When you think about M&A, the common perception is about a smaller company being acquired by a bigger company or two competitors merging their businesses to maximize value for shareholders. But you must remember M&A is not just about that. M&A deals require creativity in deal structures, negotiation skills, and, quite often, earnouts!

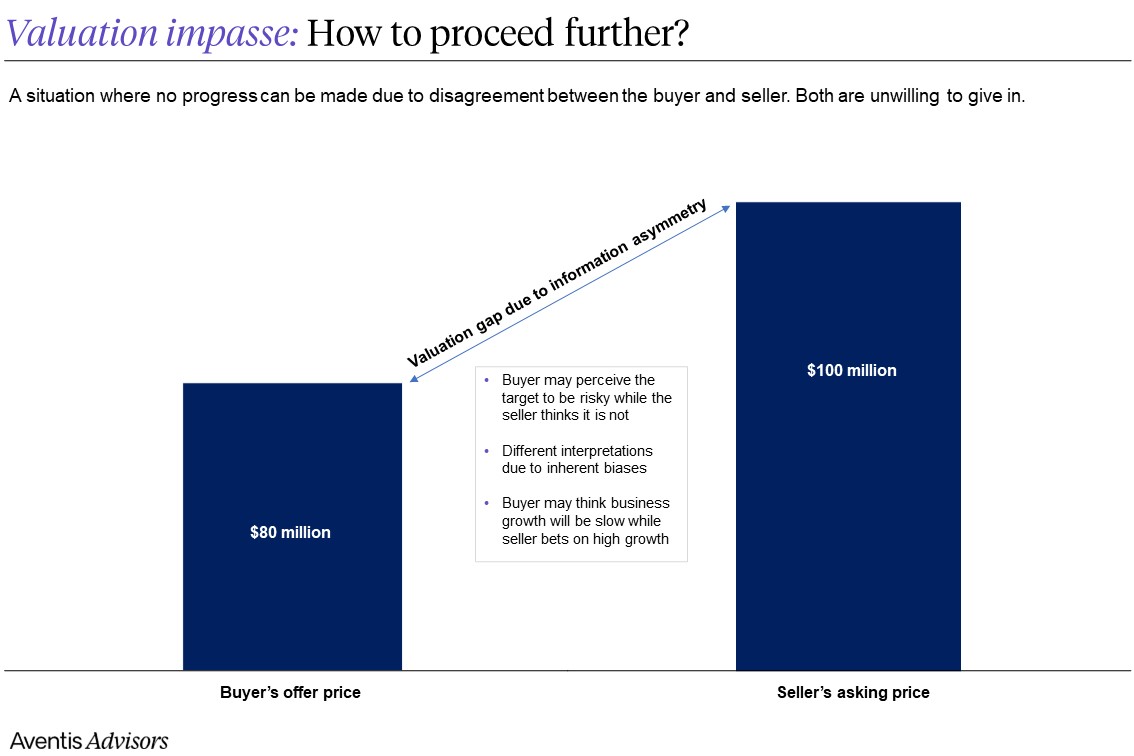

Picture this: You are a seller seeking an exit from your company. While you estimate your company’s value to be $100 million, the most that any potential buyer is willing to pay you is $80 million. This is a common challenge faced by businesses exploring a sale. The question now arises: How can you persuade a buyer to offer you a higher price for your business?

This is when earnouts come into play! An earn-out arrangement is a secret sauce that brings buyers and sellers together in such a situation to create a win-win M&A deal.

In this comprehensive guide, we’re going to cover everything you need to know about earnouts in M&A transactions – the basic concept of earnout payments, why they are used, key elements of earnout agreements, their advantages and disadvantages, and overcoming disputes that arise due to earnouts.

Let’s dive in.

Table of Contents

- What is an earnout in M&A?

- Why are earnouts used?

- How does an earnout work?

- Advantages of earnouts

- Disadvantages of earnouts

- Key elements of an earnout agreement

- How to craft a win-win earnout strategy?

- Tips while using earnouts in an M&A Deal

Summary

- Earnout is a creative mechanism used in M&A transactions where the buyer pays additional money to the seller if certain predetermined growth targets are met, ensuring alignment and risk mitigation for the parties involved.

- Having earnout payments in a deal provides extra incentives for sellers to maximize business value and meet post-acquisition targets.

- While earnouts are great and have several advantages, they are also one of the leading common causes of disputes in M&A deals due to sellers and buyers having different interpretations of meeting the target metrics.

What is an Earnout in M&A?

An earnout is an agreement between the buyer and seller where the buyer agrees to pay additional compensation to the seller if certain predetermined targets are met. These targets are related to the future growth of the business.

You may wonder what is the need to use earnouts in a deal. Here is why!

Why are Earnouts Used?

It is commonly seen that an information asymmetry exists between the buyer and seller. If you’re the seller, you will have more information about the business than the buyer. Due to this reason, you can be certain that your company is going to do well in the future and should be valued at, let’s say, $100 million.

However, the buyer would likely be skeptical about your growth forecasts and does not believe the company will do as well as you imagine. Thus, the buyer thinks your company is worth only $80 million.

In situations like this, the typical and most effective solution is to use earnout payments. It is a smart way for both sides to agree, making sure the buyer doesn’t pay overpay while pushing the seller to keep working hard to meet the business growth targets even after selling the company.

How Does an Earnout Work?

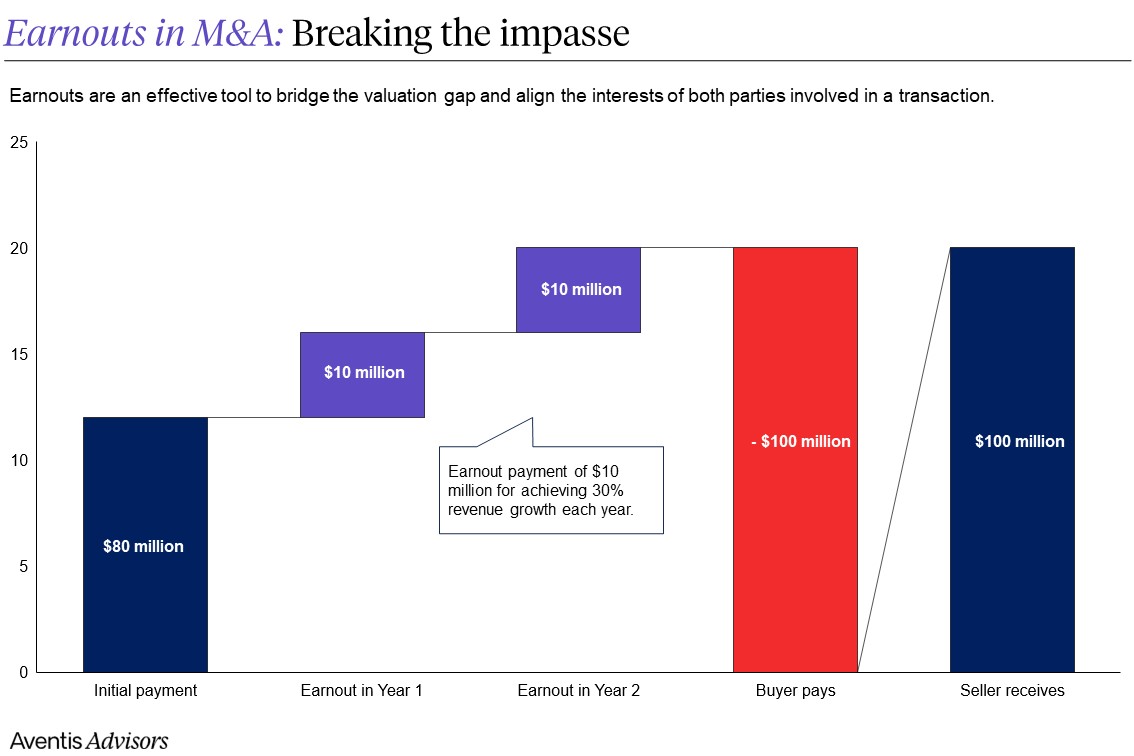

Going back to our initial example, you now know that the valuation deadlock can be broken by adding an earnout clause in the deal structure. As a seller, you will now have an incentive to meet the predetermined targets and ‘unlock’ additional payments that the buyer promised.

Let us say the target that needs to be achieved is 30% revenue growth year-over-year for the next two years. Considering you managed to meet the expected growth targets, here is what the deal structure could look like.

You will be paid an upfront payment of $80 million at closing, and the remaining $20 million will be paid as earnouts over the next two years if the company achieves predetermined financial targets tied to EBITDA, revenue, or some other metric.

Note that the earnout structuring is more of an art than a science. It is heavily negotiated between the parties, and there is no standard one-size-fits-all approach to earnouts.

Software Valuation: How to Value a Software Company

Advantages of Earnouts

Earnouts offer a range of benefits to both the buyer and the seller of an acquired company while bridging any gap between fair market value and asking price.

- Risk mitigation: By introducing earnouts in a deal, buyers enjoy reduced upfront payments and can mitigate risk around the promised future performance of the target company

- Incentivizes the sellers: The possibility of unlocking more money via an earn-out mechanism provides extra incentives to the sellers to maximize value for the business and hit the predetermined targets after the acquisition is completed. Essentially, for them, it becomes ‘the gift that keeps giving.’’

- Breaking the stalemate: The most important use of earnout payments is to bridge the valuation gap in a situation where the parties do not seem to agree on the value and price of the business

- Alignment of interests: Earnouts align the interests of the buyer and seller. Both parties have an incentive to work together to ensure a smooth transition along with the success and growth of the acquired business during the earnout period. The seller needs the additional payments, while the buyer wants to ensure the business grows and meets its targets

Disadvantages of Earnouts

Earnouts are commonly the cause of disputes due to multiple reasons ranging from misinterpretation of the target metrics to lack of agreement on how to measure the performance post-closing

- Reduced control: The seller may have limited control over the business’s operations during the earnout period. This can be challenging for founders who are used to having more autonomy and can be a cause of frustration as they are not able to run the business in the way they want to achieve the target growth

- High dispute potential: It is common to see disputes about whether the earn-out targets have been met if there are ambiguities in the earn-out agreement

- Negative external factors: Economic downturns, changes in market conditions, or industry disruptions may impact the performance of the business, affecting the ability to achieve earnout targets

- Increased complexity of the deal: While the concept of earnout payments seems very merry in theory, the actual earnout structure, in practice, adds to the complexity of the deal, which requires more negotiation and added involvement from advisors from the M&A and legal side to craft a win-win strategy.

Key Elements of an Earnout Agreement

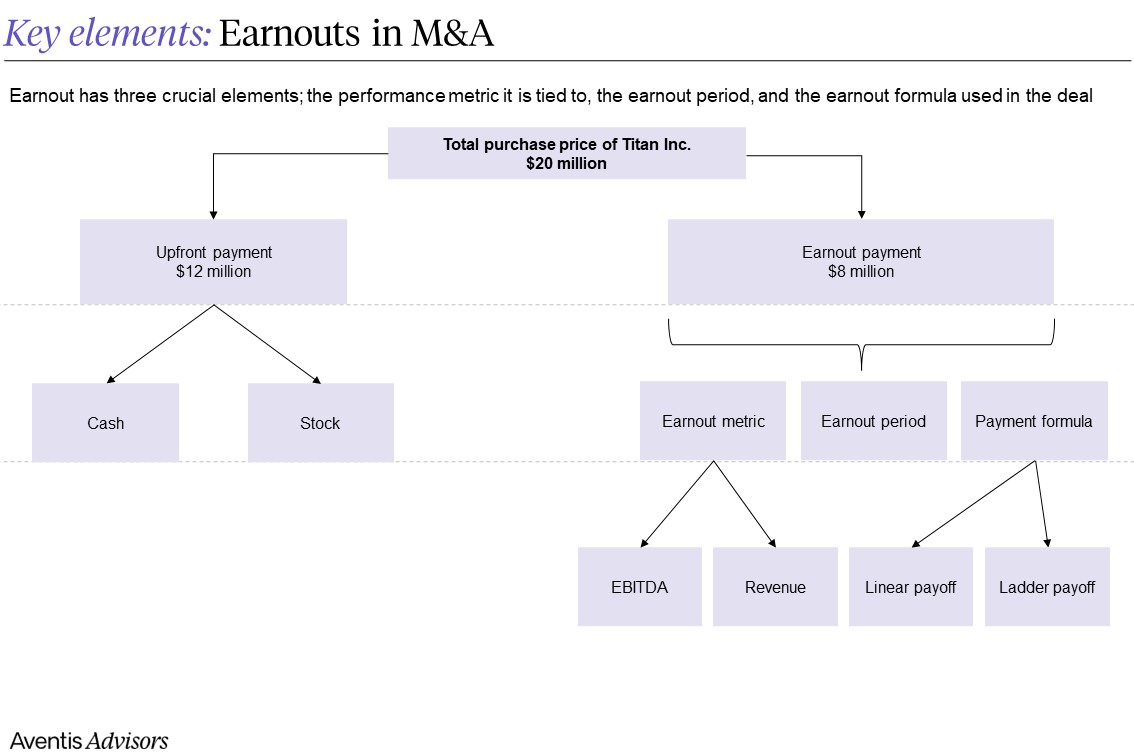

When devising an earnout strategy, there are several key aspects you must understand clearly. These are:

The total purchase price: This is the upfront payment plus all realized earnouts from the deal

Earnout portion: This can vary based on different factors, such as the negotiating power of the seller, the buyer’s satisfaction from due diligence, and more. Usually, the earnout portion is 10% to 30% of the total purchase price.

It is high when a deal is risky for the buyer, or if the seller has aggressive growth forecasts and the buyer is hesitant about it; the buyer may lock a higher portion of the total purchase price as earnout so that the seller remains incentivized to meet the targets.

However, earnout payment is a small portion of the total purchase price when a seller has more negotiation power. If you have competing offers from multiple parties to buy your business. You can leverage this to get more money upfront from the buyer instead of having to ‘earn it out’ over the next few months.

Additionally, earnouts are also small as a percentage of the total purchase price when growth forecasts of the target are reasonable, and the buyer has little to no worries about hitting these targets.

Performance metrics: These metrics govern the contingent payment to the seller if the targets are met. The most common performance metrics used in structuring earnouts are EBITDA revenue or a combination of the two. Using gross profit as an earnout measurement metric is also prevalent in M&A deals.

It is also possible to include non-financial metrics that impact earnout payments. Some examples are metrics such as the retention of key employees and customers. However, this is not as common as financial performance metrics.

Linear vs. Ladder or Tiered earnout: The linear formula involves applying a straightforward multiple to EBITDA or fixing a price based on target achievement, ensuring easy calculation and minimizing disputes.

On the other hand, a tiered approach introduces earn-out performance bands. For instance, if the target company exceeds an EBITDA of $5 million, a 10% earnout is triggered, and the earnout level rises to 15% above $7 million EBITDA and 20% above $10 million EBITDA.

Earnout time period: A reasonable timeline to complete all the earnout payments is one to three years after the deal closes. In some cases, this period can extend up to five years.

If the buyer has a well-defined and rapid integration plan that is expected to generate immediate synergies, a shorter earnout period may be appropriate. This is also the case when growth targets are short-term rather than long-term, such as doubling the revenue next year.

However, if the success of the acquisition is contingent on the implementation of long-term strategic initiatives, such as entering new markets, developing new products, or restructuring the business, a longer earnout period may be necessary to capture the full impact.

How to Evaluate an M&A Term Sheet

Crafting a Win-Win Earnout Strategy

Now that the basics are out of the way, we can move on to constructing an earnout arrangement beneficial for both sides, much like piecing together a jigsaw puzzle with its components symbolizing the vital interests of each party involved.

When it comes to earn-outs, negotiating between the desires of buyers and sellers can be tricky. Buyers want to manage business operations as they see fit. This must be carefully balanced against a seller’s wish to continue operating in a way so that they hit all set targets.

To make sure everyone has an agreeable arrangement without any friction arising later on down the line, each side needs consideration when it is time to draw up plans upfront, with risk being minimized from the buyer’s perspective, too.

A structured earnout should give both sides assurance while reducing the potential for disputes in the future. Goodwill and trust play a big role as well, simplifying dispute resolution if any arise.

It is important to document the detailed interpretation of metrics, discuss the potential areas of disputes upfront, and establish a framework that accommodates the interests of both buyer and seller. By doing so, the earnout arrangement can become a harmonious collaboration rather than a potential source of conflict.

Tips for Using Earnouts in M&A

As we come to a close discussing earnouts, let’s quickly review some helpful advice that can make the arrangement beneficial for both buyers and sellers. Keeping these tips in mind is sure to help ensure an advantageous outcome with any related transaction.

For Buyers

- After you complete your due diligence, clearly define the key performance indicators and metrics (KPIs) that will determine earnout payments and add them to the legally binding share-purchase agreement (SPA)

- Recommend the inclusion of a clause specifying the maximum amount of earnout (the cap/ceiling) payments the seller can extract during the earnout period

- Involve the seller in the goal-setting process to create a collaborative approach

- Conclude by highlighting the ultimate goal of creating a scenario where all sides benefit from an effective deal structure, fostering long-term rewards for both buyers and sellers alike

For Sellers

- Define how unforeseen events that are outside your control as the seller, such as economic downturns or industry changes, will be considered in earnout calculations

- Include provisions in the agreement to protect against external factors beyond the seller’s control that may impact performance.

- Negotiate a guaranteed minimum earnout amount in the agreement. This provides a baseline level of compensation regardless of the business’s actual performance

- Advocate for clear lines of dialogue and establish a robust framework of dispute-resolution process from the beginning

How to Sell a SaaS Business: Strategic Steps for Success

Why you need a software M&A advisor

Each software business is unique, much like every founder’s journey. Therefore, it’s essential to consult with experts in the software M&A landscape, particularly advisors who specialize in the sector and can understand your unique circumstances.

Software M&A advisors understand how to navigate market dynamics, valuations, and coordinate all the necessary workstreams. While you concentrate on running your business, software M&A advisors work diligently to ensure that no detail is overlooked and advocate for the best possible deal. Their success is directly linked to yours through a success fee structure, and their influence on the final sale price can therefore be substantial.

About Aventis Advisors

Aventis Advisors is an M&A advisor for technology and growth companies. We believe the world would be better off with fewer (but better quality) M&A deals done at the right moment for the company and its owners. Our goal is to provide honest, insight-driven advice, clearly laying out all the options for our clients – including the one to keep the status quo.

Get in touch with us to discuss how much your business could be worth and how the process looks.

Contact Us

Tell us about what you want to achieve; we can support you from start to close on your M&A journey.

Read also: