Thanks to its rapidly expanding and diverse economy, Poland has become one of the most attractive destinations in Europe for mergers and acquisitions (M&A), with deal volumes exceeding historical averages in the past 4 years. At Aventis Advisors, we believe Poland is an excellent place for investment.

However, according to Filip Dradzou, Director at Aventis Advisors “there are many risks within Poland’s M&A landscape if not fully understood including regulatory, legal, and cultural complexities”

In this blog post, we’ll cover everything you need to know to make better investment decisions and successfully expand your business in Poland. We’ll explore:

- Key trends and market data behind Polish M&A activity

- Why M&A has been booming in the last decade

- What opportunities and risks to watch out for

Let’s dive in!

Table of contents

I. M&A Overview: Steady Growth Momentum in All Areas

- Sustained Deal Activity with Recent Uptick

- Substantial Strategic Investments and Vibrant Private Equity Scene

- Growing Share of Cross-Border M&A Deals

- Significant Interest from USA, UK, and German Buyers

- M&A Deal Volumes Doubling Across Multiple Sectors

II. Attractive Macro Environment: Why Should You Invest in Poland

- Resilient and Fast-Growing Economy

- Skilled Labor at 1/2 the Cost of Western Europe

- Diversified Economy

- Economic Growth Promoted by International Organizations

III. Macro Factors to Be Aware of

- Rising Price Levels

- Interest Rates Above Historical Levels

- Changes in Exchange Rate

- Strong History and Encouraging Outlook

- Why You Should Work with a Local M&A Advisor in Poland

M&A Overview: Steady Growth Momentum in All Areas

Resilient M&A Deal Flows – Strong Uptick Since 2021

Poland has been a dominant force in the Central and Eastern European M&A landscape, consistently leading the region in deal volume over the past decade, according to data from Mergermarket. While historically stable, the market experienced a significant surge in activity starting in 2021.

After a period of relative slowdown between 2016 and 2020, attributed to political uncertainty and the COVID-19 pandemic, the Polish M&A market rebounded with exceptional resilience. This resurgence was fueled by a revitalized economy, pro-growth policies, and businesses eager to capitalize on new opportunities.

In 2021, Poland recorded 313 M&A deals, with e-commerce emerging as a particularly attractive sector due to the accelerated shift to online retail. This momentum continued despite growing headwinds from rising inflation, interest rate hikes, and the conflict in Ukraine, 2022 marked an all-time high with 477 transactions.

While deal volume has slowed to 418 in 2023 and 344 in 2024, it remains well above the decade’s median of 250 deals. Continued strength in sectors such as business services and software underscores Poland’s enduring attractiveness to both strategic and financial investors. At Aventis Advisors, our active involvement in the Polish M&A market confirms this trend.

Substantial Strategic Investments and Vibrant Private Equity Scene

Over the analyzed period, strategic investments accounted for the lion’s share of total M&A transactions in Poland.

Polands fast-growing consumer spending, reaching record levels in 2025 according to Trading Economics has encouraged both local and foreign businesses to expand their market presence through mergers and acquisitions. Poland also boasts a wealth of innovations that buyers chose to acquire rather than build in-house. Additionally, the fragmented nature of most industries in Poland has provided strategic buyers with a large pool of potential targets to choose from.

Private equity firms have emerged as the most active financial investors in Poland. While private equity deals demonstrated slow but steady growth over the analyzed period, this trend temporarily reversed in 2020-2021. During this period, strategic transactions surged, lowering the private equity proportion of total transactions. In 2022, we saw a record year for private equity with 116 transactions, and high levels continued in both 2023 and 2024.

Boosted by a sense of optimism amongst investors, private equity firms capitalized on the attractive pipeline of acquisition targets in the Polish market. Alongside private equity, there has also been rising interest from venture capital funds among financial investors. According to Prf Ventures and Invovo, VC investments peaked in 2021 and 2022 with €791 million and €781 million invested, respectively. Since then, the market has normalized to historically strong levels, with €467 million in 2023 and a rise to €493 million in 2024 .

Growing Share of Cross-Border M&A Deals

Over the past ten years, cross-border transactions as a percentage of total deal flows have steadily increased, showcasing the growing interest of foreign buyers in the Polish market. This interest can be attributed to:

- A robust economy and favorable investment climate: Poland offers a combination of a cost-effective but highly-skilled labor force as well as a large customer base

- Favorable currency exchange rates: For buyers based in locations with stronger currencies (e.g., USD and EUR), the favorable exchange rates have a meaningful effect on valuations, resulting in a relative discount compared to their home markets

Throughout 2021 and 2022, the number of cross-border M&A deals surged to record levels as foreign buyers were drawn to the strong rebound of the Polish economy. Despite the recent slowdown, foreign buyers continue to show interest in Poland, driven by the desire to enhance revenue opportunities, realize cost synergies, and gain access to innovative technologies.. As of 2024, foreign acquirers account for nearly 50% of all M&A transactions in Poland. At Aventis Advisors, we’re seeing growing interest from international buyers looking to enter and expand in the Polish market, and we’re currently advising several on acquisitions in the region. So far in 2025, inbound interest from international acquirers has been at its highest level.

Significant Interest from USA, German and UK Buyers

Among the countries in Central and Eastern Europe, Poland stands out as a leading destination for foreign investors. The primary pool of investors is led by buyers from the United States as well as Western European countries, but we are also seeing growing interest from investors in the Czech Republic and other neighboring markets.

Delving deeper into the preferences of investors from these top three countries, we can find their specific areas of interest:

- U.S.-based investors were active in acquisitions across all sectors. Key areas of interest included software (50 deals), business services (21 deals), and industrial products and services (18 deals)

- German investors focused primarily on business services (25 deals), industrial products (22 deals) and software (22 deals)

- U.K.-based investors were most active in the financial sector (25 deals), energy (24 deals) and software sector (22 deals)

M&A Deal Volumes Doubling Across Multiple Sectors

Over the last several years, Poland has witnessed a remarkable uptick in mergers and acquisitions deals across multiple sectors. Leading the charge are software, other services, and energy, with notable performances from other sectors, such as medical and industrials.

- Computer software: This was by far the fastest-growing industry in M&A deal volumes, increasing by 19x since 2010. While already benefiting from digitalization trends, the computer software industry skyrocketed even further with the pandemic in 2020. Poland, in particular, attracted substantial foreign interest due to its large number of SaaS and IT Services companies.

- Energy: The energy sector came in third, with annual M&A deal volumes growing from 12 in 2010 to a record high of 59 in 2022, 37 in 2023 and 34 in 2024 . The lion’s share of this growth came from renewable energy deals, particularly those in solar energy. The growing interest in renewables is fueled by rising prices of traditional energy sources and a series of EU-aligned environmental regulations.

- Other services: This category encompasses a range of business activities that cannot be categorized elsewhere. Unlike the steady growth in computer software and energy, M&A deal flows in other services were more uneven . Frequent acquisition targets included companies offering education, consulting, and financial services (e.g., debt collection).

Looking at the total mergers and acquisitions volumes over the last decade, the general services have been the most active sector for M&A in Poland.

In second place is the industrial products and services sector, a significant contributor to Poland’s economy due to its industrial activities. As the above chart displays, however, M&A activity in this sector has been at a stand still. We anticipate the fast-growing computer software sector to take the lead in the near future. In 2024, software overtook industrials as the second largest sector for M&A in Poland.

In second place is the industrial products and services sector, a significant contributor to Poland’s economy due to its industrial base. As the above chart displays, however, M&A activity in this sector has been at a standstill. At Aventis, we anticipate the fast-growing computer software sector will take the lead in the near future, driven by continued investor interest in the growing number of Polish software firms. In 2024, software overtook industrials as the second-largest sector for M&A in Poland.

The energy industry, led by renewables transactions, and the financial sector, also demonstrated strong performance during this period.

Attractive Macro Environment: Why Invest in Poland

Resilient and Fast-Growing Economy

As of 2024, Poland’s GDP reached a historic high of $688billion. This makes it the 21st-largest economy in the world and the 9th-largest in Europe, according to the IMF.

Poland has a resilient economy with a strong track record of real GDP growth. During the last two global market downturns, the country was a shining star within Europe. Poland avoided a recession during 2007-09, and in 2020, its real GDP growth contracted by only 2.0%. This was significantly less than the EU and OECD averages of minus 5.6% and minus 4.2%, respectively.

Despite ongoing geopolitical tensions stemming from the Russian invasion of Ukraine, Poland’s economy has remained relatively stable. The country achieved positive year-on-year (YoY) GDP growth throughout 2022, with forecasts from institutions such as the IMF suggesting this trend will continue. Implications for M&A in Poland

Implications for M&A in Poland

Poland, like many other economies, exhibits a positive relationship between GDP growth and mergers and acquisitions activity. This is driven by several factors:

- Confidence in market growth: Companies are more likely to engage in M&A transactions when they hold a positive outlook for future market growth. This confidence fuels their willingness to expand their businesses through strategic acquisitions

- Robust labor market: A strong GDP often coincides with a robust labor market, generating disposable income that helps keep demand at an adequate level

- More financing opportunities: In favorable economic conditions, as seen in Poland over the last few decades, financial institutions are more willing to lend and borrowers have better access to both domestic and foreign capital. This supports dealmaking

Impact of Global Market Slowdown on the M&A Landscape in Poland

As the global economy appears to grow more uncertain, it’s important to remember that M&A activity can remain viable. In fact, market slowdowns can present unique opportunities for those who approach them with the proper screening and due diligence. Here are a few examples:

- Finding attractive opportunities: Companies struggling with finances can look to merge or sell off parts of their business for a much-needed influx of funds. Meanwhile, savvy buyers can pick up good deals at lower prices due to more attractive valuations. Opportunistic and distressed acquisitions are typical in such economic environments.

- Poland’s shifting landscape: Poland has been a seller’s market for a long time, but it seems the tide is turning. Buyers who were once held back by lofty valuations are returning to the market. At the same time, sellers who have grown accustomed to premium pricing are adjusting their expectations. This sets up an ideal environment for M&A deals.

Growing Labor Force Available at 1/2 of Western European Salaries

Poland has the largest population in Central and Eastern Europe with approximately 38 million residents. The country’s labor force participation has remained solid and stable, strengthened by the country’s appeal as a destination for international students and workers. Additionally, the large influx of Ukrainians is expected to boost Poland’s labor force by 1.0% and 2.25% and add 1.5% and 2.5% to its working-age population.

A key selling point of Polish labor to foreign buyers is its low cost relative to most of the other members of the European Union. According to Eurostat the hourly labor cost in Poland in was EUR 15, compared to the European Union’s average of 32. This represents a 52% labor cost advantage.

Poland is one of the most prosperous members of the European Union regarding employment. Consistent economic growth has created a wealth of job opportunities, attracting leading multinational companies to the country. These companies are drawn in by an impressive workforce known for delivering high-quality services at competitive costs. As a result, the country’s unemployment rate has steadily declined over the years, remaining significantly below the EU average.

Implications for M&A in Poland

A strong labor market with low unemployment usually indicates a thriving economy. In such an environment, businesses have confidence in their future performance and look for ways to grow – prompting an increase in mergers and acquisitions. High employment rates typically also result in higher disposable income, driving growth in demand that encourages businesses to increase their offerings and production volume.

The relatively cheap talent pool in Poland also has powerful implications for cross-border M&A. For buyers based in Western Europe, for example, investing in Poland means a 60-70% “discount” on labor costs compared to their home country.

Diversified Economy

Poland has a fast-growing diversified economy with a healthy balance amongst various core sectors, including services, industry, construction, and agriculture.

Services: Services have contributed significantly to Poland’s economic growth, accounting for 59.4% of total gross value added (GVA) in 2021. Trade and motor vehicle repair have historically been the largest contributors, though their role has decreased in recent years as new-age tech-related activities have increased. Human health, social work, and financial institution activities have also seen considerable growth in this sector.

Industry: Industry-related activities, particularly manufacturing, also constitute a significant portion of Poland’s GVA, representing 25.1% as of 2021. Within manufacturing, the automotive field stands out as a pivotal contributor to Poland’s economic growth. Thanks to the country’s rich mineral resources, mining activity is also significant and draws multiple foreign buyers, including Germany, to actively acquire companies from this segment.

Construction & Agriculture: While the construction and agriculture sectors account for a small and slowly declining share of GVA, it’s important to note that real estate activities, supported by residential real estate, are holding up well within the construction sector.

Diverse opportunities for M&A in Poland

Poland’s diverse economy offers great merger and acquisition prospects for buyers in any sector. While most M&A transactions in the country took place in the service industry, particularly in the tech sector, it’s important to note that tech-related industries weren’t the only attractive target for mergers and acquisitions. For example, good M&A activity was also seen in the manufacturing and real estate sectors.

Economic Growth Promoted by International Organizations

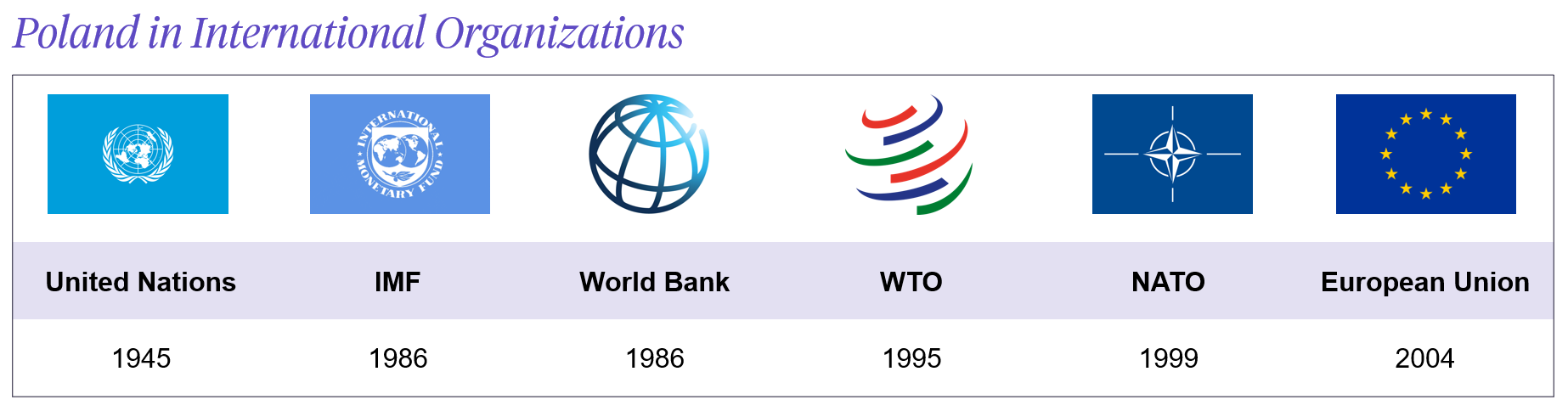

Poland is an integral member of key international organizations, such as the European Union, NATO, IMF, World Bank, and World Trade Organization. These strategic memberships offer several advantages that can increase M&A activity within the country.

Firstly, being a part of the European Union allows Poland access to the large and affluent European market. This simplifies trade and employment across borders, making the country an attractive destination for international students and workers. It also promotes common regulatory and legal frameworks with well-established financial institutions that help to level the playing field and encourage cross-border M&A.

Secondly, membership in specific organizations, such as the EU, offers significant beneficial financial grants and assistance.

Macro Factors to be Aware of

Rising Price Levels

After years of low inflation, Poland has witnessed a rise in price levels since the second half of 2021, reaching 19.2% in February 2023, according to data from S&P Capital IQ. This inflation was triggered by the COVID-19 supply chain bottlenecks and stimulus-boosted demand and has significantly accelerated in 1Q 2022 following the Russian invasion of Ukraine.

Price levels have since peaked in late 2023 and are expected to stabilize by the second half of 2024. Higher prices have been challenging for both businesses and consumer sentiment, however, Poland’s economy has proven its resilience once again as it continues to hold up well.

Impact of Inflation on M&A in Poland

Higher inflation can have numerous implications on mergers and acquisitions activity in Poland, including a focus on real growth, valuations of target companies, and more extended exclusivity periods.

Focus on Real Growth

Throughout the due diligence process, when a company’s financial health is analyzed, buyers usually assess the company’s growth by focusing on revenue. In periods marked by elevated inflation, many firms may demonstrate strong growth in monetary terms but not in volumes, especially in sectors less sensitive to price fluctuations, such as energy, commodities, or consumer staples. It is therefore essential to dive deeply into the sources of growth and understand whether the target’s expansion is genuine in real terms.

Lower Valuations

Elevated inflation often leads to inflated operating expenses due to higher inputs and energy costs. Combined with ongoing wage inflation and supply chain issues, this can put significant pressure on profitability and therefore valuations. Target companies that cannot pass on higher costs to their customers are at risk of going up for sale at a discount compared to those that can.

Longer Exclusivity Periods

Buyers may request extended exclusivity periods to allow for more detailed due diligence reviews. A typical area that draws close scrutiny during periods of high inflation is the target’s pricing power and pricing arrangements with its suppliers. This includes assessing whether the company has locked in a favorable pricing provision from its supplier and has the market power to raise prices in line with inflation.

Interest Rates Above Historical Levels

Low interest rates encourage business and consumer spending, which translates into economic growth. In Poland, the trajectory of interest rates has been marked by significant shifts.

- Historical decline: Interest rates have steadily declined since 2003, falling to 0.1% following the pandemic-led cuts in 2020 to protect the economy.

- Turning point in 2021: This trend ended in 3Q 2021 when 11 consecutive rate hikes were implemented in order to combat inflation and the depreciation of the Polish Zloty. As a result, the interest rate in Poland increased from 0.1% to 6.75% between October 2021 and September 2022.

- Promising future: Though the rate hike measures were tough, they were also effective. We are now seeing multiple promising signs of improvement, including a swift recovery of the Zloty, which is close to pre-war levels against the EUR and USD. Inflation has peaked in 2023 and analysts forecast it to stabilize by the second half of 2024.

A stable interest rate that aligns with the central bank’s long-term inflation target is the most favorable landscape for mergers and acquisitions. The typical impact of rapid rate hikes and higher rates on the M&A landscape evolves around valuation and change in the method of deal financing.

Higher Cost of Capital

A stable interest rate that aligns with the central bank’s long-term inflation target is the most favorable landscape for mergers and acquisitions. This makes debt-financed transactions, such as leveraged buyouts (LBO), less attractive. It can also result in buyers proposing alternative payment methods that require less cash to be paid at closing time. Alternative payment tactics include installment payments, promissory notes, earnout/revenue milestone payouts, rollover equity, or payment via other equitable assets.

A higher cost of capital can also weigh on valuation if the target is highly leveraged or has poor coverage ratios. Businesses will be left with less cash after interest payments resulting in a higher risk of defaulting on their debt obligations. Liquidity, solvency, and coverage metrics should therefore be closely examined during due diligence processes.

A Decline in Equity Financing

When interest rates rise, stock prices usually fall as investors shift their money into bonds and other fixed-income securities. This makes it more difficult for companies to finance an acquisition with equity, as they would need to sell more shares to raise the same amount of capital.

As a result of lower share prices, stock swap M&A deals may fall out of favor. A stock swap occurs when shareholders’ ownership of the target company’s shares is exchanged for shares of the acquiring company. It’s unlikely that the acquirer will use stock as a means of transaction financing if its share price is trading notably below fair value.

Change in Exchange Rate

Thanks to Poland’s strong economic growth, the fluctuation of the Polish Zloty (PLN)’s value has been relatively low following the 2008 financial crisis. This trend ended in February 2022 when Russia invaded Ukraine, and the PLN went into a free fall for several months. Factors such as rising geopolitical risk, high local inflation, and unprecedented interest rate hikes by central banks played a significant role in the currency’s depreciation.

Following October 2022, the PLN has regained its footing thanks to stabilizing markets and a series of interest rate hikes by Polish Central Bank (NBP)

A stable currency usually supports mergers and acquisitions growth as it builds business and consumer confidence. It also makes forecasting future performance and managing transaction risks easier. When a currency depreciates, it can lead to more inbound M&A transactions, but it can also weigh on FX-adjusted performance and valuations.

Implications for M&A in Poland

A stable currency usually supports mergers and acquisitions growth as it builds business and consumer confidence. It also makes forecasting future performance and managing transaction risks easier. Conversely, currency depreciation can increase inbound M&A by making local assets more affordable for foreign buyers, but may complicate valuation and financial performance analysis.

Increased Inbound M&A

Poland has remained a favored destination for cross-border M&A deals as foreign strategic investors and private equity firms want to reap the benefits of the country’s fast-growing market strategic location, and competitive labor costs.. A weaker Polish Zloty (PLN) can further attract foreign strategic and financial investors as it effectively reduces the acquisition cost of local businesses for buyers operating in stronger currencies.

Focus on FX-Adjusted Performance

During due diligence, buyers must distinguish between organic business performance and temporary gains or losses caused by currency movements. Exporters may appear to grow rapidly during periods of depreciation, while import-reliant companies might suffer margin pressure if they cannot pass on higher costs to consumers.

Impact on Valuations

The impact of currency fluctuations on valuation depends on the company’s specific exposure:

- Positive: Export-driven firms, those with foreign cash reserves, and companies with no reliance on imported goods or foreign debt may benefit from a weaker PLN

- Negative: Businesses with significant foreign-denominated liabilities or import-heavy operations may see lower profitability and valuation

Summary of M&A in Poland

Strong History and Encouraging Outlook

Throughout the past three decades, Poland has achieved consistent economic growth, with its capital, Warsaw, becoming the business center of Central and Eastern Europe. Poland’s well-diversified economy is among the fastest-growing and most resilient in Europe, supported by a stable macroeconomic environment, low labor costs, a business-friendly regulatory framework, and significant investment from both foreign entities and the European Union.

As a result, M&A activity has been booming in the country. Poland has ranked #1 numerous times in Central and Eastern Europe in terms of M&A deal volumes and total transaction value, a trend that we at Aventis Advisors expect to continue.

While the country’s tech-related industries have seen the most rapid growth in recent years, we have also seen rising deal volumes across a range of industries, particularly in software, energy, and other services. Strong momentum was also observed in both strategic and financial transactions, with private equity activity and cross-border deals on the rise, especially from investors in the US and UK.

Poland is currently facing numerous headwinds, and as a result, analysts forecast slower economic growth in the years ahead compared to pre-pandemic levels. However, investor confidence remains high. Thanks to its financial resilience and diversification, Poland is still expected to outperform more mature Western markets. We continue to see strong deal momentum and long-term opportunity in the Polish M&A landscape.

Why You Should Work with a Local M&A Advisor in Poland

The growing number of M&A deals in Poland has increased demand for M&A advisors across strategic investors and private equity firms. M&A advisors provide invaluable expertise and guidance, from finding businesses for sale to doing due diligence and helping close the deal,from sourcing opportunities to due diligence and closing.

Engaging a Polish M&A advisor is especially important throughout the due diligence process. In Poland, this typically involves a detailed review of the target’s financials, legal structure, and tax position. Depending on the industry and deal specifics, additional areas such as IT, cybersecurity, operational, market, or environmental due diligence may also be required. A Polish M&A advisor can help navigate local regulations and standards, ensuring a comprehensive assessment of risks and opportunities.

Beyond due diligence, local insight is key to identifying the best-fit acquisition targets. A Polish advisor brings market intelligence, access to deal flow, and an understanding of emerging sectors and top-performing companies, allowing you to uncover high-quality opportunities that align with your strategy.

Cross-border transactions add another layer of complexity due to cultural, legal, and regulatory differences. A local advisor bridges the gap, helping foreign buyers understand Poland’s business environment, overcome language and cultural barriers, and navigate compliance requirements. With the right advisor by your side, you can approach deals in Poland with confidence and maximize your chances of a successful outcome.

Aventis Advisors Will Help You Navigate the Polish M&A Landscape

Aventis Advisors is a Polish M&A advisor focusing on technology and growth companies. Our team has accumulated significant know-how in helping international buyers navigate the unique complexities of investing in Poland. With our experience in bringing together foreign investors and Polish targets, you can trust us to care for all your investment needs – from understanding complex financial requirements to bridging cultural gaps!

Check out our recent case study on how we supported Apave, a French TIC company, in their acquisition of the Polish ISO certification company ISOCERT.

Contact us if you want to learn more about M&A in Poland. We would be happy to answer any of your questions and find the best deals for you.