Handling mergers and acquisitions (M&A) requires a significant investment of time and effort from businesses. This is where M&A advisors come in, acting as the guiding force that can determine whether a deal succeeds or becomes a missed opportunity.

But what exactly do M&A advisors do, and how can M&A services benefit your business? In this blog post, we’ll explore the roles and responsibilities of M&A advisors, their value to your company, and tips for choosing the right advisor to help you navigate your next M&A transaction.

Table of Contents

- What do M&A advisors do?

- Why hire an M&A advisory firm?

- What are the different types of M&A advisors?

- What are the M&A advisory fees?

- How to choose the right M&A advisor?

What do M&A advisors do?

M&A advisors are skilled professionals who provide guidance to clients engaged in a sale, financing event, or corporate restructuring. They possess a deep understanding of the entire sale process, from start to finish, including negotiating deals, finding buyers, and representing the seller’s credibility within a business context. They also reduce distractions for the business owner and the management team. With their in-depth knowledge of mergers and acquisitions, M&A advisors help companies identify potential synergies, such as acquiring new product lines, intellectual property, human capital, and customer bases.

M&A advisory firms offer a wide range of services, including buy-side and sell-side advisory services, along with supplementary finance-related support. In this ever-evolving industry landscape, companies must take into account various factors when selecting an M&A advisory firm, including regulatory compliance, the firm’s track record, their experience within the company’s specific industry, and the technological capabilities needed to assess the market environment effectively.

Buy-side and sell-side advisory services

Buy-side and sell-side advisory services are integral components of M&A transactions. These services involve M&A advisors assisting companies with mergers and acquisitions, offering advice on valuation techniques, generating a competitive buying atmosphere, and helping identify the most suitable buyer.

M&A advisors leverage their expertise in industrial middle-market M&A transactions to provide valuable insights to their clients. Valuation techniques commonly used by financial advisors during the M&A process include comparables analysis, which involves using a set of relevant metrics to evaluate similar companies within the same industry.

The primary objective of M&A firms during the sale process is to generate a competitive buying atmosphere. This ensures that the selling company receives the most advantageous deal and is sold to the most suitable buyer.

By offering buy-side and sell-side advisory services, M&A advisors facilitate the entire M&A process from initial exploration to deal closure. Their expertise helps companies navigate complexities, maximize transaction value, and ensures all parties involved achieve their objectives.

Additional finance-related support

In addition to their primary focus on merger and acquisition transactions, M&A advisors offer their clients a range of finance-related services. These include restructuring, capital raising, and other financial considerations essential for companies during mergers and acquisitions.

M&A advisory firms also provide more specialized services, including debt and equity financing as well as succession planning. Offering such comprehensive support allows M&A advisors to help companies navigate the complexities of mergers and acquisitions and ensure a smoother and more successful transaction process.

Why hire an M&A advisory firm?

You should hire an M&A advisor when planning to sell your business for the following reasons:

Maximizing valuation

The key advantage of partnering with strategic M&A advisors when selling a business is securing the best possible outcome. Seasoned advisors know how to effectively position your business, identify the most suitable buyers, and enhance your chances of achieving a higher valuation along with more favorable deal terms.

A critical aspect of this is managing a structured sale process involving multiple buyers. This competitive environment allows you to leverage offers against each other, giving you a stronger negotiating position and greater confidence throughout the process.

Strategically framing your business

M&A advisors regularly engage with multiple buyers and have insight into what attracts or deters them from certain businesses. They can assist you in strategically positioning your company by highlighting its strengths while downplaying any weaknesses.

Additionally, advisors can help you analyze the acquisition strategies and motives of various buyers, enabling you to develop a customized approach for each potential buyer, increasing your chances of success.

Bring new buyers to the table

Many successful companies regularly receive interest from potential buyers—some are genuinely interested, while others, like business development teams from private equity firms, may be casting a wide net without serious intent to make a deal.

M&A advisors, with their access to advanced industry research tools and extensive networks, can introduce unexpected but relevant buyers into the mix. The more potential buyers involved, the greater the competition, which can drive up your company’s valuation.

Additionally, M&A advisors often have prior experience working with these buyers and understand how they assess and value companies. This insight allows them to advise you on which buyers are worth focusing your efforts on and where to prioritize your preparation.

Financial expertise

Even if you’ve built a successful business and are familiar with financial terms, or have a CFO and accounting team handling day-to-day finances, mergers and acquisitions (M&A) are a whole different ballgame, with their own specialized financial considerations.

When buyers make offers, they often use complex financial jargon and expertly navigate the numbers, which can leave you feeling like they’re angling to reduce the value of your company. Terms like “cash-free, debt-free basis,” net working capital adjustments, earn-outs or call-put options are common.

It’s crucial to have someone on your side who can break down the pros and cons, spot any non-standard terms, and flag areas where buyers might be tweaking the deal to their advantage.

An experienced advisor can be invaluable in guiding you through these complexities.

Letting you focus on the business

A significant part of completing a deal lies in the sheer amount of time it requires. If your company has attracted buyer interest, it’s likely because your management team is already excelling and deeply involved in the daily operations.

Responding to extensive, often repetitive inquiries from potential buyers, preparing detailed KPI reports, coordinating multiple due diligence teams, and ensuring timelines are met can be overwhelming.

Even if you manage to carve out the time, it takes away from focusing on growing and strengthening your business. One of the biggest risks during this period is that your company’s performance could suffer as your leadership becomes distracted by the deal process.

What are the different types of M&A advisors?

M&A advisory firms and investment banks differ in several ways. M&A advisory firms focus primarily on transactions, providing assistance with restructuring, capital raising, and other financial matters. Conversely, investment banks offer a broader range of services. M&A advisory firms typically cater to middle and lower markets, while investment banks serve larger clients with a higher revenue threshold.

Despite their differences, both M&A advisory firms and investment banks play crucial roles in the world of mergers and acquisitions. It’s essential for companies to consider their specific needs and objectives when choosing between the two types of financial institutions.

Services offered

Both M&A advisory firms and investment banks offer various services related to mergers and acquisitions. M&A advisory firms provide buy-side and sell-side advisory services and other finance-related support, while investment banks offer a more comprehensive range of services, including underwriting, sales and trading, equity research, asset management, commercial banking, and retail banking.

This difference in the scope of services offered allows companies to choose the financial institution that aligns best with their specific needs and objectives. By understanding the services provided by both M&A advisory firms and investment banks, businesses can make informed decisions regarding which type of financial institution is most suitable for their M&A transactions.

Clientele and market focus

M&A advisory firms and investment banks not only differ in their range of services, but also in their clientele and market focus. As mentioned earlier, M&A advisory firms primarily serve middle and lower markets and specialize in providing M&A advisory services to corporations and private equity firms. On the other hand, investment banks cater to a broader range of clients and offer a wide range of services beyond M&A advisory.

By understanding the differences in clientele and market focus between M&A advisory firms and investment banks, companies can select the financial institution that most closely aligns with their unique needs and goals in the realm of mergers and acquisitions.

What are the M&A advisory fees?

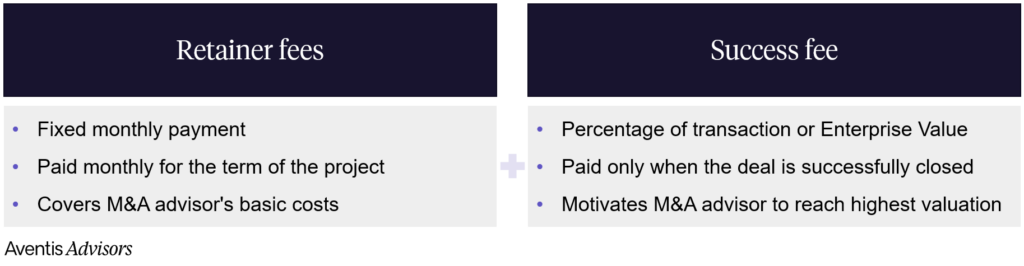

M&A advisory services fees are typically categorized into two main types: fixed fees and success fees. Fixed fees can take the form of monthly payments, one-time charges, or milestone-based payments. These fees are designed to cover the costs of services rendered and to demonstrate the client’s commitment to the transaction. On the other hand, success fees are commission-based and are payable only upon the successful closing of a transaction.

Retainer fees, which are charged monthly throughout the sale process, generally range from $5,000 to $25,000. The amount tends to be higher for larger and more complex transactions, such as those involving multiple legal entities or cross-border considerations. Conversely, companies with straightforward structures and uncomplicated accounting may incur lower fees.

The success fee varies based on several factors. Firstly, the deal size plays a crucial role; smaller transactions often have a higher success fee percentage, sometimes reaching up to 10% of the total transaction value. Secondly, the risk associated with the deal influences the fee; the more certain a deal is to close, the lower the risk for the M&A advisor, which typically results in a reduced success fee.

Success fees usually range from 2% to 10% of the transaction value and are often subject to negotiation between the seller and the advisor. For a more comprehensive analysis of M&A fees, please refer to our detailed article that explores these financial intricacies.

Understanding the fee structures associated with M&A advisory services enables companies to make informed choices about whether to engage an M&A advisor or an investment bank for their transactions. By comparing the fees and costs of both options, businesses can find the financial institution that best aligns with their budget and objectives.

Learn how we can support your M&A journey.

How to choose a right M&A advisor?

While there are many factors to consider—such as reputation, financial expertise, duration of experience, and personal rapport—we believe the three aspects outlined below are the most crucial in selecting an M&A advisor that aligns with your needs.

In any case, we recommend speaking with several advisors from different walks of life so you can compare your options and select the one you believe will deliver the best results.

Industry expertise

An advisor with industry expertise has hands-on experience with transactions in your segment, understands the market, and speaks your language. They know which KPIs are critical for your business and have a deep understanding of your business model.

Many advisors focus on just one or a few sectors, giving them the ability to truly understand your business. They’ve likely spoken with potential buyers, reviewed actual valuations in term sheets, and navigated due diligence challenges specific to your industry.

While generalist advisors might handle diverse deals—selling a trucking company one day, an AI startup the next, and a healthcare clinic after that—this approach may work for smaller, simpler transactions. For larger, more complex deals, we believe a specialist with deep industry knowledge is the best choice.

Network and understanding of the buyers

A skilled M&A advisor keeps a close eye on buyer activity and strategies, enabling them to identify the most likely candidates for an acquisition. They know which companies are actively pursuing M&A opportunities, what specific assets or capabilities they are seeking, and can provide insight into who might be the best fit.

A good advisor also helps set realistic expectations for the transaction. While many tech founders dream of being acquired by giants like Google or Microsoft, such outcomes are relatively rare. An experienced advisor will guide you on not only who could be a suitable buyer but also who is unlikely to be a match, saving you time by avoiding unnecessary pitches.

For our clients, we regularly provide a high-level overview of potential buyers after just a brief discussion of the company and its financials.

Valuation guidance

The right M&A advisor will provide a realistic valuation and avoid overpromising what can’t be delivered. It can be tempting to go with the advisor who promises the highest number, but this often leads to disappointment when actual offers fall short. This approach wastes valuable time, as you’ll have entered the process with incorrect assumptions.

A good advisor will emphasize that the final valuation remains uncertain until you present the company to the market.

One of the key things we can do before starting any M&A process is to guide you on valuation. With years of experience tracking valuation multiples in industries like Software, SaaS, IT services, and TIC, we can advise you on the right multiple for your business and whether, historically, now is the best time to sell.

Learn how we can support your M&A journey.

Summary

In conclusion, M&A advisors are pivotal in guiding companies through the complexities of mergers and acquisitions. Now that you better understand the roles and responsibilities of M&A advisors, the value they bring to transactions, and the differences between M&A advisory firms and investment banks, you can make a more informed decision about which type of financial institution best suits your unique needs and goals.

Hiring an M&A advisory firm can bring significant value to a company. From providing expert guidance throughout the entire M&A process to handling the price negotiations, mitigating uncertainties, and managing communication with multiple prospective buyers, M&A advisors can offer a wealth of knowledge and support. They act as a safeguard during the transaction process and ensure the deal proceeds smoothly and efficiently.

Why you need an M&A Advisor

Every company is unique, just as every founder’s journey is unique. Therefore, it’s crucial to seek guidance from experts in the M&A space, particularly advisors who specialize in your sector and can understand your situation.

M&A advisors possess deep knowledge of market dynamics, valuation methodologies, and the intricacies of the M&A process. While you focus on managing your business, advisors diligently ensure that every detail is addressed and advocate for the best possible deal on your behalf. The M&A advisors’ success is intertwined with yours, and their expertise can often significantly influence the final sale price.

About Aventis Advisors

Aventis Advisors is an M&A advisor for technology companies. We support founders of software and IT services companies across the globe, leveraging deep industry knowledge, rigorous research, and extensive networks to deliver exceptional outcomes.

Our team combines cutting-edge market insights with decades of experience, allowing us to identify trends, opportunities, and strategic partners that align with our clients’ goals.

Get in touch with us to discuss how much your business could be worth and how the process looks.