Valuing a technology company differs significantly from traditional valuation methods due to the industry’s unique nature.

Technology companies typically exhibit key features that make them different from other businesses, including:

- Rapid growth rates

- Initial negative earnings

- A significant share of intangible assets that aren’t reflected on financial statements, such as patents and customer data, amongst others.

As a result, it’s important to adapt standard valuation methods to accommodate the unique distinctions of tech companies.

How to Value a Tech Company

Valuation methods have traditionally been divided into income-based, market-based, and asset-based approaches.

- Income-based approach: Performing a discounted cash flow analysis based on financial projections.

- Market-based approach: Benchmarking to comparable public companies and precedent transactions

- Asset-based approach. Estimating the fair value of a company’s assets and liabilities

Given that most technology companies have very few tangible assets reflected on their balance sheets, income-based and market-based approaches are considered to be more suitable for valuations.

In this article, we briefly summarize these two standard methods and their unique differences when applied to tech companies.

Discounted Cash Flow in tech company valuations

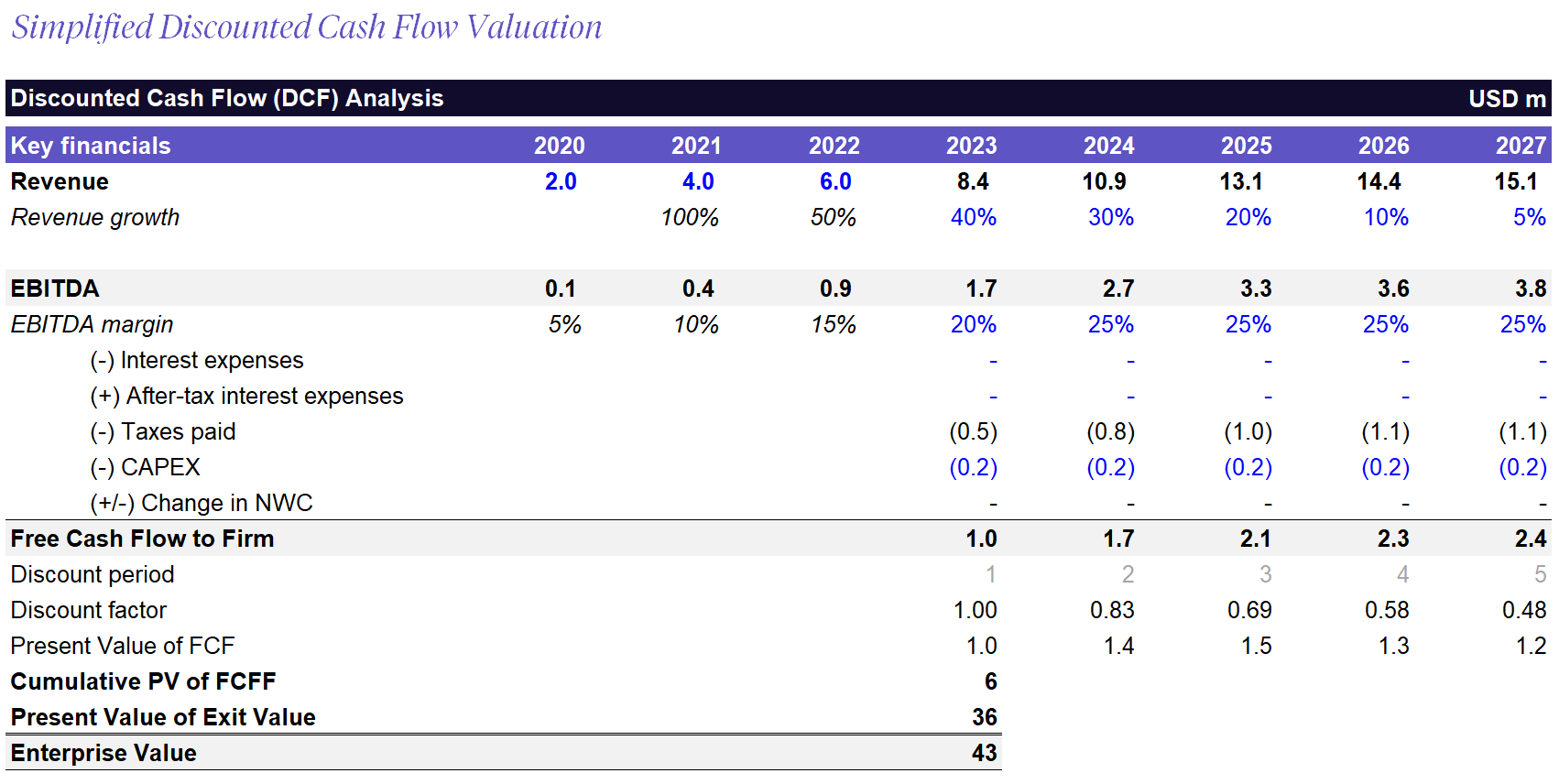

A discounted cash flow valuation (DCF) is a business valuation method that estimates a company’s value based on its expected future cash flows. Below is an overview of how DCF works in tech company valuations.

A company’s expected future cash flows are modeled based on the company’s financial projections, including assumptions for revenue growth, operating expenses, capital expenditures (CAPEX), and working capital. Detailed financial projections typically cover a period of 3 to 5 years, after which a stable cash flow growth rate is assumed.

The discount rate used in DCF valuation is typically the cost of capital for the asset, reflecting the riskiness of cash flows. It can also be the required return rate for the investor performing the valuation. For tech companies, it’s usually higher compared to traditional businesses. Early-stage businesses may see exceptionally high discount rates.

Projected cash flows are then discounted back to their present value using the chosen discount rate. A sensitivity analysis is also commonly used to assess how changes in critical assumptions can affect the valuation. This helps determine how robust a valuation is.

As DCF valuation is deeply rooted in financial theory, with numerous assumptions and detailed calculations, it’s often considered to be the most precise. That said, it can be a cumbersome approach to tech company valuation due to the number of inputs and difficult interpretation.

On top of that, many tech startups operate in highly uncertain environments, making it difficult to predict revenue and earnings far into the future. At the same time, slight changes to the terminal growth rate and discount rate can significantly affect the final valuation, making this method less reliable.

A DCF approach can be helpful for mature technology companies with stable growth and predictable profitability. However, even in such cases, investors prefer more straightforward valuation methods like using revenue or EBITDA multiples.

Despite its complexity, DCF can be a useful tool for understanding which metrics drive a tech company’s valuation. By adjusting assumptions related to factors like revenue growth and profitability, it’s possible to get a good idea of which metrics have the biggest impact on a company’s value.

Revenue or Earnings multiples

The most common method for valuing technology companies is to use a multiple of revenue or earnings.

Revenue multiples

Revenue multiples are often used when earnings multiples can’t be calculated due to no earnings. This is common in the tech industry, especially with companies that invest aggressively in customer acquisition and growth, such as SaaS businesses. While not directly related to cash flows, revenue multiples can still be a useful benchmark when earnings multiples can’t be applied.

Earnings multiples

Earnings multiples are typically used for mature tech companies with a history of positive earnings. This method is essentially a simplification of the DCF valuation method, where a higher multiple corresponds to lower risk and higher growth outlook.

EV/EBITDA multiples

EV/EBITDA is one of the most commonly used valuation multiples for technology companies.

EV is an abbreviation of Enterprise Value, a comprehensive measure of a company’s valuation that considers both equity value and financial debts net of cash. It allows for the valuation of a company’s operations irrespective of how it is financed (by debt or equity).

EBITDA stands for earnings before interest, taxes, depreciation, and amortization and is considered a good proxy for a company’s cash flow. When calculating multiples, it’s advised to normalize EBITDA to remove one-off items and owner’s costs, revealing the company’s true earnings potential.

As EBITDA is a proxy for cash attributable to both equity holders and debt holders ( interest is added back), the numerator of the EBITDA multiple is Enterprise Value. The second input in earnings valuation is the multiple itself.

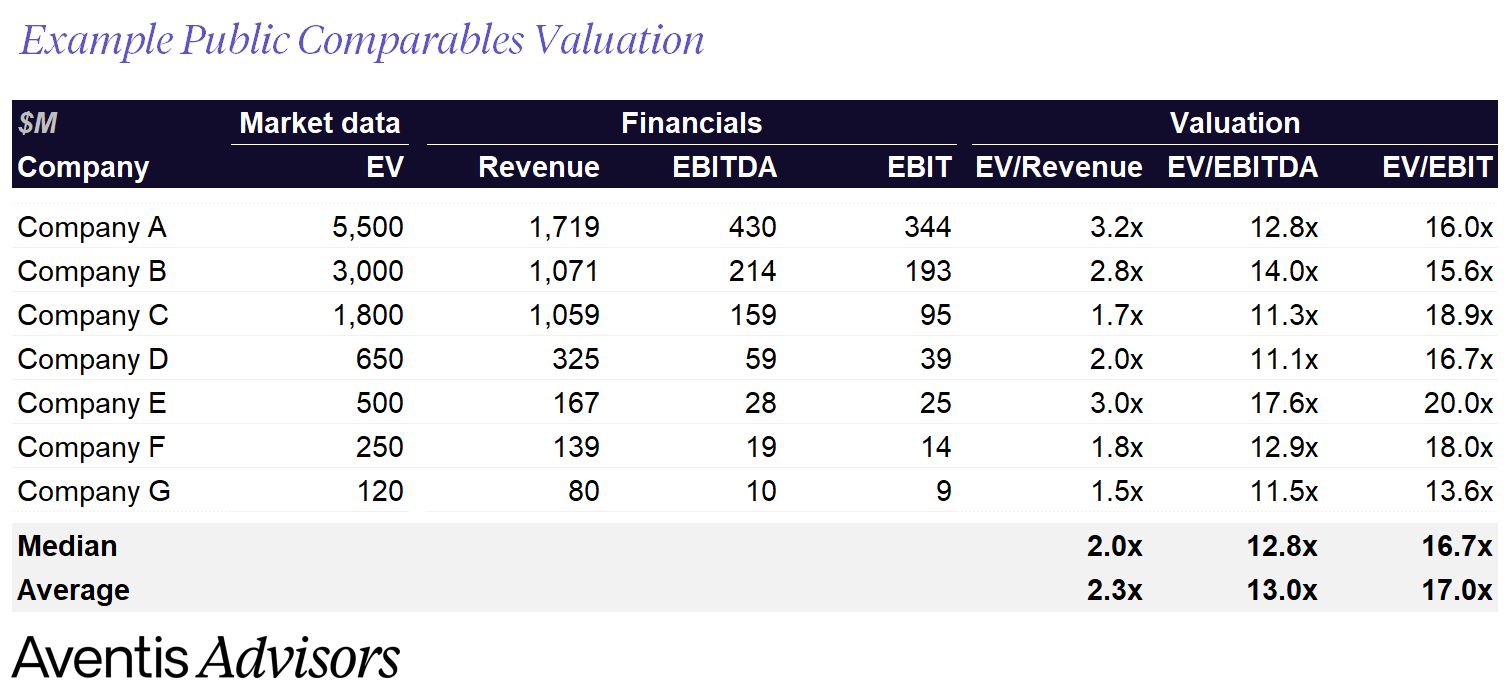

Publicly traded companies and precedent transactions are the two most common sources of comparable multiples.

Public comparables

Publicly listed companies are traded on stock exchanges daily and required to report financial results quarterly. This makes it easy to calculate the multiples implied by investors by using a company’s current stock price and most recently reported Revenue or EBITDA.

When benchmarking a company against public comparables, it’s essential to select a proper peer group. These are companies which operate in the same industry and have similar growth rates and risk profiles. Peer groups are never perfect, so it’s common practice to include more companies in the comparison and provide a range of multiples.

An important note is that publicly traded companies typically enjoy higher valuations than their private peers. There are two reasons for this. Firstly, public companies have lower risk due to having audited financials and corporate governance. Secondly, their shares are liquid, which provides significant value to the holder.

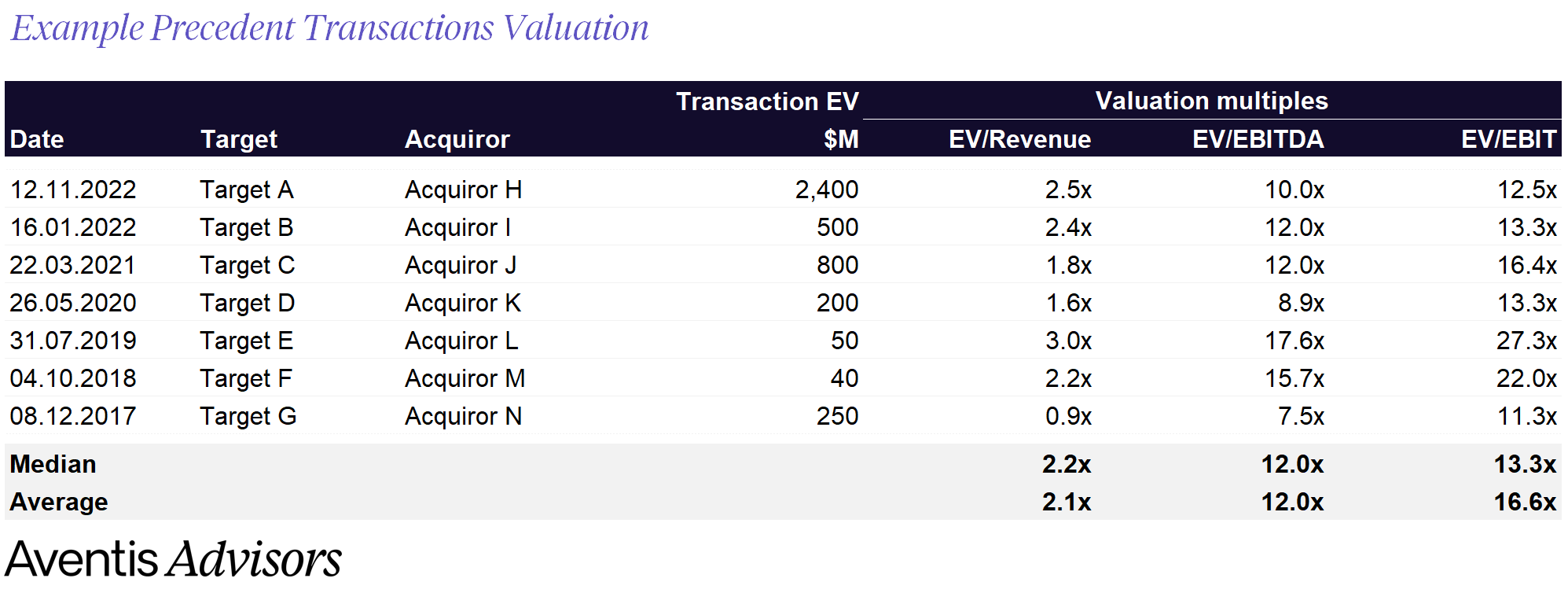

Precedent transactions

Precedent transactions involve determining a company’s value by comparing it to similar transactions that have taken place in the same industry. These transactions serve as benchmarks for valuing the target company.

While publicly listed companies are often used in valuation multiples for benchmarking, they tend to be multi-billion dollar companies with liquid shares. On the other hand, private M&A transactions happen among companies of all sizes. As a result, more accurate results can be achieved when evaluating private companies or those of different sizes.

The challenge with this is to collect enough data for comparable transactions. In many private transactions, deal values are rarely disclosed, and the transactions themselves can be difficult to find. To build a relevant peer group, you therefore need access to large datasets of past M&A deals.

One way to calculate the multiples used in precedent transactions is by searching for press releases announcing acquisitions. M&A advisors typically have access to specialized databases and can create a precedent transaction analysis for you.

Analysis of precedent transactions in Software industry

What is not reflected in traditional business valuation methods?

Traditional business valuation methods provide a foundation for estimating a company’s value based on financial metrics, but they may not fully capture certain factors that can significantly impact a company’s worth.

Below are two key factors that aren’t often reflected in traditional business valuations.

Synergies with the buyer

One factor not typically accounted for in traditional valuation methods is the potential synergies a buyer can achieve through an acquisition. Both strategic and financial investors expect to generate value for themselves by completing a transaction.

For strategic investors, synergies can come from various sources, including improving their technology offerings, saving on development costs, acquiring a strong team, or eliminating a competitor. These synergies allow strategic investors to pay a strategic premium on top of the company’s cash flow value..

Financial investors, on the other hand, usually focus on improving a company’s operations post-acquisition, including accelerating revenue growth, improving the bottom line, and financing strategic M&A.

Knowing this, it becomes essential to understand how a buyer can benefit from a deal and use this in negotiations. This is where an experienced advisor with industry experience and buyer relationships can add significant value. Pinpointing and leveraging potential synergies is essential in negotiations and can lead to a higher transaction price for the seller.

Competition for the deal

The competitive dynamics of a deal process are one of the most critical factors in determining a company’s valuation and the final transaction price..

When multiple buyers are competing to acquire a company, it creates a competitive environment that can drive up the price. Conversely, a solitary buyer knows he holds all the cards and can negotiate the price more aggressively. With no other investors to fall back on, buyers may try to slow down the process to gain more information and assess how the company performs vs. budget over time.

Creating a competitive environment when selling a company is therefore essential to achieve the best possible valuation. This can be done by arranging a structured sale process, marketing the company to a wide pool of potential investors, setting strict offer submission deadlines, and keeping the disclosure of information to a minimum.

Early stage tech companies

It can be difficult to value companies without revenues, earnings, or a business model using any of the methods described above. Investors in such early-stage companies take equity positions based on the potential size of the market, the quality of the team, and the maturity of the technology the company has developed.

Why you need a technology M&A advisor

Understanding your technology company’s valuation is essential for navigating the competitive landscape and strategically planning your exit strategy. Each technology company is distinct, reflecting the unique vision of its founders. Consequently, engaging with seasoned technology M&A advisors who specialize in the sector and can understand your situation is key.

Technology M&A advisors excel at navigating market dynamics, valuations, and coordinating all crucial workstreams. While you concentrate on managing your business, technology M&A advisors work tirelessly to ensure that no detail is overlooked and advocate for the best possible deal. Their success is closely linked to yours, and their influence on the final sale price can be considerable.

About Aventis Advisors

Aventis Advisors is an M&A advisor focusing on technology and growth companies. We believe the world would be better off with fewer (but better quality) M&A deals done at the right moment for a company and its owners. Our goal is to provide honest, insight-driven advice by clearly laying out all the options for our clients – including the one to keep the status quo.

Get in touch with us to discuss how much your business could be worth and how the process looks.

Sign up for our newsletter below to stay current on valuation trends.