Over the past two decades mergers and acquisitions (M&A) started to play a pivotal role in driving growth, expanding market presence, and maximizing shareholder value. With a large population, robust economy and faster economic growth, Poland became an attractive investments destination.

Whether you are considering buying or selling a business, partnering with the right M&A advisor in Poland can be the key to a successful transaction. Engaging the right financial advisor in Poland will help you increase your chances of success, get your M&A project done faster and get better deal terms. In this post, we will explore the importance of hiring an M&A advisor and delve into the distinct advantages and disadvantages of different types of advisors, including boutique investment banks, Big-4 companies, and bulge-bracket investment banks.

Understanding the Role of an M&A Advisor

An M&A advisor serves as a trusted partner who provides professional guidance and expertise throughout the complex M&A process. They possess comprehensive knowledge of the local market, regulatory landscape, and industry trends, making them invaluable in navigating the intricacies of buying or selling a business in Poland. Here are some compelling reasons why you need an M&A advisor:

a. Expertise and Experience

M&A advisors bring specialized skills and experience to the table. They possess a deep understanding of valuation techniques, deal structuring, due diligence, and negotiation strategies. M&A advisors also know the local market well, including regulations, accounting rules, and legal requirements. Relying on their support helps mitigate risks and ensures a smoother transaction process.

b. Access to Networks:

M&A advisors have extensive networks of potential buyers, sellers, investors, and other industry professionals. These connections can open doors to strategic partnerships, facilitate introductions, and attract qualified investors, enhancing the chances of finding the right match for your business.

c. Deal Execution:

M&A transactions involve numerous complex tasks, such as identifying potential acquisition targets, screening and evaluation, financial analysis, and documentation. M&A advisors streamline these processes, ensuring efficiency, accuracy, and compliance with local regulations.

Choosing the Right Advisor for you in Poland

Once you decide to engage a local M&A advisor, it’s time to pick the firm you want to work with. There are tens of M&A advisory firms in Poland to choose from, which can be divided into three categories: Boutique M&A Advisors, Big-4 Accountancy Companies, and Bulge Bracket Investment Banks. Each of these groups has its unique advantages as well as disadvantages which we analyze below:

a. Boutique M&A Advisors

Boutique M&A firms specialize in M&A advisory services, catering to niche markets or specific industries. In Poland, there are around 20 boutique M&A firms that you can consider for your M&A deal. They typically offer personalized attention, tailored strategies, and an intimate understanding of sector-specific dynamics. Here are the pros and cons of working with a boutique investment bank in Poland:

Pros:

- Niche Expertise: Boutique firms often focus on specific industries, allowing them to possess in-depth knowledge and understanding of the unique challenges and opportunities within those sectors.

- Personalized Approach: Due to their smaller size, boutique M&A advisors in Poland provide more personalized attention and custom-tailored strategies to meet their clients’ specific needs.

- Flexibility and Agility: Boutique firms can often adapt quickly to changing market conditions and offer greater flexibility in deal structuring.

Cons:

- Limited Resources: Compared to larger institutions, boutique M&A firms may have fewer resources at their disposal, which can impact their capacity to handle large-scale and complex transactions.

- Potential Reach: While boutique firms may excel within their niche, they may have a more limited reach in terms of access to global markets and potential buyers or sellers.

b. Big-4 Companies

The Big-4 accounting firms (KPMG, Deloitte, EY, PwC) , known for their comprehensive professional services, also provide M&A advisory services. Here are the pros and cons of working with a Big-4 company:

Pros:

- Breadth of Services: Big-4 companies offer a wide range of services, including auditing, tax advisory, legal counsel, and M&A consulting. This breadth allows them to provide integrated solutions and address various aspects of the M&A process.

- Global Presence: Big-4 firms have a robust international network, providing access to a vast pool of potential buyers or sellers worldwide.

- Regulatory Knowledge: With their expertise in accounting and compliance, Big-4 firms thoroughly understand local and international regulations, ensuring compliance throughout the transaction.

Cons:

- A potential lack of focus on M&A advisory services: While they have extensive resources, their primary focus may be on other service lines, such as auditing or tax advisory, which could impact the level of dedicated attention given to your specific M&A needs.

C. Bulge Bracket Investment Banks

Bulge bracket investment banks are large financial institutions that offer a broad range of financial services, including M&A advisory. Here are the pros and cons of working with a bulge bracket investment bank:

Pros:

- Global Reach: Bulge bracket banks have a vast global network, enabling them to tap into international markets and attract a wide range of potential buyers or sellers. They have extensive resources and relationships with major institutional investors, private equity firms, and strategic buyers worldwide.

- Deal Execution Capability: These banks have a robust infrastructure and experienced deal teams that can handle large-scale and complex transactions. They possess a deep understanding of the M&A process and can efficiently execute deals.

- Brand Reputation: Bulge bracket banks often have established brands and a strong reputation in the financial industry. This can provide credibility and instill confidence among potential buyers or sellers.

Cons:

- Less Personalized Service: Due to their size and the volume of transactions they handle, bulge bracket banks may provide a less personalized approach than boutique firms. The client may have less direct access to senior advisors and be assigned to junior team members.

- Higher Costs: Working with a bulge bracket bank can be more expensive, as their fee structures are often higher than boutique firms or Big-4 companies. These banks typically charge a percentage of the transaction value as their advisory fee.

- Lack of Physical Presence in Poland: Large investment banks have no investment bankers permanently based in Poland, as deals suitable for them are rare. Therefore their local expertise may be limited.

Understanding M&A Advisor Fees in Poland

When engaging an M&A advisor in Poland, one important consideration is understanding the fee structure and associated costs. M&A advisory fees can vary depending on factors such as the complexity of the transaction, the scope of services provided, the advisor’s reputation, and the deal size. Here are some key points to consider regarding M&A advisor fees in Poland:

a. Retainer Fees: In some cases, M&A advisors may charge a retainer fee, which is an upfront payment for their services. Retainer fees are commonly used for engagements involving significant pre-deal work, such as market research, financial analysis, and valuation. This fee helps cover the advisor’s initial costs and demonstrates the client’s commitment to the transaction.

b. Success Fee: M&A advisors include a success fee in their fee structure. The success fee is an additional payment contingent upon the successful completion of the transaction. This fee is intended to incentivize the advisor to work diligently and effectively to achieve a favorable outcome for the client.

c. Hourly or Fixed Fee: In certain situations, M&A advisors may charge an hourly or fixed fee for their services. This fee structure is typically used for specific tasks or projects within the overall transaction, such as due diligence or valuation. Hourly or fixed fees can provide more transparency and control over costs, especially for smaller transactions or when the scope of work is well-defined.

e. Expenses: Apart from the advisory fees, clients should also consider the expenses associated with engaging an M&A advisor. These expenses can include travel costs, legal fees, valuation fees, data room costs, and other out-of-pocket expenses incurred during the transaction process. It is important to discuss and clarify which expenses will be covered by the advisor and which will be the client’s responsibility.

When engaging an M&A advisor, it is essential to have open and transparent discussions about the fee structure. Clients should carefully evaluate the advisor’s value proposition and consider the expected benefits and outcomes of the transaction. It would also be best to compare fee structures and proposals from multiple advisors to ensure a fair and competitive arrangement.

Understanding M&A Advisors Fee Structure

Why Consider M&A in Poland?

Poland has emerged as a compelling destination for mergers and acquisitions (M&A) due to several factors making it an attractive market for buyers and sellers. Let’s explore the reasons why Poland is interesting for M&A:

Strong Economic Growth

Poland has experienced robust economic growth over the past decades, making it one of the fastest-growing economies in Europe. The country’s GDP growth, stable political environment, and favorable business climate have attracted foreign investors seeking expansion and market entry opportunities. This economic growth has contributed to an active M&A market, with companies looking to capitalize on the country’s growth potential.

Strategic Geographic Location

Situated at the crossroads of Central and Eastern Europe (CEE), Poland offers a strategic geographic location that provides access to a wide range of markets. With its well-developed transportation infrastructure, Poland serves as a gateway to the European Union (EU) market of over 500 million consumers. This geographic advantage makes Poland an attractive base for companies looking to expand their reach into the broader European market.

Vibrant Business Environment

Poland has fostered a vibrant and dynamic business environment that supports entrepreneurship and innovation. The country has implemented favorable policies and reforms to attract foreign investment, including tax incentives, streamlined regulations, and improved infrastructure. This business-friendly environment encourages both domestic and international companies to pursue M&A opportunities in Poland.

Sector Opportunities

Poland offers diverse sectoral opportunities for M&A activity. Industries such as manufacturing, technology, telecommunications, energy, retail, and real estate have experienced significant growth and present attractive investment prospects. The country’s skilled workforce, strong educational system, and favorable cost structures make it an appealing destination for companies seeking to invest in or acquire businesses in these sectors.

Access to Skilled Labor

Poland boasts a highly skilled and educated workforce, offering a competitive advantage for companies engaged in M&A activities. The country’s education system produces a large pool of talented professionals in various fields, including engineering, technology, finance, and management. Access to skilled labor is a critical factor for companies considering M&A, as it supports operational efficiency, innovation, and long-term growth.

Supportive Government Initiatives

The Polish government has implemented various initiatives to support M&A activities and attract foreign investment. These initiatives include investment incentives, grants, and support programs to facilitate transactions and foster economic growth. The government’s commitment to creating a favorable investment climate and actively promoting Poland as an attractive investment destination contributes to the country’s appeal for M&A.

M&A Market In Poland

Conclusion

When embarking on an M&A transaction in Poland, the expertise and guidance of an M&A advisor are crucial. Boutique M&A Advisors, Big-4 companies, and bulge-bracket investment banks each offer distinct advantages and considerations. Boutique firms provide niche expertise and personalized attention, while Big-4 companies bring comprehensive services and regulatory knowledge. Bulge bracket banks offer global reach and deal execution capabilities but at potentially higher costs and with less personalized service.

Ultimately, choosing an M&A advisor in Poland depends on your specific needs, transaction size, industry, and desired outcomes. Consider factors such as expertise, industry knowledge, network, deal track record, and the chemistry between your organization and the advisor. Engaging the right M&A advisor will significantly increase the likelihood of a successful transaction, ensuring optimal value realization and positioning your business for future growth and success in Poland’s competitive business landscape.

Remember, the M&A process can be complex, and seeking professional guidance is essential to navigate potential challenges and maximize opportunities. With the support of a knowledgeable and experienced M&A advisor in Poland, you can confidently pursue your M&A goals and achieve desired outcomes.

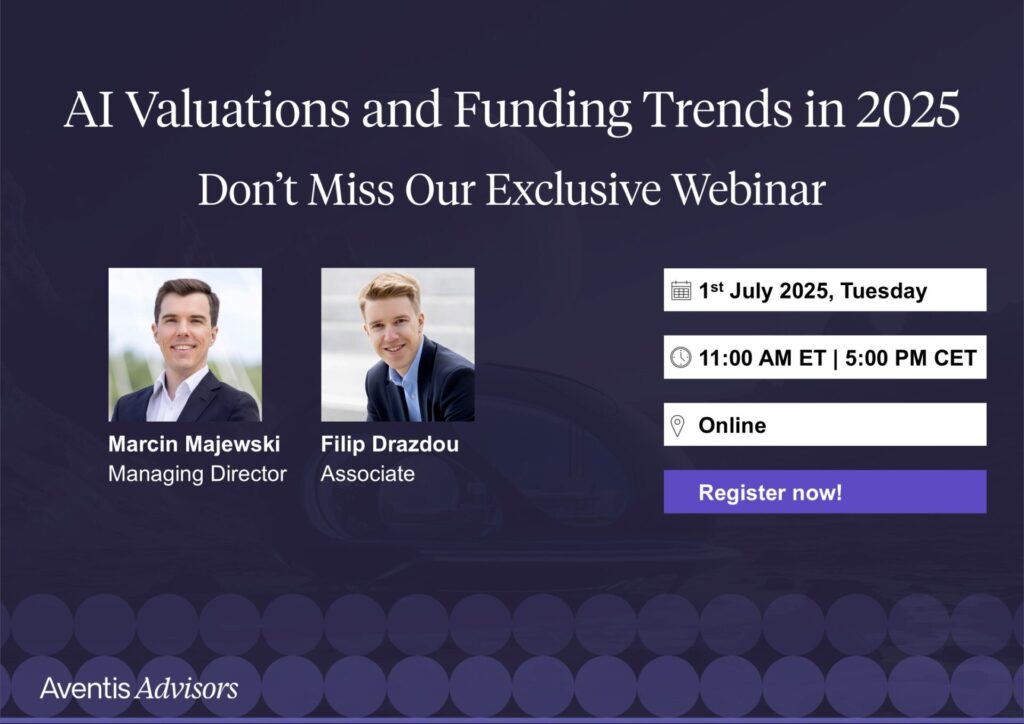

About Aventis Advisors

Aventis Advisors is an M&A advisor technology and growth companies. We work with financial investors, strategic buyers and family offices looking to enter the Polish market through M&A. We help at all stages of the transaction, from identifying prospective acquisition targets to the negotiation and completion of transactions. Our firm also does sell-side engagements, advising on the sale of companies, spinoffs and divestments. We have the potential to reach a large variety of investors around the globe, providing our customers with the finest transaction conditions.

Get in touch with us to discuss how much your business could be worth and how the process looks.