The artificial intelligence boom has created a landscape flooded with ambitious startups, bold claims, and soaring valuations. Everyone seems to have an AI-powered tool, a generative AI pitch, or a revolutionary approach to automating processes. But not all that glitters in the AI ecosystem is gold. In the context of AI in M&A, the real challenge for buyers is cutting through the hype and identifying companies that offer real, sustainable value.

This is especially difficult in a space evolving as quickly as artificial intelligence. New models are released weekly. Market trends shift fast. Investor interest can evaporate overnight. And valuation multiples are often driven by momentum, not grounded in fundamentals like recurring revenue, historical data, or the defensibility of AI algorithms. Acquiring AI companies based on surface-level traction—or simply to check a box—can lead to costly missteps that strain both operational capacity and balance sheets.

What matters most is whether the AI applications under review align with the acquirer’s business goals. Do they enhance decision making through real-time data analysis? Can they integrate without disrupting existing architecture? Do they help leverage AI to improve customer experiences or just add complexity? These are the crucial questions strategic buyers must answer early in the M&A process.

It’s also important to recognize the skills gaps that can emerge when new technology is bolted onto legacy systems. Buyers must assess whether they have the human intelligence in place to manage, govern, and evolve newly acquired capabilities—especially when navigating ethical considerations or handling sensitive data.

Ultimately, companies that approach M&A with a clear AI strategy—not just urgency—will be best positioned to stay ahead. The winners in this race will be those who move deliberately, evaluate AI beyond its headline promises, and integrate new technology in a way that aligns with long-term value creation.

Table of Contents

- AI M&A Evolution Over the Last Decade

- AI Strategy in Action: How to Spot Defensible AI Assets

- Avoiding the AI M&A Hype Trap: Smart Moves vs. Overpaying

- Implementing AI Systems Post-Acquisition: What Happens After the Deal Closes

- AI M&A and Business Goals: Turning FOMO into Strategic Advantage

AI M&A Evolution Over the Last Decade

From niche to necessity

Over the last decade, AI M&A has evolved from an exploratory niche to a strategic pillar of growth. In the early 2010s, acquisitions in the AI space were mostly opportunistic—targeting small research teams, early machine learning tools, or vertical-specific experiments. At that time, AI was considered experimental, not essential.

Accelerating adoption through AI technologies

But as AI systems matured and proved their ability to improve predictive analytics, automate decision making, and enhance efficiency, companies began to recalibrate. By the late 2010s, deal activity surged, with buyers focused on acquiring AI technologies that could drive operational improvements and align with core business objectives.

ChatGPT and the new M&A urgency

The inflection point came in late 2022 with the public release of OpenAI’s ChatGPT. In just weeks, it reframed public understanding of what generative AI could do—at scale, in real time, and with almost no technical barrier to entry. This led to a massive spike in investor interest, corporate adoption, and strategic urgency.

The capital shift and valuation pressure

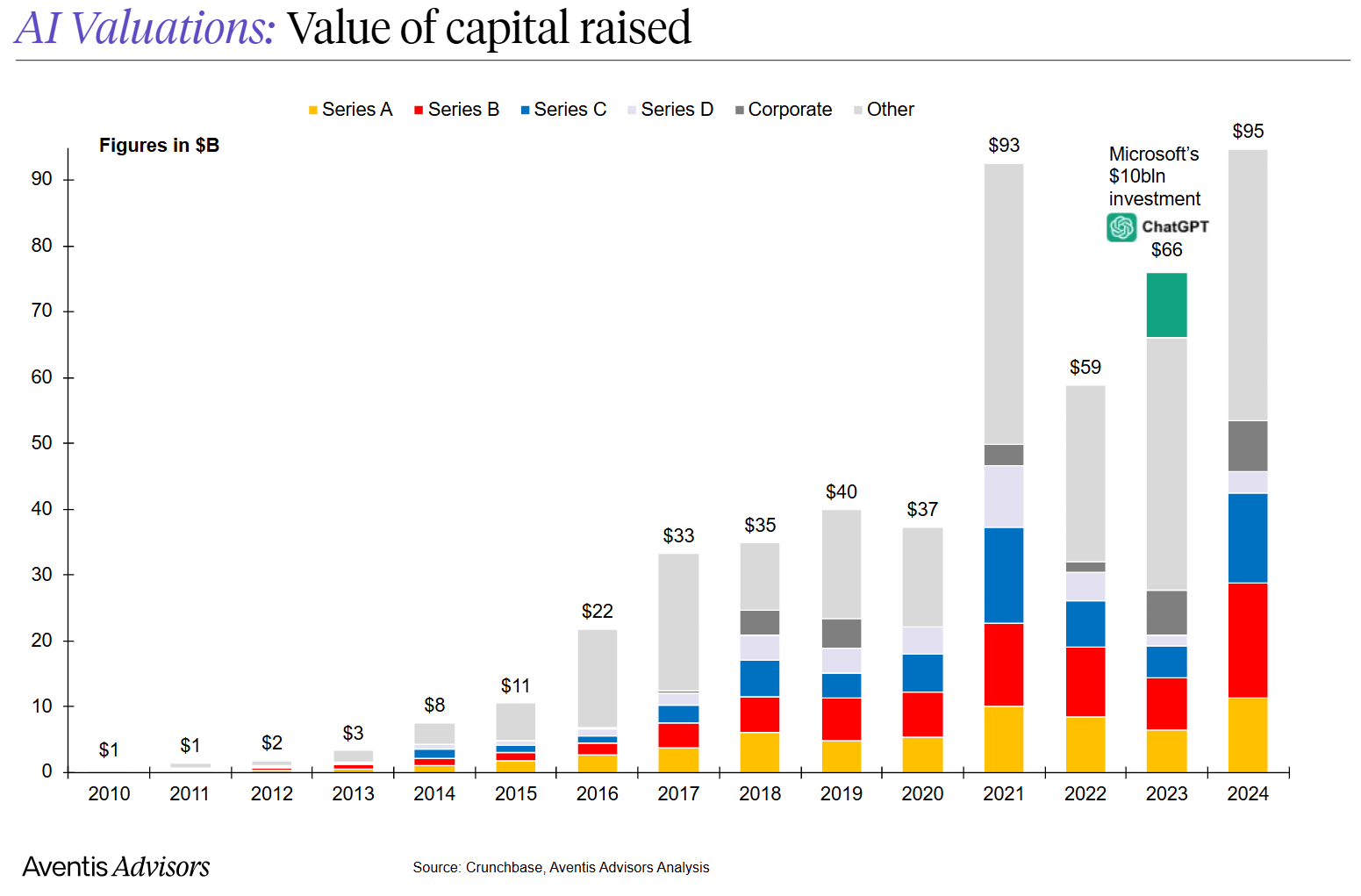

The wave of capital that followed has redefined the AI landscape. As shown in the chart below, the value of capital raised in AI skyrocketed from $37B in 2020 to $93B in 2021, then $95B in 2024—driven in part by large-scale deals like Microsoft’s $10B investment into OpenAI.

For a deeper look at valuation dynamics in this space—including market multiples and recent deal trends—see our article: How AI Company Valuations Are Changing

Case Study: Canva’s Acquisition of Leonardo.AI

A prime example of this evolution is Canva’s 2024 acquisition of Leonardo.AI, a generative AI startup that had already attracted over 19 million users and helped generate more than one billion images. This wasn’t a bet on potential—it was a bet on productized, scaled AI with real user traction. By integrating Leonardo.AI’s generative capabilities into its design ecosystem, Canva expanded both its technological edge and user value proposition. The acquisition underscores how, in the post-ChatGPT landscape, leading companies are prioritizing fully-formed AI solutions that can be embedded directly into core products.

AI Strategy in Action: How to Spot Defensible AI Assets

Proprietary Data and Tailored AI Systems

Defensible AI companies are built on access to proprietary, high-quality data. Through exclusive partnerships, unique behavioral insights, or deep historical datasets, their models gain accuracy and relevance over time—creating a competitive moat. Beyond data, these companies often build custom AI systems instead of relying on off-the-shelf solutions. That control lets them align AI development with business objectives, optimize performance, and react quickly to market shifts.

Operational Integration and Domain Expertise

What sets the best apart isn’t just what they’ve built, but how it’s embedded. These companies don’t offer standalone tools—they deliver AI solutions woven into core workflows, streamlining operations and enhancing decision making. Their products are sticky and hard to displace. And their teams? They bring not just technical firepower, but deep domain knowledge—understanding the pain points of the industries they serve, and designing AI to solve them precisely.

Spotting these traits early helps buyers avoid overhyped deals and identify companies positioned for sustainable growth.

Avoiding the AI M&A Hype Trap: Smart Moves vs. Overpaying

Distinguishing Momentum from Sustainable Value

In an overheated market, the risk of overpaying for unproven AI companies is real—and rising. As the fear of missing out intensifies, so does the temptation to outbid competitors just to gain a foothold. But reactive acquisitions made under pressure often come with inflated post-money valuations and uncertain long-term returns.

The key to avoiding the hype trap is to understand the difference between momentum and value. A startup might be experiencing rapid growth, but is that growth based on repeatable, scalable success? Or is it a function of a recent funding round, media buzz, or a few marquee customers testing an AI solution that hasn’t yet proven ROI?

Smart buyers ask tough questions early. How much of the company’s AI output is truly automated versus powered by human intervention behind the scenes? Is the company using proprietary algorithms, or just plugging into public models from OpenAI or Hugging Face? Is the technical team capable of continuous improvement, or is the product nearing a ceiling?

Evaluating AI Systems for Integration Readiness

Another critical lens is integration readiness. Even the most exciting generative AI product can become a burden if it can’t fit into an acquirer’s existing systems. Companies must evaluate how easily the AI tools will slot into their operations—from data compatibility to regulatory compliance to customer-facing workflows.

Integration challenges are often underestimated during fast-moving deals. Misalignment between acquired AI systems and an organization’s data architecture or business goals can result in implementation delays, cost overruns, or low adoption.

Structuring Smart Deals Around AI Strategy

Negotiating structure also matters. Rather than chasing sky-high sticker prices, strategic buyers can pursue structured deals—such as milestone-based earnouts, minority stakes, or joint ventures—that create upside while reducing immediate financial risk. These alternatives help balance excitement with discipline.

Ultimately, the smartest moves come from aligning the acquisition target with a clear AI strategy. If a deal doesn’t support business goals, enhance efficiency, or offer deeper insights into operations or customers, then even the flashiest AI brand may not be worth the premium.

Implementing AI Systems Post-Acquisition: What Happens After the Deal Closes

Aligning AI Integration with Business Objectives

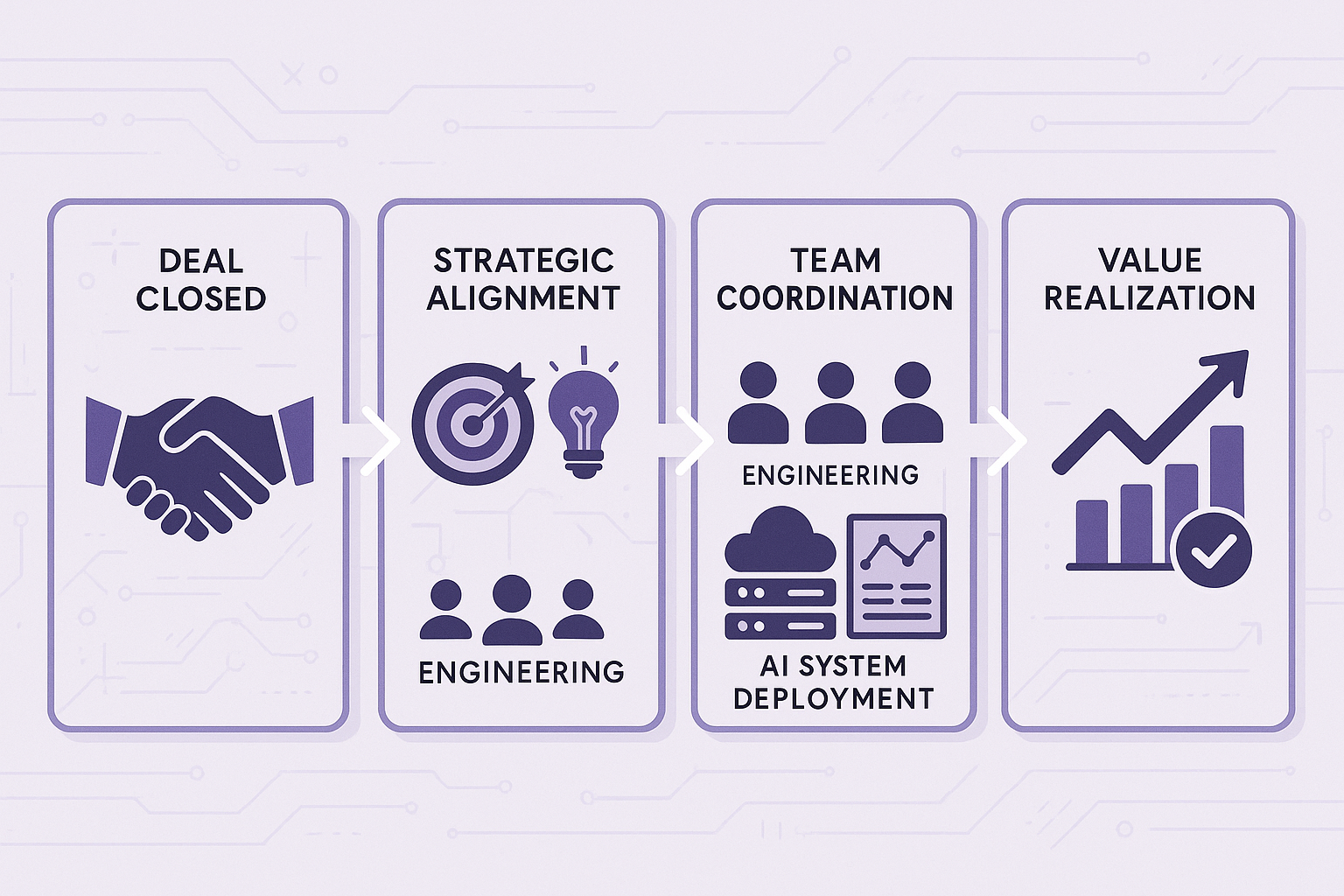

Acquiring an AI company is only the beginning. The real challenge—and long-term value—lies in integration. Many deals that look strong on paper stumble during execution because the acquirer lacks the infrastructure, cross-functional coordination, or organizational readiness to embed AI into day-to-day operations.

That’s why strategic alignment must begin before the ink dries. The acquirer should define clear business objectives for the AI system. Will it enhance predictive analytics? Automate repetitive tasks? Support decision making with deeper, real-time insights? Without this clarity, even advanced AI platforms risk becoming siloed initiatives with little impact.

Team Coordination and System Deployment

Team coordination is crucial. Product, engineering, and data leaders must align early. If the acquired team is left isolated, integration efforts stall and synergies evaporate. But with shared KPIs, strong change management, and ongoing communication, AI systems can be deployed efficiently—moving the organization closer to measurable impact.

Managing Data Quality and Cultural Fit

Data quality is another key success factor. AI tools only work if the underlying data is clean, accessible, and structured across systems. Many organizations underestimate the lift required to align pipelines and normalize legacy formats.

Finally, don’t overlook cultural integration. Most AI companies are built for speed; acquiring organizations often are not. Achieving value realization depends on flexible governance, executive sponsorship, and a willingness to evolve internal processes to support the AI team’s operating model.

AI M&A and Business Goals: Turning FOMO into Strategic Advantage

Replacing Urgency with Strategic Clarity

AI M&A has become one of the defining trends of this business cycle. But while the fear of missing out may drive many companies into the game, it’s the ones who move with focus—not fear—that will come out ahead. Successful AI acquisitions are not reactive. They are the result of well-defined strategies, targeted objectives, and a clear understanding of how AI can support long-term business goals.

As competition heats up, the market will continue to reward companies that can differentiate between hype and real innovation. That means identifying AI companies with domain-specific expertise, proprietary technologies, scalable systems, and alignment with operational needs. It means looking beyond funding rounds and headlines to evaluate whether an AI solution can actually improve decision making, drive efficiency, and integrate seamlessly with existing processes.

Enhancing Decision Making Through Strategic AI Acquisitions

One of the most underestimated advantages of acquiring an AI company is the impact on decision making. With advanced AI systems, businesses can process vast amounts of market data, customer behavior, and operational performance in real time—converting noise into insights.

By embedding AI into core functions like forecasting, risk analysis, and scenario modeling, companies elevate both the speed and quality of their strategic decisions. AI doesn’t just help automate; it helps anticipate. That’s a game-changer in fast-moving or volatile industries.

Strong AI capabilities also improve internal alignment. When leaders across finance, product, and operations share access to unified AI insights, they make better coordinated decisions—faster. This enables smarter capital allocation, more responsive go-to-market moves, and tighter operational control.

Ultimately, acquiring AI with the intent to improve decision making—not just product features—is a long-term strategic edge. It turns AI M&A into a mindset shift: from reactive analysis to proactive leadership.

What It Takes to Win in the AI Ecosystem

For acquirers, winning in the AI ecosystem requires more than capital. It requires internal readiness, cross-functional alignment, and a willingness to adapt quickly. It also calls for balancing bold ambition with disciplined execution—especially when valuations are high and the noise is deafening.

On the other side of the table, for AI founders, this climate represents a window of opportunity. Companies that can show real traction, clear ROI, and a path to scalability will find receptive buyers eager to enhance their AI capabilities through acquisition.

FOMO may have sparked the AI M&A wave—but only focus will carry companies through it successfully. The future belongs to those who not only adopt AI but operationalize it with intention, turning short-term urgency into long-term strategic advantage.

About Aventis Advisors

Aventis Advisors is an M&A advisor for SaaS companies. We believe the world would be better off with fewer (but better quality) M&A deals done at the right moment for the company and its owners. Our goal is to provide honest, insight-driven advice, clearly laying out all the options for our clients – including the one to keep the status quo.

Get in touch with us to discuss how much your business could be worth and how the process looks.