If you’re preparing to sell your business, one of the most important decisions you’ll make is choosing your M&A advisor and ensuring your interests align with theirs. This must be carefully considered, whether you intend to work with a boutique M&A firm or a bulge bracket investment bank’s M&A division.

One of the major factors to consider in this step is the amount and structure of M&A advisory fees. These will have a considerable impact on how much money you walk away with after the transaction.

Clearly understanding these fees and how they work can help you make more informed decisions for your business by evaluating the transaction’s overall cost and your potential return on investment.

In this article, we discuss the different types of fees typically charged by M&A advisors and investment banks, other fees and costs that can arise during an M&A transaction, and how to ensure you get the best outcome when selling your business.

Introduction to M&A advisory and investment banking fees

Before diving into the typical fees charged by M&A advisors and investment banks, it’s worth understanding what services they provide in a sell-side advisory capacity.

- Preliminary work: This includes preparing the promotional material required to market your business to potential buyers. M&A advisory firms and investment banks can save you considerable time and energy by selecting the right data to show to potential buyers.

- Matchmaking: An M&A advisor or investment banker will typically utilize their extensive network to match suitable buyers and sellers. Advisors have a good understanding of the buyer’s needs and know how to pitch your business to get them to pay top dollar.

- Due diligence: Once a buyer has been selected, advisors assist with the due diligence to ensure the right data is collected, analyzed, and presented in the appropriate format.

- Negotiation: To ensure deal terms are beneficial to their clients, M&A advisors will take part in the negotiation process. This helps manage and minimize any potential problems that may occur throughout the transaction.

- Closing: Finally, advisors will help draft the sell and purchase agreement and manage the signing and closing of a deal.

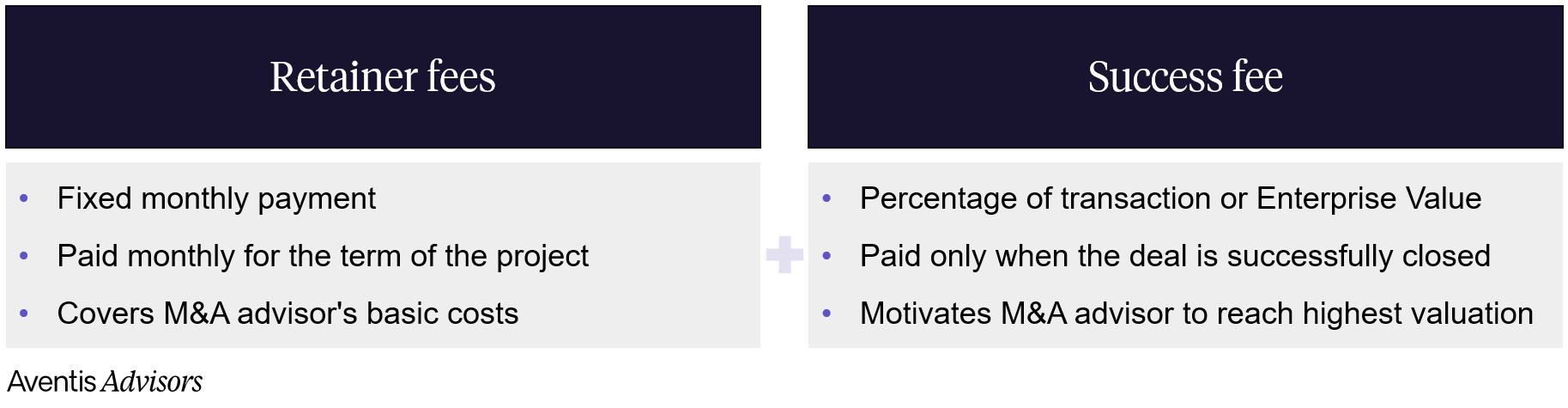

There are two types of fees typically charged by M&A advisors for the services they render: retainer fees and success fees.

- Retainer fees are a flat fee paid upfront, regardless of whether or not a transaction is successful.

- Success fees are only paid if a transaction is completed successfully. They have multiple variations and are typically agreed upon as a percentage of the final sale price.

Retainer Fees

Many M&A advisors charge a retainer fee.

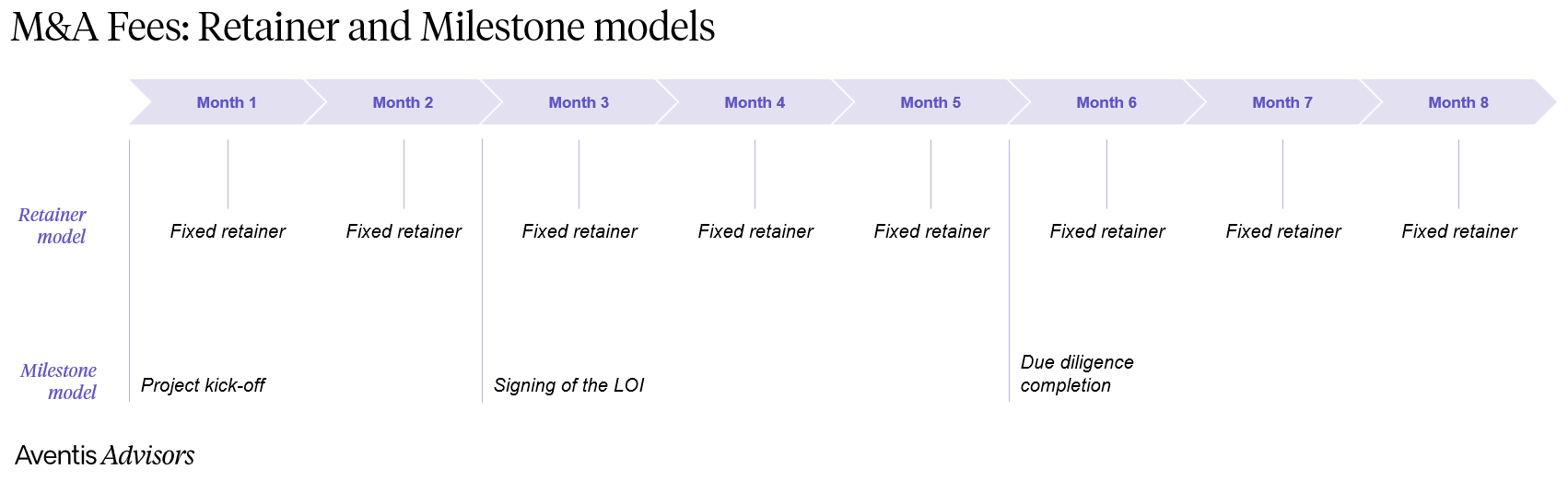

This is a fixed upfront fee, typically non-refundable and usually paid monthly over an agreed number of months. As a general rule, the number of months is usually capped at six to 12 months to avoid it being paid indefinitely if a deal takes longer than anticipated.

How do retainer fees work?

The retainer fee will always be subject to negotiation between the parties and can vary based on several factors.

The most common influencing factors include:

- The size and complexity of the transaction

- The level of competition between advisors to win the given mandate

- The expertise, reputation, network, etc. of a firm (e.g. a large investment bank may be more expensive).

Why pay retainer fees?

Retainer fees are an essential part of M&A deals and can help ensure that both sides are committed to completing the transaction. There are many reasons why retainer fees are beneficial in mergers & acquisitions.

- They allow advisors to allocate the necessary resources required to properly manage a project.

- They provide financial security to advisors in case a deal is unexpectedly delayed or canceled.

- They show advisors that the buyer/seller is serious about their intentions.

The right retainer fee is an amount that keeps the investment banker engaged but also motivates them to close the deal and earn the success fee.

You may occasionally find M&A advisors who don’t charge retainer fees. As a business owner, this may seem appealing, however it’s important to remember that retainer fees exist to keep advisors engaged and committed to your case. Some upfront expense should be expected if you want your advisor or investment banker to provide decent services.

Ultimately, retainer fees are a win-win as they demonstrate that both parties are committed to working together.

Milestone fees as a substitute for retainer fees

Some M&A advisors and investment bankers may offer to substitute retainer fees with milestone fees.

Milestone fees are payments made at specific points throughout the sale process. For example, a milestone fee may be paid upon signing the Letter of Intent, completing due diligence, or delivering a draft of the purchase agreement.

These fees can help incentivise an advisory team to align with the client’s objectives. They can also give structure to a project by providing measurable progress and verifiable deliverables.

However, before agreeing to milestone fees you must carefully consider the appropriate fee structure. Make sure you understand what deliverables are expected at each milestone and that the fee is commensurate with the value of the deliverable. Otherwise, you may find yourself paying for something that doesn’t provide much value to your M&A project.

Success fee

Success fees are the main compensation provided to M&A advisors and usually make up the majority of their income. They help motivate advisors to work hard to close a deal and not get comfortable with the retainer fee only.

How do success fees work?

The success fee is usually a percentage of the total transaction or Enterprise Value and only paid out if the deal is completed. This helps ensure that advisors are aligned with the interests of the seller and working to close a deal at the highest possible price.

M&A projects can be highly complex and often involve a great deal of financial risk for the advising firm. If a deal falls through, the firm will not receive any compensation for their work. For that reason, M&A firms typically only take on deals they believe have a high chance of success or offer very high fees upon closing.

In some cases, an M&A advisory firm or investment bank might deduct their retainer fee from their success fee. Pay attention to this when negotiating fee structures as it can significantly impact how much you end up paying your advisor.

Most common success fee structures

Success fee structures vary and it’s up to the involved parties to select an appropriate structure for the given mandate. If done well, a success fee offers a win-win situation as the advisor’s fee will ultimately pay for itself with your company’s increased enterprise value.

Below are some examples of common success fee structures.

Flat Percentage

With a flat percentage agreement, the success fee is a fixed percentage of the target’s transaction value. While this does incentivise an advisor to strive for a higher selling price, the incentive can be quite marginal. Some consider a flat percentage to not be compelling enough for advisors to “go the extra mile” in maximizing transaction value.

If negotiating the highest price is not the primary objective for the seller, or in cases where it may be difficult to garner competitive bids, flat percentages may be a good option.

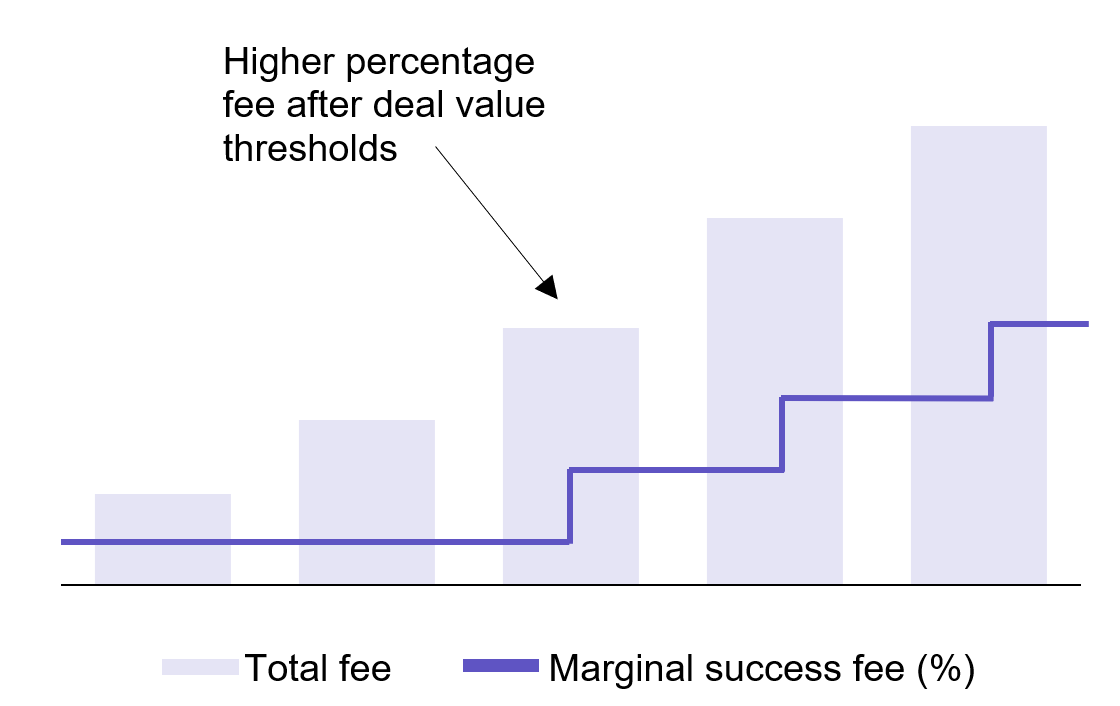

Scaled Percentage

An ascending percentage scale is a common extension of the flat percentage fee. In this situation, different percentages are applied to successive portions of the final sale price.

See the below example for illustrative purposes.

A scaled percentage success fee structure gives the most incentive to M&A advisory firms or investment banks to work hard and achieve the highest possible transaction value. The thresholds should be carefully considered, however, to ensure that the final success fee is in line with the service provided.

This fee structure is more common when an M&A advisor or investment banker is required to find multiple prospective buyers. This is because these situations generally require additional time and effort to position and market the business favorably.

Fixed Fee

Under the fixed fee structure, an advisor agrees to receive a fixed amount if the deal is completed. This kind of arrangement gives no incentive for the advisor to work towards maximizing transaction value.

A fixed fee works well in cases when the buyer and seller have already been identified and an advisor is only needed to help with due diligence and negotiations.

Fixed Fee + Bonus

This is an extension of the fixed fee that offers an additional bonus to advisors if the sale price is above a certain threshold.

Compared to the scaled percentage success fee, this fee structure gives less incentive to M&A advisors to work towards achieving the highest sale price. Similar to a fixed fee, this agreement is usually used when the buyer and seller have already been identified.

Minimum Fee

In this fee structure, a minimum success fee will be paid regardless of the deal outcome. If a deal falls apart or is closed at a much lower than expected valuation, the M&A advisor will be paid the minimum amount. In case of a successful closing, however, the advisor will receive a higher percentage fee.

Setting a minimum fee gives protection to an M&A advisory firm or investment bank while also pushing them to remain committed to closing the deal at the highest possible value.

Other M&A fees

Breakup fee

In an M&A transaction, a breakup fee is paid by the seller if they decide to back out of a deal. This compensates M&A advisors for the time and resources they’ve put into the deal. Not all investment bankers will use breakup fees in their engagements.

Fees paid to other professionals

As well as merger and acquisition fees, other fees may also be incurred from other professional services firms. These include legal fees and accounting fees. It’s vital to be aware of these other fees in advance, as they can add up quickly.

Unlike M&A advisor success fees, these extra fees are rarely contingent. Lawyers typically charge by the hour, with a cap. Tax advisors and accountants may charge by the hour or provide a fixed price.

The total fees paid during an M&A transaction will vary depending on the size and complexity of the deal, so it is essential to get an estimate from your advisors and consultants beforehand.

Other potential costs in an M&A transaction

Some costs incurred throughout an M&A transaction may require reimbursement from the client to the M&A advisory firm or investment bank. These might include travel, accommodation, meals, and technology.

These costs are usually minor and have been on the decline as virtual meetings become more popular.

Engaging an investment banker

Things to consider when engaging an M&A advisor include their experience, success rate, fees, and motivation to close the deal. Ultimately, you want to choose the advisor who is most likely to get you the best result.

You may be inclined to negotiate the lowest possible fees when hiring an investment banker. However, this may not be in your best interest for various reasons. Instead, your focus should be on creating a win-win situation for the both of you.

Seeking out advisors with niche expertise or strong relationships with likely buyers can help you sell your business faster and at a higher price. Since success fees are usually a percentage of the sale price, you’ll still come out ahead even if you are paying a higher fee structure.

M&A advisor fee structures may seem complex, but understanding the basics can help you get the best possible outcome for your business. By aligning your interests with those of your advisor, you can ensure the sale process is smooth and successful.

If you plan on selling a business, have any questions about M&A advisor fees, or want to learn more about how we can help you sell your business, get in touch with our team. We would be happy to answer any of your questions.

These additional resources can also be helpful if you’re considering selling your business or want to know how to best prepare your business for sale.

Learn how Aventis helps to successfully sell your business

M&A advisor fee structures can seem complex, but understanding the basics will help you make sure you’re getting the best possible outcome for your business. By aligning your interests with those of your advisor, you can make sure that the sale process is smooth and successful.

If you plan on selling a business, have any questions about M&A advisor fees, or want to learn more about how we can help you sell your business, get in touch with us. We would be happy to answer any of your questions.