize the valuation.