Wstęp

Branża SaaS jest dynamiczna, szybko rozwijająca się i pełna możliwości. Jako założyciel zbudowałeś maszynę do generowania stałych przychodów, rozwiązując rzeczywiste problemy za pomocą skalowalnego oprogramowania, jednocześnie generując przewidywalny dochód. Ale w pewnym momencie możesz zacząć zastanawiać się nad kolejnym krokiem: czy skalować dalej, dokonać zwrotu, czy wyjść z inwestycji.

Sprzedaż firmy SaaS to poważna decyzja, a poruszanie się po tym procesie może wydawać się skomplikowane. Jednak dzięki odpowiedniej strategii sprzedaż może być płynnym, zyskownym przejściem, a nie przytłaczającym wyzwaniem.

W tym przewodniku omówiono wszystko, co musisz wiedzieć o sprzedaży firmy SaaS - od powodów sprzedaży firmy, zrozumienia wskaźników wyceny, takich jak roczny przychód cykliczny (ARR) i koszt pozyskania klienta (CAC), po identyfikację poważnych nabywców, strukturyzację transakcji i optymalizację strategii wyjścia. Przeanalizujemy również kwestie związane ze sprzedażą, zapewniając maksymalizację wartości i przygotowanie się do kolejnego przedsięwzięcia.

Sprzedaż firmy SaaS nie chodzi tylko o wypłatę gotówki - chodzi o wykorzystanie zbudowanej wartości i stworzenie nowych możliwości na przyszłość. Niniejszy przewodnik zawiera jasną mapę drogową, która pomoże Ci ocenić, czy sprzedaż jest właściwym krokiem i jak skutecznie poruszać się po tym procesie.

Spis treści

- Główne powody, dla których założyciele SaaS decydują się na sprzedaż

- Przygotowanie firmy SaaS do sprzedaży

- Gdzie sprzedać swój biznes SaaS?

- Znalezienie odpowiedniego nabywcy

- Jak działa proces sprzedaży

- Rozważania po sprzedaży

- Pomiar wartości działalności SaaS

- Najczęstsze pułapki, których należy unikać

- O Aventis Advisors

Główne powody, dla których założyciele SaaS decydują się na sprzedaż

Sprzedaż firmy SaaS to poważna decyzja. Włożyłeś całe serce w jej zbudowanie, a myślenie o wyjściu z inwestycji oznacza zastanowienie się nad wartością, którą stworzyłeś i możliwościami, które masz przed sobą.

Oto kilka typowych powodów, dla których założyciele SaaS decydują się na sprzedaż swoich firm:

Chcesz przenieść swój biznes na wyższy poziom, ale brakuje Ci środków

Skalowanie działalności SaaS wymaga znacznych zasobów - kapitału, infrastruktury i dostępu do nowych rynków. Jeśli jesteś ograniczony w tych obszarach, sprzedaż strategicznemu nabywcy z głębszymi kieszeniami lub szerszym zasięgiem może odblokować szybszy wzrost. Nie chodzi o wycofanie się; chodzi o uznanie, że inny podmiot może pomóc w szybszym i bardziej efektywnym skalowaniu produktu SaaS.

Skupiasz się głównie na tworzeniu świetnych produktów

W miarę rozwoju firmy SaaS możesz zostać zasypany kwestiami operacyjnymi, kosztami pozyskiwania klientów i zadaniami administracyjnymi. Jeśli twoją pasją jest rozwój produktu, sprzedaż może uwolnić cię od codziennego zarządzania, pozwalając ci skupić się na innowacjach. Wielu założycieli firm SaaS decyduje się na sprzedaż, gdy zdają sobie sprawę, że wolą stworzyć kolejny duży produkt, niż zajmować się ciężkimi sprawami operacyjnymi.

Twój produkt może być częścią większego pakietu

W niektórych przypadkach biznes SaaS może mieć większy potencjał jako część większej oferty usług. Nabywcy często szukają oprogramowania, które uzupełnia ich istniejące usługi, umożliwiając sprzedaż krzyżową i rozszerzenie zasięgu klientów.

Większa firma może zaoferować Twojemu produktowi SaaS nowe rynki i klientów, do których trudno byłoby dotrzeć samodzielnie. Dzięki temu sprzedaż staje się strategiczną decyzją, zapewniającą pełne wykorzystanie potencjału produktu.

Chcesz czerpać korzyści

Po latach poświęceń sprzedaż firmy SaaS może być zwieńczeniem ciężkiej pracy. Niezależnie od tego, czy szukasz wolności finansowej, odkrywasz nowe przedsięwzięcia, czy po prostu cieszysz się owocami swojej pracy, sprzedaż pozwala ci zarobić na swoim sukcesie.

Dla wielu założycieli chodzi o coś więcej niż tylko wartość pieniężną - chodzi o elastyczność, aby móc realizować inne pasje lub wycofać się po zbudowaniu wartościowego i dochodowego biznesu.

Ciekawi Cię wartość Twojej firmy SaaS?

Porozmawiajmy! Uzyskaj bezpłatną 60-minutową wycenę już teraz.

Przygotowanie firmy SaaS do sprzedaży

Do przygotowanie firmy SaaS do sprzedażyNależy skupić się na strategicznych krokach, które zwiększą wycenę, zapewnią dobre wyniki finansowe i przyciągną wykwalifikowanych nabywców. Staranne przygotowanie nie tylko zwiększy wartość firmy, ale także przyspieszy proces sprzedaży i zwiększy prawdopodobieństwo znalezienia odpowiedniego nabywcy.

Poniżej znajdują się kluczowe kroki, aby zmaksymalizować atrakcyjność firmy i zapewnić płynną sprzedaż.

Krok 1: Ulepsz swoją wycenę biznesową SaaS

Przed przystąpieniem do procesu sprzedaży kluczowe jest zwiększenie wartości firmy poprzez strategiczne decyzje. Wiąże się to z harmonogramem sprzedaży, optymalizacją cen, udoskonaleniem strategii sprzedaży i zmniejszeniem zależności właściciela.

Czas sprzedaży zapewniający najwyższą wydajność

Maksymalizacja wyceny firmy SaaS oznacza sprzedaż w najlepszym momencie. Silne trendy wzrostowe i pozytywne perspektywy rynkowe zwiększają zaufanie kupujących. Większość nabywców, w tym firmy private equity i nabywcy strategiczni, poszukują firm o zrównoważonych przychodach i potencjale wzrostu.

W ciągu ostatnich dziewięciu lat tempo wzrostu SaaS stopniowo zwalniało w miarę osiągania przez firmy skali, a mediana wzrostu spadła do 23% r/r w drugim kwartale 2020 roku. Podczas gdy pandemia tymczasowo odwróciła ten trend, pociągając popyt do przodu i przyspieszając wzrost, rynek powrócił do swojej długoterminowej trajektorii. Po osiągnięciu szczytowego poziomu w drugim kwartale 2021 r., tempo wzrostu normalizuje się i może nawet dalej spadać, jeśli warunki makroekonomiczne ulegną pogorszeniu.

Podczas gdy szacunki wskazują na wolniejszy wzrost pod koniec 2024 r. i na początku 2025 r., w drugiej połowie 2025 r. spodziewane jest potencjalne przyspieszenie. Zmiana ta może być spowodowana niższymi stopami procentowymi, pojawiającymi się branżami SaaS i postępami w zakresie sztucznej inteligencji zwiększającymi możliwości oprogramowania. Dla założycieli SaaS rozważających wyjście z inwestycji zrozumienie tych trendów ma kluczowe znaczenie - zsynchronizowanie sprzedaży z odnowionym optymizmem inwestorów może prowadzić do wyższej wyceny i zwiększonego zainteresowania kupujących.

Optymalizacja strategii cenowej

Zaniżanie cen jest częstym błędem wśród założycieli SaaS, ponieważ często obawiają się oni rezygnacji klientów z powodu podwyżek cen. Jednak zaniżanie wartości produktu SaaS może zaszkodzić postrzeganej wartości i ogólnej rentowności.

Regularna ponowna ocena strategii cenowej może znacząco zwiększyć przychody i wycenę firmy. Nawet niewielkie podwyżki cen, jeśli są odpowiednio wdrożone, mogą mieć duży wpływ na miesięczne przychody cykliczne (MRR) i roczne przychody cykliczne (ARR), które są kluczowymi wskaźnikami wyceny w branży SaaS. Wskaźniki te są ściśle analizowane przez potencjalnych nabywców podczas oceny wyceny przedsiębiorstwa.

Dopracowanie strategii sprzedaży

Aby zwiększyć postrzeganą wartość swojej działalności SaaS, należy zdywersyfikować bazę klientów i dotrzeć do klientów korporacyjnych o wysokiej wartości. Podczas gdy wiele firm SaaS polega na samoobsługowych modelach sprzedaży, korzystanie z modeli sprzedaży wspomaganej może pomóc w zdobyciu większych kontraktów. Te transakcje na poziomie korporacyjnym zwiększają średnią wartość kontraktu (ACV), poprawiają stabilność przepływów pieniężnych i sprawiają, że Twoja firma jest bardziej atrakcyjna dla strategicznych nabywców.

Ekspansja na nowe rynki i zmniejszenie zależności od jednego segmentu klientów również zwiększa wycenę firmy i zmniejsza ryzyko dla nowego nabywcy.

Zmniejszenie zależności od właściciela

Firma w dużym stopniu zależna od swojego założyciela podniesie czerwone flagi dla potencjalnych nabywców. Wdrażaj procesy, które pozwolą Twojej firmie SaaS działać niezależnie. Przeszkol pracowników, zautomatyzuj rutynowe operacje i wprowadź struktury przywódcze, aby zapewnić, że firma będzie mogła nadal prosperować bez ciebie. Większość kupujących, w tym ci z największego rynku dla firm internetowych, preferuje firmy, które wymagają minimalnego wysiłku ze strony nowego właściciela.

Krok 2: Zorganizuj dane finansowe i wskaźniki SaaS

Solidne dane finansowe i jasno przedstawione wskaźniki SaaS mają kluczowe znaczenie w procesie sprzedaży. Kupujący będą analizować kondycję finansową firmy i poszukiwać spójnych, przewidywalnych strumieni przychodów. Oto jak przygotować swoje finanse i wskaźniki:

Poznaj swoje wskaźniki SaaS

Potencjalni nabywcy będą oceniać kluczowe wskaźniki SaaS, takie jak:

Zapewnienie jasnej narracji wokół tych wskaźników, która wyjaśnia trendy i kluczowe podjęte decyzje, znacznie zwiększy zaufanie kupujących i usprawni proces due diligence. Dobrze skonstruowane wyjaśnienie tych liczb może stanowić różnicę między przyciągnięciem poważnie zainteresowanych nabywców a radzeniem sobie z kopaczami opon. Aby dowiedzieć się, jaki jest Twój aktualny poziom gotowości, zobacz, jak skorzystać z naszej usługi Pulpit gotowości do wyjścia z SaaS.

Dokładność prognoz finansowych

Poza uporządkowaniem danych finansowych i wskaźników, tworzenie dokładnych i przekonujących prognoz finansowych ma ogromne znaczenie w procesie sprzedaży. Prognozy te - obejmujące prognozy przychodów, przewidywania wydatków i szacowane stopy wzrostu - działają jak okno na przyszłość firmy, umożliwiając potencjalnym nabywcom ocenę jej rentowności i skalowalności.

Profesjonalna wycena, która obejmuje wskaźniki wyników finansowych, takie jak zysk netto, uznaniowe zarobki sprzedającego i dochód netto, będzie stanowić wsparcie dla ceny wywoławczej. Silne prognozy finansowe mogą kształtować proces negocjacji, pomagając uzasadnić najwyższe mnożniki i zapewnić korzystną transakcję. Prognozy te muszą być jednak oparte na danych, realistyczne i stale aktualizowane w miarę rozwoju firmy i zmian warunków rynkowych.

Utrzymywanie aktualnych informacji o firmie przez cały czas.

Proces sprzedaży spółki SaaS jest dynamiczny i może trwać kilka miesięcy. W tym czasie firma będzie nadal działać, pozyskiwać nowych klientów i generować przychody. Oznacza to, że kluczowe wskaźniki nie pozostaną takie same, ale będą nadal ewoluować. Kluczowe jest aktualizowanie tych wskaźników podczas procesu sprzedaży.

Regularne aktualizacje zapewniają potencjalnym nabywcom dokładne zrozumienie wyników firmy w czasie rzeczywistym. Nie tylko zwiększa to przejrzystość, ale także pokazuje zaangażowanie w utrzymanie dobrej kondycji firmy, nawet w okresie przejściowym, zwiększając tym samym zaufanie kupujących. Kupujący, którzy chcą nabyć lidera rynku, docenią aktualne dane finansowe, które mogą mieć duże znaczenie dla zabezpieczenia transakcji.

Krok 3: Uwzględnienie wymogów prawnych

Dokładne przygotowanie prawne jest niezbędne do zapewnienia płynnego i udanego procesu sprzedaży. Rozpoczyna się to od kompleksowego przeglądu wszystkich umów, w tym umów z klientami, umów z dostawcami i umów z pracownikami, w celu zidentyfikowania i rozwiązania wszelkich niekorzystnych warunków, które mogłyby skomplikować transakcję. Upewnienie się, że wszystkie umowy są dobrze udokumentowane i zgodne z prawem, może pomóc zapobiec nieoczekiwanym problemom podczas badania due diligence.

Oprócz przeglądu umów, kluczowe znaczenie ma zabezpieczenie i udokumentowanie praw własności intelektualnej (IP), takich jak znaki towarowe, patenty i prawa autorskie. Jasna własność własności intelektualnej nie tylko chroni firmę przed ryzykiem prawnym, ale także zapewnia potencjalnych nabywców o jej długoterminowej wartości. Zaangażowanie doświadczonego doradcy M&A może pomóc usprawnić te przygotowania prawne i wzmocnić Twoją pozycję w procesie sprzedaży.

Krok 4: Przygotowanie atrakcyjnego pakietu danych

Pakiet danych to bezpieczne repozytorium online, w którym przechowywane są wszystkie krytyczne dokumenty biznesowe. Obejmuje to sprawozdania finansowe, umowy, dane użytkowników, wskaźniki operacyjne i wszystko inne, czego potencjalny nabywca może potrzebować do oceny Twojej firmy.

Przygotowanie atrakcyjnego pokoju danych nie tylko przyspiesza proces due diligence, ale także pokazuje potencjalnym nabywcom, że Twoja firma jest dobrze zorganizowana i przejrzysta. Dobrze przygotowany pokój danych może stanowić różnicę między płynną transakcją a jej fiaskiem.

Gdzie sprzedać swój biznes SaaS?

Do rozważenia jest kilka ścieżek, w tym sprzedaż bezpośrednio zainteresowanym nabywcom, wystawienie na rynku online lub współpraca z doradcą ds. fuzji i przejęć. Każda z tych opcji wiąże się z innymi korzyściami i wyzwaniami.

Sprzedaż bezpośrednia strategicznym nabywcom

Jednym ze sposobów sprzedaży firmy SaaS jest bezpośrednie dotarcie do potencjalnych nabywców - takich jak konkurenci, liderzy branży lub firmy private equity - którzy mogą postrzegać Twoją firmę SaaS jako cenne przejęcie. Jeśli masz już kontakty lub znasz firmy, które mogą być zainteresowane, takie podejście może być skuteczne.

Jak znaleźć nabywców:

- Wykorzystaj swoją sieć: Dotrzyj do kontaktów branżowych, partnerów, a nawet klientów, którzy mogą być zainteresowani nabyciem Twojej firmy programistycznej.

- Cold Outreach: Podobnie jak w przypadku pozyskiwania nowych klientów, możesz wysyłać e-maile lub dzwonić do strategicznych nabywców i prezentować swoją działalność. Podkreśl swoje powtarzające się przychody, zysk netto i pozycję rynkową, aby wzbudzić zainteresowanie.

- Wydarzenia branżowe i społeczności internetowe: Bierz udział w wydarzeniach związanych z branżą SaaS i technologiczną lub uczestnicz w forach internetowych, na których aktywni są potencjalni nabywcy.

Zalety:

- Pełna kontrola nad negocjacjami i warunkami transakcji

- Brak opłat brokerskich - maksymalizacja uznaniowych zarobków sprzedającego

Wady:

- Wymaga dużego wysiłku w zakresie wyszukiwania, docierania i negocjowania.

- Ryzyko radzenia sobie z oponami (kupujący, którzy nie są poważni).

- Nawet bez opłaty doradczej, nadal będziesz musiał zatrudnić prawnika i księgowego.

Umieszczenie swojej firmy SaaS na platformie Marketplace

Dla założycieli SaaS szukających szybko nowego nabywcy, internetowe platformy biznesowe mogą być świetną opcją. Platformy te działają jako największy rynek kupna i sprzedaży firm online, umożliwiając wystawienie produktu SaaS tam, gdzie aktywnie poszukują go wykwalifikowani nabywcy.

Popularne rynki do sprzedaży działalności SaaS:

- Acquire.com: Wiodąca platforma do kupowania i sprzedawania firm SaaS, z naciskiem na bootstrapped i dochodowe firmy.

- Flippa: Ogólny rynek kupna i sprzedaży firm internetowych, w tym mniejszych startupów SaaS.

- Empire Flippers: Wyselekcjonowany rynek dla uznanych i dochodowych firm internetowych, w tym firm SaaS.

- MicroAcquire: Platforma przeznaczona specjalnie do pozyskiwania i sprzedawania firm SaaS typu bootstrapped.

Zalety:

- Dostęp do szerokiej puli zainteresowanych nabywców.

- Może prowadzić do szybszego procesu sprzedaży niż sprzedaż bezpośrednia.

Wady:

- Musisz samodzielnie zweryfikować kupujących, co może być czasochłonne.

- Platformy handlowe mogą pobierać opłaty za wystawienie lub prowizję.

- Mniejsza szansa na uzyskanie najwyższych mnożników w porównaniu ze sprzedażą w ramach fuzji i przejęć.

Współpraca z doradcą ds. fuzji i przejęć w celu uzyskania maksymalnej wartości

Dla założycieli SaaS poszukujących najwyższej wyceny i bezproblemowej sprzedaży, współpraca z doradcą ds. fuzji i przejęć jest często najlepszą strategią. Doświadczeni doradcy specjalizują się w planowaniu wyjścia z inwestycji i łączą sprzedających z nabywcami strategicznymi lub firmami private equity, które są skłonne zapłacić premię za odpowiedni biznes.

Dlaczego warto wybrać doradcę ds. fuzji i przejęć?

- Profesjonalna wycena: Eksperci oceniają ARR, MRR, dochód netto, CAC, wskaźnik rezygnacji i przyszłą rentowność, aby zapewnić najwyższe mnożniki.

- Weryfikacja kupujących i negocjacje: Odfiltrowują oni kandydatów i zajmują się negocjacjami, aby zmaksymalizować wartość transakcji.

- Sprawny proces sprzedaży: Doradcy ds. fuzji i przejęć zarządzają analizą due diligence, umowami i zamknięciem transakcji, ograniczając kwestie operacyjne.

Zalety:

- Dostęp do zamożnych nabywców strategicznych i firm private equity.

- Mniej dźwigania - doradcy zajmują się negocjacjami i papierkową robotą.

- Większe prawdopodobieństwo sprzedaży premium, szczególnie w przypadku liderów rynku.

Wady:

- Doradcy pobierają opłaty za sukces, zazwyczaj stanowiące procent ceny sprzedaży.

- Okres zarobkowy może być wymagany w niektórych transakcjach, w zależności od modelu biznesowego.

Wybór właściwej ścieżki sprzedaży firmy SaaS

Najlepsza strategia wyjścia zależy od wielkości firmy, jej rentowności i potencjału wzrostu. Bezpośrednia sprzedaż za pośrednictwem outreach lub marketplace może zadziałać, jeśli priorytetem jest szybkość i jesteś przygotowany do samodzielnego zarządzania procesem. Opcje te wymagają jednak znacznego wysiłku i nie dają gwarancji uzyskania najlepszej wyceny.

Dla tych, którzy dążą do maksymalizacji wartości i przyciągnięcia poważnych nabywców, doradca ds. fuzji i przejęć zapewnia najlepszą szansę na płynne i zyskowne wyjście z inwestycji. Zajmując się negocjacjami, pozyskiwaniem nabywców i analizą due diligence, doradcy pozwalają założycielom skupić się na rozwoju firmy, zapewniając jednocześnie optymalną strukturę transakcji.

Kupujący strategiczny kontra kupujący finansowy - który z nich jest odpowiedni dla Ciebie?

Jak przygotować firmę do sprzedaży

Znalezienie odpowiedniego nabywcy

Znalezienie odpowiedniego nabywcy dla Twojej firmy SaaS ma kluczowe znaczenie dla maksymalizacji jej wartości i zapewnienia płynnego przejścia. Idealny nabywca powinien zgadzać się z wizją firmy, dysponować zasobami finansowymi wspierającymi rozwój i dostrzegać strategiczną wartość produktu SaaS. Współpraca z doradcą ds. fuzji i przejęć znacznie zwiększa prawdopodobieństwo pozyskania odpowiedniego nabywcy, jednocześnie usprawniając cały proces sprzedaży.

Rodzaje potencjalnych nabywców

W transakcjach fuzji i przejęć powszechny jest podział kupujących na dwie grupy: inwestorzy strategiczni i finansowi. Jednak w sektorze SaaS, trzecia kategoria - pionowe konglomeraty oprogramowania - również odgrywa znaczącą rolę.

- Pionowy konglomerat oprogramowania: Ważnym typem nabywcy specyficznym dla firm SaaS są pionowe konglomeraty oprogramowania (np. Constellation Software). Podmioty te łączą w sobie cechy zarówno nabywców strategicznych, jak i finansowych. Koncentrują się na wskaźnikach wyceny biznesowej, takich jak powtarzające się przychody i zyski, ale obsługują swoje przejęcia w nieskończoność, odblokowując wartość w czasie bez planowanej strategii wyjścia.

- Strategiczni nabywcy: Nabywcy strategiczni to zazwyczaj inne firmy programistyczne, konkurenci lub gracze branżowi, którzy chcą zwiększyć swój udział w rynku, pozyskać nowych klientów lub zintegrować uzupełniającą technologię. Nabywcy ci są często skłonni zapłacić wyższą cenę ze względu na synergie, jakie mogą osiągnąć po przejęciu.

- Private Equity i nabywcy finansowi: Firmy private equity i inni inwestorzy finansowi koncentrują się przede wszystkim na wynikach finansowych, stałych przychodach i potencjale wzrostu. Szukają firm z silnymi przepływami pieniężnymi, stabilnym dochodem netto i wysoką skalowalnością. W przeciwieństwie do nabywców strategicznych, zazwyczaj mają oni plan wyjścia, mający na celu sprzedaż firmy po wyższej wycenie po usprawnieniu działalności.

Jak ocenić właściwe dopasowanie nabywcy?

Wybór odpowiedniego nabywcy wiąże się z oceną jego zdolności finansowej, aby upewnić się, że stać go na zakup i późniejsze koszty operacyjne. Równie ważne jest dopasowanie strategiczne, ponieważ nabywca powinien podzielać wizję firmy i plany rozwoju. Wreszcie, nie należy zapominać o zgodności kulturowej. Nabywca powinien współgrać z kulturą i wartościami firmy, aby przejście po sprzedaży było płynne zarówno dla zespołu, jak i klientów.

Jak działa proces sprzedaży

Poruszanie się po złożonych wodach sprzedaży firmy SaaS obejmuje wiele etapów, z których każdy ma swoje własne znaczenie i wyzwania. To właśnie na tych etapach wiedza doradcy ds. fuzji i przejęć staje się nieoceniona.

Etap 1: Negocjowanie umowy

Proces ten często rozpoczyna się od "teasera" - krótkiego, anonimowego dokumentu zaprojektowanego w celu wzbudzenia zainteresowania potencjalnych nabywców bez ujawniania tożsamości firmy SaaS. Dokument ten zazwyczaj podkreśla kluczowe punkty sprzedaży, atrakcyjne wskaźniki i siłę modelu powtarzalnych przychodów przy jednoczesnym zachowaniu poufności.

Następnym dokumentem jest Memorandum Informacyjne (Info Memo), czyli szczegółowy dokument zawierający kompleksowe informacje na temat firmy SaaS. Obejmuje on wszystko, od historii firmy, opisów produktów, analizy rynku, wyników finansowych, kluczowych wskaźników SaaS, takich jak miesięczny przychód cykliczny (MRR) i koszt pozyskania klienta (CAC), po prognozy na przyszłość. Memorandum informacyjne jest podstawowym dokumentem, którego potencjalni nabywcy będą używać do oceny wyceny firmy.

Po memorandum informacyjnym zwykle następuje faza pytań i odpowiedzi, w której zainteresowane strony mogą uzyskać wyjaśnienia i więcej informacji. Doradca ds. fuzji i przejęć pomoże zarządzać tym procesem, odpowiadając na pytania i zapewniając, że cała komunikacja wspiera ogólną strategię negocjacyjną, co ma kluczowe znaczenie dla przyciągnięcia wykwalifikowanych nabywców.

Ważnym kamieniem milowym w procesie zawierania transakcji jest list intencyjny (LOI). Jest to dokument, który określa zamiar kupującego dotyczący zakupu firmy, w tym proponowaną cenę i warunki. Chociaż nie jest prawnie wiążący, LOI oznacza poważne intencje ze strony kupującego i pozwala obu stronom przejść do bardziej szczegółowych negocjacji, ostatecznie pomagając zmaksymalizować wartość Twojej firmy SaaS.

Po zaakceptowaniu LOI, kupujący rozpocznie proces due diligence. Obejmuje on dokładny przegląd firmy, w tym aspektów finansowych, prawnych i technicznych. Due diligence finansowe ocenia kondycję finansową spółki, koncentrując się na przepływach pieniężnych i zysku netto. Prawne due diligence bada zobowiązania umowne, spory prawne oraz zgodność z prawem i przepisami. Techniczne badanie due diligence obejmuje dogłębną analizę oprogramowania, w tym jego architektury, bazy kodu, skalowalności i potencjału przyszłej rentowności.

Etap 2: Zamknięcie transakcji

Etap zamknięcia obejmuje sfinalizowanie umowy kupna-sprzedaży (SPA) i zorganizowanie płatności za pomocą bezpiecznej metody, takiej jak usługa escrow. Doradca ds. fuzji i przejęć, współpracując z zespołem prawnym, zapewnia, że wszystkie te kroki zostaną wykonane sprawnie i w najlepszym interesie klienta.

Na tych etapach doradca ds. fuzji i przejęć odgrywa kluczową rolę. Pomagają przygotować teaser i memorandum informacyjne, aby upewnić się, że są one atrakcyjne i dokładne. Zarządza procesem pytań i odpowiedzi, pomagając odpowiadać na zapytania w sposób maksymalizujący postrzeganą wartość. Wreszcie, kieruje wszystkimi negocjacjami, wykorzystując swoją wiedzę rynkową i doświadczenie, aby zapewnić najlepsze możliwe warunki.

Rozważania po sprzedaży

Po sprzedaży firmy SaaS należy wziąć pod uwagę kilka kluczowych kwestii, aby zapewnić płynne przejście i zabezpieczyć swoją przyszłość finansową.

Okres przejściowy

Po pierwsze, wiele transakcji obejmuje okres przejściowy, w którym poprzedni właściciel zapewnia wsparcie nowemu właścicielowi. Zazwyczaj obejmuje to szkolenie nowego właściciela lub zespołu zarządzającego, przedstawianie ich kluczowym klientom lub partnerom oraz pomoc w rozwiązywaniu wszelkich wyzwań, które pojawiają się w pierwszych dniach po przejęciu. Długość i charakter tego okresu wsparcia przejściowego powinny być jasno określone w umowie sprzedaży udziałów.

Umowy o zakazie konkurencji

Po drugie, umowy o zakazie konkurencji są powszechne w sprzedaży firm SaaS. Te prawnie wiążące umowy ograniczają sprzedającemu możliwość rozpoczęcia podobnej działalności lub współpracy z bezpośrednim konkurentem przez określony czas i na określonym obszarze geograficznym. Podczas gdy umowy te chronią inwestycję kupującego, jako sprzedający ważne jest, aby upewnić się, że warunki umowy o zakazie konkurencji są uczciwe i rozsądne oraz nie będą nadmiernie ograniczać możliwości przyszłej kariery.

Konsekwencje podatkowe

Wreszcie, sprzedaż firmy może mieć znaczące konsekwencje podatkowe i będziesz musiał zaangażować się w staranne planowanie finansowe, aby skutecznie zarządzać nowo odkrytym bogactwem. W zależności od jurysdykcji i struktury transakcji, możesz mieć do czynienia z podatkiem od zysków kapitałowych lub innymi zobowiązaniami podatkowymi. Zaleca się współpracę z doradcą podatkowym lub planistą finansowym, który pomoże ci zrozumieć konsekwencje podatkowe sprzedaży, zidentyfikować strategie minimalizacji zobowiązań podatkowych oraz poprowadzi cię w inwestowaniu i zarządzaniu finansami po sprzedaży.

Pomiar wartości działalności SaaS

Przed przystąpieniem do procesu sprzedaży niezbędne jest określenie wyceny firmy SaaS. Zrozumienie wartości firmy pomaga ustalić realistyczne oczekiwania, przyciągnąć wykwalifikowanych nabywców i zmaksymalizować cenę sprzedaży. Firmy SaaS są zazwyczaj wyceniane w oparciu o trzy podstawowe metody, z których najczęściej stosowaną jest wielokrotność przychodów.

Mnożniki przychodów SaaS

Na stronie Najpopularniejsza metoda wyceny dla firmy SaaS jest przez Wielokrotność EV/Revenue (Enterprise Value to Revenue), a nie EV/EBITDA. Wynika to z faktu, że wiele firm SaaS przedkłada wzrost nad rentowność, reinwestując przychody w pozyskiwanie klientów, rozwój produktów i ekspansję rynkową. Model biznesowy SaaS pozwala na tymczasową nierentowność, o ile powtarzające się przychody i przyszłe trendy rentowności pozostają silne.

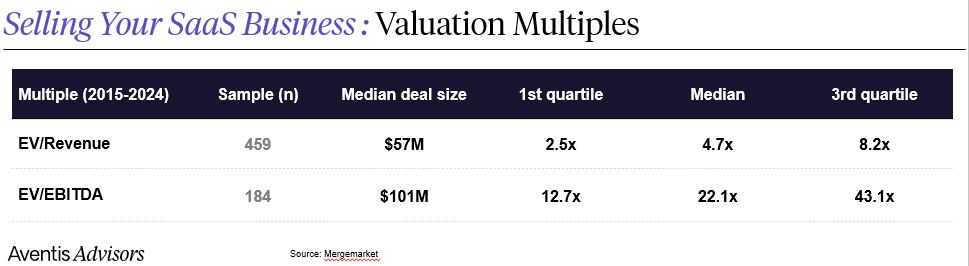

W naszej analizie ponad 450 transakcji pokazuje medianę wielokrotność przychodów na poziomie 4,7x, przy czym wyceny znacznie się różnią:

- Najlepsze 25% transakcji osiągnęło mnożniki powyżej 8,2x

- Dół 25% widział mnożniki poniżej 2,5x

Wielkość transakcji odegrała ważną rolę w określaniu wyceny SaaS, przy czym większe transakcje generalnie wymagają znacznie wyższych mnożników. Przykładowo, nasza analiza przejęć SaaS wykazała, że transakcje z przedziału $50M-$100M miały medianę mnożników przychodów na poziomie 6,3x, podczas gdy te z przedziału $100M-$500M miały medianę mnożników na poziomie 5,4x. Z kolei w przypadku mniejszych transakcji ($5M-$20M i $20M-$50M) mediana mnożników była znacznie niższa i wynosiła odpowiednio 3,2x i 3,1x.

Rozbieżność tę można przypisać kilku czynnikom. Większe, bardziej ugruntowane firmy SaaS są często postrzegane jako mniej ryzykowne inwestycje, oferujące większą przewidywalność i stabilność. Ponadto, podmioty przejmujące mogą osiągnąć korzyści skali i efektywność operacyjną poprzez integrację większej firmy. Wreszcie, przejęcie głównego gracza na rynku może pomóc skonsolidować udział w rynku i wzmocnić przewagę konkurencyjną.

Jakie są mnożniki wyceny dla firm SaaS?

Wzrost przychodów i rentowność firmy

Istnieje wiele czynników wpływających na wycenę, ale dwa najważniejsze to wzrost przychodów i rentowność. Wskaźniki te oferują migawkę bieżących możliwości generowania gotówki przez firmę i prognozują potencjał przyszłego wzrostu zysków.

Suma tych dwóch wskaźników jest również wykorzystywana do obliczania tzw. reguły 40. Reguła 40 mówi, że efektywna firma SaaS ma sumę marży zysku i wzrostu przychodów powyżej 40. Dla publicznych firm SaaS w naszej analizie reguła 40 jest ważnym wyznacznikiem wielokrotności przychodów, przy czym 10% w wyniku reguły 40 odpowiada 1,0-krotnemu wzrostowi wielokrotności.

Przewidywalność przychodów jest kolejnym kluczowym czynnikiem. Firmy SaaS z wysokim udziałem powtarzających się przychodów są wyceniane bardziej korzystnie, ponieważ modele oparte na subskrypcji zapewniają stabilność i długoterminową widoczność. Niskie wskaźniki rezygnacji i wysoka retencja przychodów netto (NRR) sygnalizują lojalność klientów i ekspansję, co dodatkowo wpływa na wyższe wyceny. Z kolei firmy o niestabilnych przychodach lub w dużym stopniu polegające na jednorazowej sprzedaży często odnotowują niższe mnożniki ze względu na wyższe ryzyko.

Kluczową rolę odgrywa również efektywność pozyskiwania klientów. Silny Wskaźnik LTV/CAC wskazuje, że firma może pozyskiwać i utrzymywać klientów z zyskiem, co czyni ją atrakcyjną dla inwestorów. Jednak nawet świetny model pozyskiwania klientów musi być poparty silną retencją - wysoki odpływ klientów może obniżyć wartość, niezależnie od początkowej skuteczności pozyskiwania klientów.

Firmy SaaS dla przedsiębiorstw często uzyskują wyższe mnożniki ze względu na długoterminowe kontrakty, wyższe wartość życiowa klienta (LTV)i niższe churn. Nabywcy postrzegają te źródła przychodów jako bardziej stabilne w porównaniu z firmami skoncentrowanymi na małych i średnich przedsiębiorstwach, w których rotacja klientów jest zwykle wyższa.

Ostatecznie wycena SaaS jest dynamicznym równaniem, w którym wzrost, rentowność, utrzymanie i wydajność współdziałają ze sobą. Firmy, które osiągają dobre wyniki w zakresie tych wskaźników, przyciągają strategicznych nabywców gotowych zapłacić premię, podczas gdy słabości w dowolnym obszarze mogą znacząco wpłynąć na ostateczną wycenę.

Wycena biznesu SaaS nie jest prostym zadaniem - to po części sztuka, po części nauka. Jednak dzięki zrozumieniu tych kluczowych czynników będziesz dobrze przygotowany do określenia uczciwej ceny, która odzwierciedla prawdziwą wartość Twojej firmy SaaS.

Najczęstsze pułapki, których należy unikać

Chociaż perspektywa sprzedaży firmy SaaS może być ekscytująca, ważne jest, aby podejść do tego procesu z jasnym zrozumieniem potencjalnych wyzwań. Nieprzewidzenie i nieuwzględnienie tych pułapek może znacząco wpłynąć na ostateczny wynik, potencjalnie pozostawiając mniej niż zasługujesz, a nawet całkowicie wykoleić sprzedaż.

Rozumiejąc znaczenie dokładnej wyceny, gruntownego przygotowania prawnego, płynnego przejścia, wyboru odpowiedniego nabywcy i unikania pochopnych decyzji, założyciele SaaS mogą pewnie poruszać się po procesie sprzedaży i maksymalizować swoje zyski. Dzięki starannemu planowaniu i realizacji, sprzedaż firmy SaaS może być satysfakcjonującym doświadczeniem, które otwiera nowe możliwości na przyszłość.

O Aventis Advisors

Każda firma SaaS jest wyjątkowa, podobnie jak podróż każdego założyciela. Dlatego tak ważne jest, aby skonsultować się z ekspertami w dziedzinie fuzji i przejęć SaaS, w szczególności z doradcami, którzy specjalizują się w tym sektorze i mogą w pełni zrozumieć konkretne okoliczności.

Aventis Advisors jest doradcy M&A koncentrując się na spółkach SaaS. Wierzymy, że świat byłby lepszy z mniejszą liczbą (ale lepszej jakości) transakcji fuzji i przejęć przeprowadzanych we właściwym momencie dla firmy i jej właścicieli. Naszym celem jest dostarczanie uczciwych, opartych na wiedzy porad, jasno określających wszystkie opcje dla naszych klientów - w tym opcję utrzymania status quo.

Skontaktuj się z nami aby omówić, ile może być warta Twoja firma i jak zmaksymalizować wycenę.