Getting the valuation of your SaaS business right can make or break once-in-a-lifetime decisions like a company sale or a significant capital raise.

That’s why it’s essential to understand current valuation practices. Understanding them helps with:

- Negotiating an acquisition offer: Many potential buyers often lowball in their initial offers. Understanding the market environment gives you leverage and context for negotiations.

- Raising capital: Choosing a defensible valuation figure for your next round ensures you don’t undervalue your company or discourage potential investors.

- Understanding your company’s value: This can help you manage your wealth tied to the business.

- Taking strategic decisions: To maximize company value and understand what metrics drive SaaS valuation in the current cycle.

In this post, we look at valuations for public SaaS companies and what has driven their boom-and-bust cycle over the past eight years. We also analyze private SaaS valuations in M&A transactions to provide practical guidance to founders of mid-size SaaS companies.

Table of Contents

II. Public Market SaaS Valuations

- Our Sample

- SaaS Stock Market Performance

- SaaS Revenue Multiples

- Valuation Drivers: Growth

- Valuation Drivers: Profitability

- Valuation Drivers: Rule of 40

III. Private SaaS Valuations in M&A Transactions

- Our Sample

- EV/Revenue and EV/EBITDA Multiples for SaaS Companies

- Valuation Drivers: Company Size

- SaaS vs On-Premise Software Company Valuations

- Public Markets vs M&A Transactions

What is a SaaS Business?

SaaS, or Software as a Service, delivers centrally hosted software over the internet to customers.

Vendors manage infrastructure and updates, while customers access the latest version via subscriptions or usage-based billing. The term is often misapplied, so we set clear criteria before discussing valuation multiples.

A true SaaS company meets all three conditions:

- Software is the core offering, and licensing that software drives revenue. Marketplace, fintech, or commission-led models are excluded from this research.

- Delivery is cloud-based and centrally hosted by the vendor, not customer-managed infrastructure. Firms deriving most revenue from on-premise deployments are excluded from our sample.

- Access is provided as a service (subscription, pay-per-use, or per-transaction). Customers continuously receive updates and use the current supported version.

For an overview of valuations across software segments (both SaaS and on-premise), check out our separate analysis.

Public Market SaaS Valuations

Our Sample

In our analysis, we look at the most liquid SaaS companies listed on top stock exchanges:

- Companies listed on NASDAQ or NYSE

- $1B+ market cap as of 13.01.2023

Our analysis includes fewer companies to focus solely on pure-play SaaS businesses. This is why we excluded companies that:

- Generate a significant part of the revenue from on-premise software: SAP, Intuit, Palantir, etc.

- Generate a significant part of the revenue from resale: Twilio, etc.

- Generate a significant part of the revenue from commissions on GMV/purchases, e.g. Applovin, The Trade Desk, etc.

We started with a sample of 26 companies in 2015. We have since managed the addition of new SaaS companies to our sample and in case companies get delisted due to being taken private by private equity funds, they remain in our index till the point they were publicly traded. As of 2025, our index sample consists of 70 SaaS companies.

SaaS Stock Market Performance

SaaS companies have experienced an unprecedented run since 2015. While the post-COVID monetary stimulus certainly provided the final push forward, we’ve seen that the bulk of appreciation happened during a period of stable growth in 2015-2020.

Our proprietary Aventis SaaS index peaked at more than 700 points (100 = January 1, 2015) in early 2021, marked by a meme stock mania and SPAC boom. This was also a period of peak IPO activity.

The Federal Reserve’s rate hikes in early 2022 ended the bull market. As most SaaS companies were unprofitable, their valuations fell sharply as higher rates reduced the value of future cash flows. Since its peak, the Aventis SaaS Index has declined by more than 60%.

By mid-2023, the index partially rebounded amid a broader market rally and optimism around AI-driven growth. However, this recovery was concentrated among large-cap players such as Adobe, Salesforce, and ServiceNow, while many smaller SaaS companies remained stagnant.

IPO activity reflected this shift. After nearly two years of silence following the 2021 peak, Klaviyo’s September 2023 IPO tested market appetite. The cautious reception signaled a more disciplined environment where companies must prove strong growth and a clear path to profitability.

By late 2024, ServiceTitan’s successful IPO suggested a slow reopening. As 2025 began, the SaaS IPO pipeline grew, but most companies waited for better conditions to avoid down-round pricing. By mid-2025, activity remained selective, with investors prioritizing profitability and sustainable growth over aggressive expansion.

Note: The Aventis SaaS Index uses end-of-month data.

SaaS Revenue Multiples

EV/Revenue is the most widely used multiple for SaaS valuation. Since many SaaS companies remain unprofitable while reinvesting heavily in growth, profit-based multiples are often less meaningful. However, dividing a company’s revenue multiple by its target EBITDA margin provides a rough estimate of its potential future EV/EBITDA. For example, a company trading at 4.8x revenue that expects to reach a 30% EBITDA margin implies a future ~16.0x EV/EBITDA.

From 2015 to 2020, the median EV/Revenue multiple for public SaaS companies rose steadily, supporting higher share prices alongside strong revenue growth. The sharpest increase came in April 2020, when the median jumped from a COVID low of 9.8x to nearly 20.0x. Top-quartile companies traded above 30.0x, with Asana setting the record at 89.0x revenue on November 9, 2021.

For most of 2021, the median held between 18.0x and 19.0x, before collapsing in early 2022 as monetary policy tightened. By early 2023, the median had fallen to 6.7x. Since then, multiples have stabilized. In early 2025, they briefly climbed to 7.3x amid optimism around AI integration and improving profitability, but by July 2025, renewed uncertainty and tariffs pushed the median back to around 6.0x. As of September 2025, the median EV/Revenue multiple stands at 6.1x, reflecting modest recovery but still far below pandemic highs.

Insights from our October 14, 2025 webinar, Navigating SaaS Exits in the AI Era, show that investors now reward operational efficiency and meaningful AI integration rather than speculative “AI wrappers.” Companies with durable growth, profitability, and proprietary data continue to attract premium valuations, while simpler, horizontal tools face growing AI-driven substitution risk. To learn more, read the full webinar recap here.

Join us for our year end webinar on 10th December. Save your spot.

Valuation Drivers: Growth

Revenue growth has always been a crucial SaaS metric.

The calculation is simple. If customer lifetime value (LTV) is larger than customer acquisition cost (CAC), keep investing in new customer acquisition. Because profitability will follow at scale, short-term profits are irrelevant, and growth is key.

As with any new industry, growth starts high but slows as it becomes harder to expand revenue from a larger base. By Q3 2020, the median SaaS company’s revenue growth had slowed to 20% YoY and was on a clear downward path.

During COVID, companies rapidly digitized, pushing the median growth rate up by 11 percentage points to 31%. This surge immediately boosted revenue multiples, which are highly sensitive to growth rates, especially in a low interest rate environment.

The jump proved short-lived. Growth rates quickly returned to their long-term decline as revenue bases expanded and market saturation set in. Looking ahead, growth could even drop below 15%, creating strong headwinds for valuations. The collapse in growth rates has been one of the core drivers behind falling revenue multiples.

By Q4 2023, the median SaaS growth rate was 17% annually, well below pre-COVID levels. It slipped to 16% in Q1 2024 and held steady through the rest of that year.

The decline accelerated in 2025. By Q2 2025, median revenue growth fell to 12.8%, with forecasts pointing to a further slowdown through at least Q3 2025

Valuation Drivers: Profitability

The other part of the SaaS company valuation equation is profitability because cash flow is essentially the most important matter in a company’s valuation. From 2015 to 2019, SaaS companies were on track to profitability with improving EBITDA and net income margins. But these improvements stagnated after 2019 and even declined slightly as early-stage, loss-making companies entered our index. For most of the past three years, a median public SaaS company operated with an 8-14% net loss. During that same time, immediate cash flow generation became less important as interest rates stayed close to zero.

Because of this, increased interest rates were a big blow to public SaaS companies’ valuations. While yields on short-term Treasuries grew to over 5%, valuation multiples for companies with significant losses declined the fastest.

With this change in the economic environment, SaaS businesses are now adapting to the new paradigm. Many have laid off staff, implemented a hiring freeze, decreased investments, and aggressively cut operating expenses.

The most exposed companies have high burn rates compared to their cash balance. With the IPO market frozen and debt getting increasingly expensive, many businesses need to break-even as soon as possible to stay afloat.

SaaS profitability trend in 2023

In Q1 2023, only 23 firms in our sample of 68 were profitable on a Net Income level, and 30 were profitable on an EBITDA level. Those that were profitable had a median revenue multiple of 7.8x, compared with 6.7x for unprofitable companies.

Let’s take Descartes, a vendor of SaaS logistics software as an example. In early 2023 they traded at 13.7x revenue while generating a healthy 40% EBITDA margin. The company was relatively immune from the tech sell-off that followed, while the stock prices of its peer SaaS companies plummeted.

By Q4 2023 we observed a fundamental shift as SaaS profitability margins advanced toward positive territory. Companies in our index touched an all-time high 4 quarters average EBITDA margin at +3%, while the 4 quarters average net income margin indicated a break-even level at 0%.

SaaS profitability trend in 2024

In Q1 2024, we see that the median EBITDA margin for SaaS has reached a new all-time high of 7%. This shows profitability is becoming a major focus for SaaS, and if the trend continues, we will soon see that SaaS will break even before the end of 2024. Currently, the median net profit margin stands at -1%.

SaaS 4 quarters average EBITDA margins have continued to advanced towards positive territory and reached 5% in Q2 2024. Also, net margin improved from -1% to 0% QoQ.

As of Q3 2024, both median EBITDA margin and net margins are positive, being 6% and 2% respectively. By the end of 2024 we saw that layoffs and drastic cost custting measures by SaaS companies slowed down. However, the focus on profitability remains a key driver for SaaS businesses.

SaaS profitability trend in 2025

SaaS companies have continued to improve profitability in 2025. Years of cost-cutting and efficiency measures are finally showing results. The median EBITDA margin reached 7.5% in Q2 2025, while the net income margin turned slightly positive at 1.2%.

Valuation Drivers: Rule of 40

The Rule of 40 is calculated as a sum of the company’s growth rate and profitability. As the argument goes, SaaS companies can easily choose between revenue and growth, so fast growth compensates for low profitability and vice versa. A healthy SaaS company is supposed to score above 40 on this metric.

As of January 2023, revenue growth decelerated for most companies. This slowdown wasn’t compensated by the increase in profit margin. Only a few companies exceeded the Rule of 40 with a comfortable margin (e.g., Adobe, Descartes, and EngageSmart).

In our latest update for Q2 2025, the picture remains challenging. The median Rule of 40 score is just 23%, down from around 30% in 2015, showing a steady decline over the past decade.

Out of 58 actively traded SaaS companies, only 13% exceeded the Rule of 40, showing that most are still struggling to balance slowing growth with profitability.

The Rule of 40 also has a direct impact on valuations. In Q2 2025, each 10-point improvement in this metric was linked to about a 1.5x increase in EV/Revenue multiples, up sharply from 0.8x in Q1. This shows how strongly investors now focus on operational efficiency.

Companies scoring above 40 attract premium valuations and stronger investor interest, while those below 40 face lower multiples and tougher fundraising or exit negotiations.

Private SaaS Valuations in M&A Transactions

In this section, we dive into the M&A deals involving SaaS companies over 2015-2025, focusing on valuation trends and key drivers.

Our Sample

In our analysis of Private SaaS M&A transactions, we looked at 1,000+ software deals since 2015 and marked the ones where the target company is considered to be operating a SaaS business model.

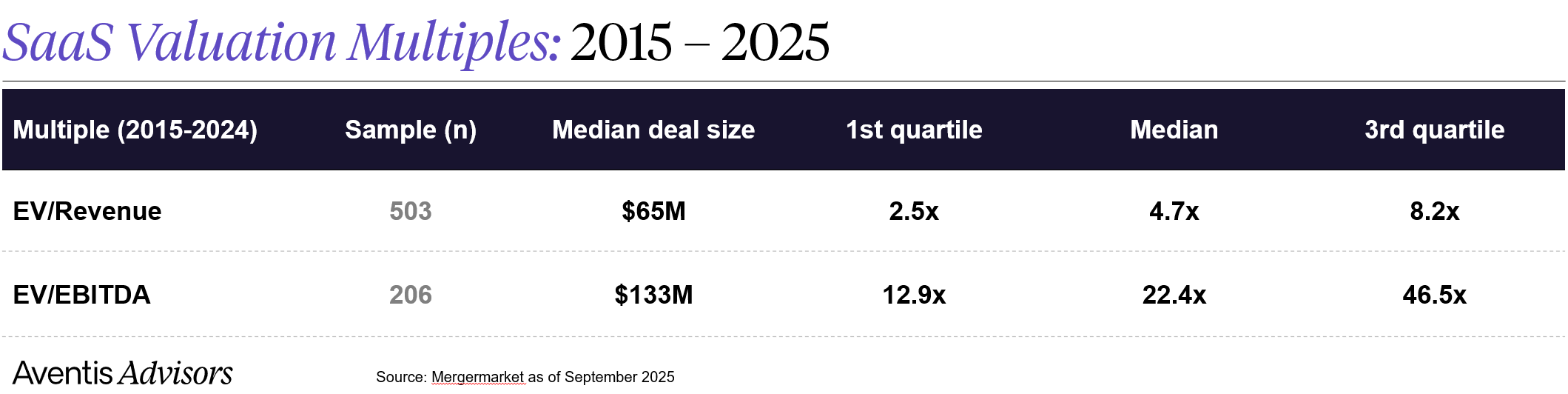

Over the past nine years, 503 SaaS transactions had a disclosed revenue multiple, and 206 transactions had a disclosed EBITDA valuation multiple.

EV/Revenue and EV/EBITDA Multiples for SaaS Companies

Despite the volatility in public markets, revenue multiples in private SaaS M&A transactions have generally been more stable over the past decade. However, shifts in deal mix and market sentiment have still had a noticeable impact in recent years.

Between 2015 and 2025, the median SaaS company was valued at around 4.7x EV/Revenue. A quarter of companies achieved valuations above 8.2x, reflecting strong growth, profitability, or strategic value to buyers.

During the 2020–2021 public market boom, private SaaS multiples saw only a modest increase, rising from 5.8x to 6.4x at the peak. By 2023, the median multiple had fallen sharply to 3.3x, reflecting a cooling M&A environment and tighter buyer scrutiny.

In 2024, the median revenue multiple reached a low of 2.9x, before jumping to 5.7x in 2025. This recent increase, however, is based on a relatively small sample of deals, so it should not be viewed as a definitive sign of market recovery. Much of the rise was driven by a higher proportion of large transactions over $50M, which naturally command higher multiples.

EBITDA multiples followed a similar pattern. Since 2019, deals involving profitable SaaS companies have consistently traded above 20.0x EV/EBITDA, with the median reaching 29.1x in 2022. In 2025, EBITDA multiples also spiked sharply, but the small deal sample limits how representative these figures are for the broader market.

The significant spread in valuations comes down to company fundamentals. Higher-valued SaaS firms typically operate in large, expanding markets, have low churn, high net revenue retention, and efficient customer acquisition strategies. Among these factors, deal size remains the single strongest predictor of valuation, which we explore in the following section.

Valuation Drivers: Company Size

Deal size is one of the most important determinants of the valuation multiple. In our sample, the median revenue multiple was almost twice as high for deal sizes in the $50-100M basket as compared to the $20-50M basket.

There may be several factors contributing to this large difference:

- Many larger M&A transactions involve targets from the public market. This means buyers need to pay a premium to delist the company from the stock exchange.

- A lot of the larger deals are highly strategic, with buyers tending to pay a premium to acquire companies that may be synergistic with their own products. For example, recent acquisitions of Slack by Salesforce, Figma by Adobe (the regulators called off the acquisition), Mailchimp by Intuit, etc.

- Larger companies typically operate in larger total addressable markets with ample growth potential, while many smaller software businesses are local and difficult to scale (e.g. cloud accounting software in European countries).

- A larger transaction size opens up a larger base of potential investors. Many top private equity funds with low cost of capital have a strict minimum investment size in their mandates.

SaaS vs On-Premise Software Company Valuations

In our analysis, we compared the valuations of businesses operating a SaaS model with those of non-SaaS businesses such as on-premise software providers, API/SDK platforms, and software component companies.

Between 2015 and 2020, the SaaS premium, which represents the valuation difference between SaaS and non-SaaS companies, remained strong at more than 40 percent. By 2021, however, non-SaaS valuations increased sharply to a median of 5.3x EV/Revenue, which narrowed this premium as demand shifted toward traditional software businesses.

In 2023, SaaS valuations continued to decline in a challenging M&A environment. The sample of non-SaaS transactions during this period was too small to establish a reliable median, but there were clear signs of growing investor interest in these segments. With significant capital still chasing deals, buyers began to focus on non-SaaS targets, which pushed up competition and valuations for hybrid and on-premise models.

By 2024, the SaaS premium recovered, with SaaS companies valued about 27 percent higher than their non-SaaS peers. This trend appeared even stronger in 2025, with the premium rising sharply. However, the 2025 data is based on a relatively small number of non-SaaS deals, so the actual premium may be less dramatic than the figures suggest.

At the same time, many traditional on-premise companies have been accelerating their transition to cloud delivery and subscription-based pricing. As a result, their business models increasingly resemble those of SaaS companies, which is gradually blurring the lines between the two categories and influencing how investors assess valuation.

Public Markets vs Private SaaS Valuations

After several years of significant overvaluation, public SaaS valuations fell sharply by the end of 2022, bringing them much closer to private M&A deal multiples. Throughout most of 2023 and 2024, public and private valuations moved in line with each other, reflecting a more balanced and stable market environment.

In 2025, public multiples showed signs of stabilizing. By August 2025, the median EV/Revenue multiple reached 6.1x, which is higher than the lows recorded in 2024 but still well below the 2021 peak. While this indicates progress toward healthier pricing, the market remains far from the levels seen during the pandemic-driven boom.

2026 SaaS M&A Outlook

We expect SaaS deal activity to strengthen in 2026, supported by two major factors:

- Lower interest rates, with the Federal Reserve signaling additional cuts through 2025.

- Record levels of dry powder in both private equity and venture capital, ready to be deployed in technology M&A.

As financing becomes cheaper, buyers will be more willing to pursue acquisitions, while sellers will see more attractive exit opportunities.

- Artificial Intelligence is expected to remain in focus. While SaaS companies have already started leveraging the integration of OpenAI’s ChatGPT into their products, this may not be a standalone reason to unlock a valuation premium. Instead, SaaS companies with proprietary or in-house AI integrations will command higher premiums, reflecting the market’s growing appetite for advanced technology stacks and adapting to newer trends such as M&A in AI.

- Deal flow will favor larger, scaled platforms with strong retention and clear paths to profitability. Smaller targets will still trade but with tighter diligence and more earnout structures. AI remains a key factor: basic integrations won’t drive value, but proprietary models and embedded workflows will.

- The U.S. will lead activity, with Europe gaining as rates ease. Expect cross-sector deals as incumbents in payments, healthcare, and industrials acquire SaaS + AI to stay competitive. Select IPOs may return for profitable, scaled companies, while most exits will be secondary buyouts or dual-track processes.

- In 2026, premium multiples will go to SaaS businesses with durable growth, strong cash flow, and defensible AI capabilities.

- AI M&A deals could complement SaaS products and may rise in popularity with strategic companies rushing to maintain the lead in the AI race.

Why you need a SaaS M&A advisor

Monitoring SaaS company valuations offers important insights into market trends and aids in timing your exit strategy. However, each SaaS business is unique, much like every founder’s journey. Therefore, it’s essential to consult with experts in the SaaS M&A landscape, particularly advisors who specialize in the SaaS sector and can understand your unique circumstances.

SaaS M&A advisors understand how to navigate market dynamics, valuations, and coordinate all the necessary workstreams. While you concentrate on running your business, SaaS M&A advisors work diligently to ensure that no detail is overlooked and advocate for the best possible deal. Their success is directly linked to yours through a success fee structure, and their influence on the final sale price can therefore be substantial.

About Aventis Advisors

Aventis Advisors is an M&A advisor for SaaS companies. We believe the world would be better off with fewer (but better quality) M&A deals done at the right moment for the company and its owners. Our goal is to provide honest, insight-driven advice, clearly laying out all the options for our clients – including the one to keep the status quo.

Get in touch with us to discuss how much your business could be worth and how the process looks.