PDFs Before the Cloud Era

Now ubiquity in the document exchange, PDF format was first developed in 1993 by Adobe. Highly flexible and designed initially to disrupt paper, PDFs were declared dead multiple times, but the ecosystem is better than ever. After Adobe released the PDF specification in 2008, the format got another boost in popularity.

Technically complicated and the domain of some of the best minds in tech, the PDF software industry has given way to many small and mid-size companies around the globe but rarely attracted the attention of investors.

What brought on the wave of investor interest in PDF libraries is the rapidly changing landscape of how PDF documents are generated, edited, and viewed.

Before the cloud era, PDF software was primarily understood as desktop and later mobile applications for creating, viewing and editing PDF files. The landscape was dominated by Adobe Reader and Adobe Acrobat, which once accounted for up to 40% of Adobe’s revenue. The growth of mobile spurred the development of multiple mobile apps with PDF functionality for Apple and Android devices. Yet the mobile business model was complex: relying on one-off purchases and focused on the B2C segment.

At the same time, enterprise software was rapidly migrating to the Cloud, inviting a new type of PDF software. Now, enabling PDF functionality in the cloud web application was necessary – viewing, editing, and generating documents inside the apps.

This changed the nature of the business itself as well: now B2B, developer-focused, and shifting to the subscription model, the industry was finally able to scale rapidly and attract a wave of capital. The pandemic helped: making paper, the original competitor of PDF, even more obsolete.

Tools to perform mundane tasks, such as splitting, merging, and converting were also shifting to the web, allowing the websites, such as iLovePDF and Small PDF to become some of the most popular websites across the globe: #117 and #173 respectively (Alexa) with 50M+ monthly visits.

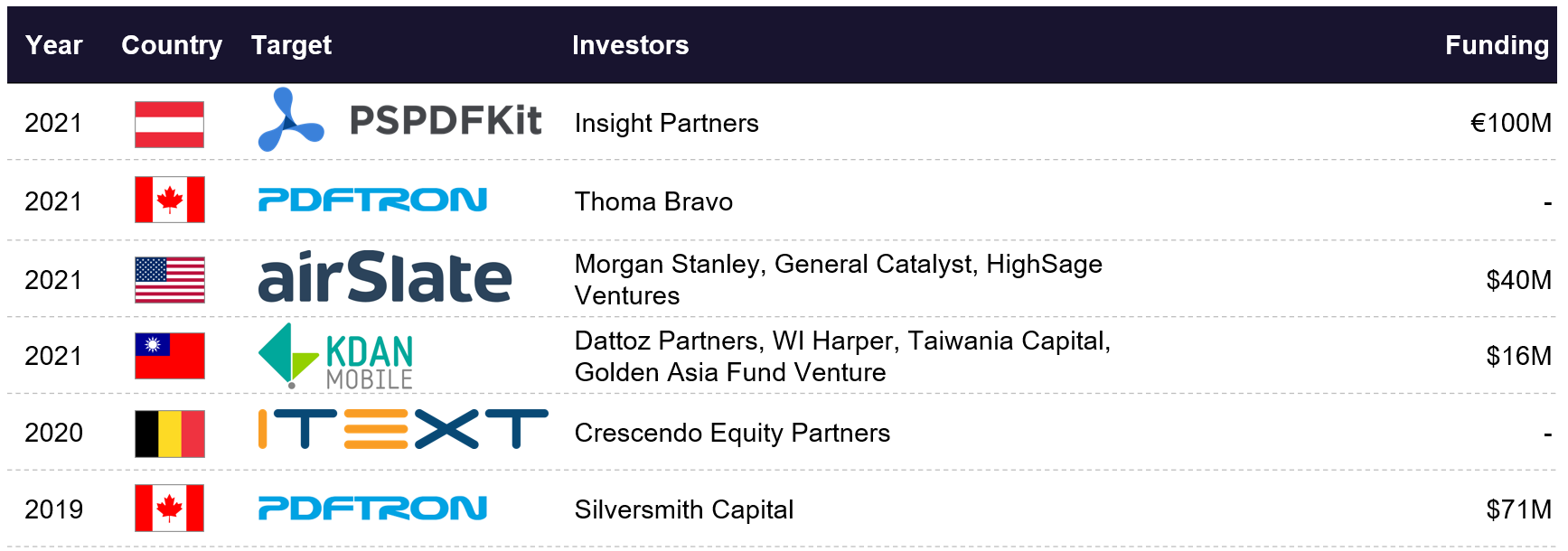

Top Deals in PDF Technology

Companies providing the new infrastructure for the web apps explosion were quickly caught up by top tech funds:

- In 2019, PDFTron Systems, first received $71M from Silversmith Capital Partners and later strategic investment from Thoma Bravo

- In 2020, iText, a leading developer of server-side PDF technology, was acquired by Crescendo Equity Partners

- In 2021, PSPDFKit, developer of PDF SDK, attracted €100M from Insight Partners

- AirSlate, a diverse document processing software company, which counts PDFFiller among its products, raised funding from a conglomerate led by Morgan Stanley

- In 2022, ITEXT was acquired by PDFTron Systems in a mega deal, concluding the first phase of consolidation in the industry.

PDFTron acquisitions

With a wave of new capital, many companies went on an acquisition spree with a goal of building a larger document processing platform. Most notably, PDFTron has completed numerous deals in the ecosystem, acquiring such firms as BCL Technologies, ActivePDF, Iceni Technology, PDF3D, Windward Studios, and PDFLib.

One of the most notable acquisitions is the deal with iText, which combines PDFTron’s strength in client-side technology with iText’s server-side offering and allows it to serve customers more comprehensively.

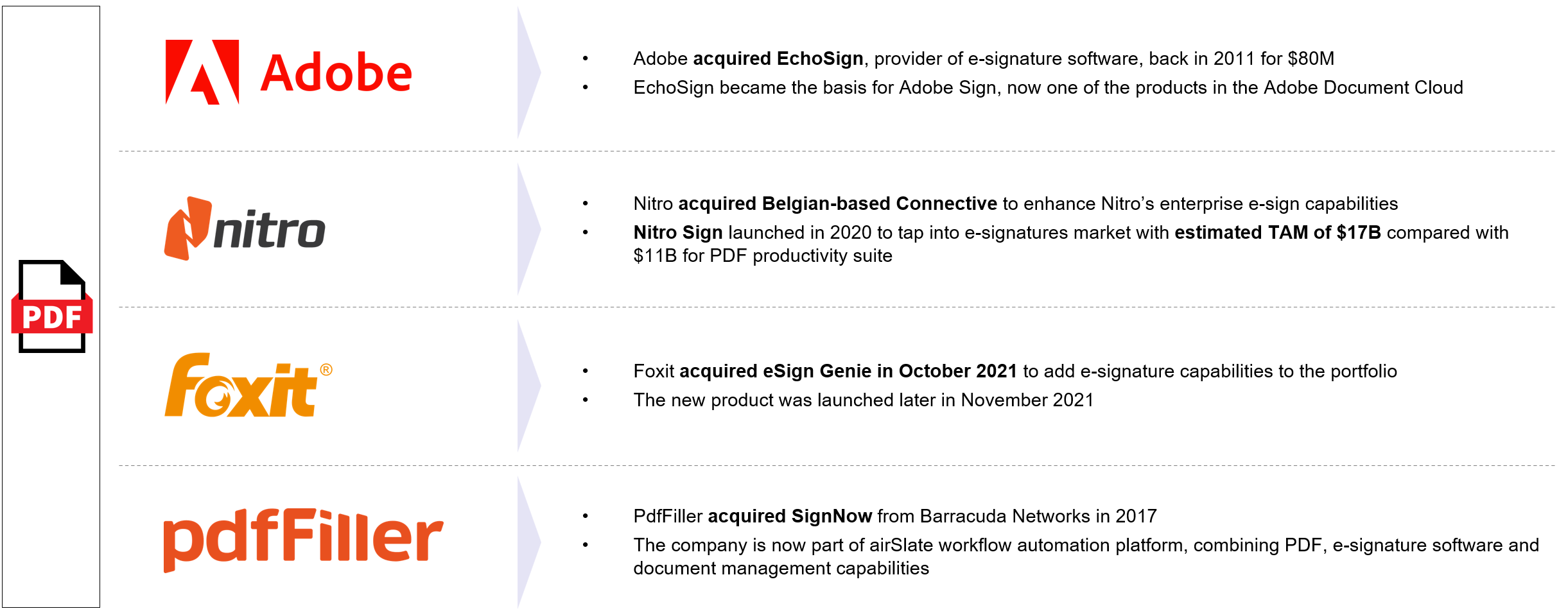

Entering the e-signature market

At the same time, vendors of desktop PDF software were also diversifying into the adjacent business lines: most commonly Forms and E-signatures. Adobe, Nitro Software, Foxit, and airSlate each have completed an acquisition of an e-signature company.

Nitro Software, an Australian developer of PDF software, now increasingly focuses on the e-signature offering. The company estimates that the Total Addressable Market for the e-signature software is worth $17B, compared to the $11B for PDF. Initially having an in-house developed solution, in November 2021 the company raised $140M to acquire Connective, a European provider of e-signature solutions.

Companies, such as PDFFiller are betting not only on signatures but also on forms functionality, capitalizing on the fact that PDFs are still one of the primary ways of filling in applications.

In November 2022, PDFTron also entered the field with an acquisition of Eversign, a cloud-based platform for e-signatures.

The question now is whether the PDF format will be in the end disrupted as it disrupted paper documents. After 30 years of being challenged, it seems that the format is still thriving and is now is a core element of the growing web applications industry. With the software vendors backed by the leading PE funds, it seems the PDF software companies are only growing stronger.

Why you should work with a Technology M&A advisor

Working with an M&A advisor specializing in technology and niche sectors like PDF technology is essential for navigating the evolving landscape and capitalizing on emerging opportunities. As the sector shifts from desktop to cloud-based, subscription-driven models, expert guidance is crucial for identifying growth opportunities, managing acquisitions, and connecting with investors. A technology M&A advisor with deep market knowledge can help companies capitalize on trends in B2B, developer platforms, e-signatures, and document processing. With ongoing consolidation and significant investment, partnering with a technology M&A advisor helps you sell your business or find strategic targets, ensuring you stay competitive and maximize your potential in this dynamic market.

About Aventis Advisors

Aventis Advisors is an M&A advisor focusing on technology and growth companies. We believe the world would be better off with fewer (but better quality) M&A deals done at the right moment for the company and its owners. Our goal is to provide honest, insight-driven advice, clearly laying out all the options for our clients – including the one to keep the status quo.

Get in touch with us to discuss how much your business could be worth and how to maximize the valuation.